Decision making in the face of uncertainty

Decision making in the face of uncertainty

When markets rise or fall ten percent in a day and your account values oscillate by thousands of dollars along with those shifts, it is easy to become concerned about short term market behavior. Concern would be a perfectly normal reaction. However, what you do with your concern determines how you fare not just now but in the future. If that concern becomes an overwhelming need to not see lower portfolio values on coming statements, you can easily be swayed into making a short-term bet on the market and sell stocks to preserve assets.

No one knows when we will get past Covid-19, but given the massive amount of resources, attention, and effort being put forward to defeat the virus, it is hard to imagine it is anything other than a matter of time before this weird world we are living in now looks more normal. Financial markets may get worse in the next few months, but it is also true markets often recover before other things improve. How can we make a good choice in light of all this uncertainty?

Framing decision-making around a short-term prediction about what will happen in the markets and trading based on those predictions is a low probability and high stress approach to markets. Instead, consider what you will think when this is all in the past, whether that is in a few months or longer.

Imagine it is the spring of 2025… Looking back on 2020, you had three choices with respect to your investments after they dropped in the “Coronacrash:” buy more stocks, hold the stocks you had, or sell stocks. What choice do you think you will have wanted to make?

Imagine it is the spring of 2025. We have all been eating in restaurants, going on trips, and attending concerts, sporting events, and worship services. Looking back on 2020, you had three choices with respect to your investments after they dropped in the “Coronacrash:” buy more stocks, hold the stocks you had, or sell stocks. What choice do you think you will have wanted to make?

Through all past downturns, those who held on or bought some stocks (as we do when we rebalance) were happy with their choice. Those who sold stocks saw mixed results. Those who sold at or after the market bottom suffered losses which permanently damaged their portfolios. The only sellers that would be happy were the few who sold before the market bottomed, and IF they bought again at a price lower than the time of sale, and IF they didn’t get scared out of the stock market in the future. That’s a pretty iffy approach given many of these sellers were panicked.

Note the small window of time in which the seller could have bought at prices low enough to make a difference. Since news at the time was extraordinarily negative, it would have been hard for someone frightened about the conditions to buy then.

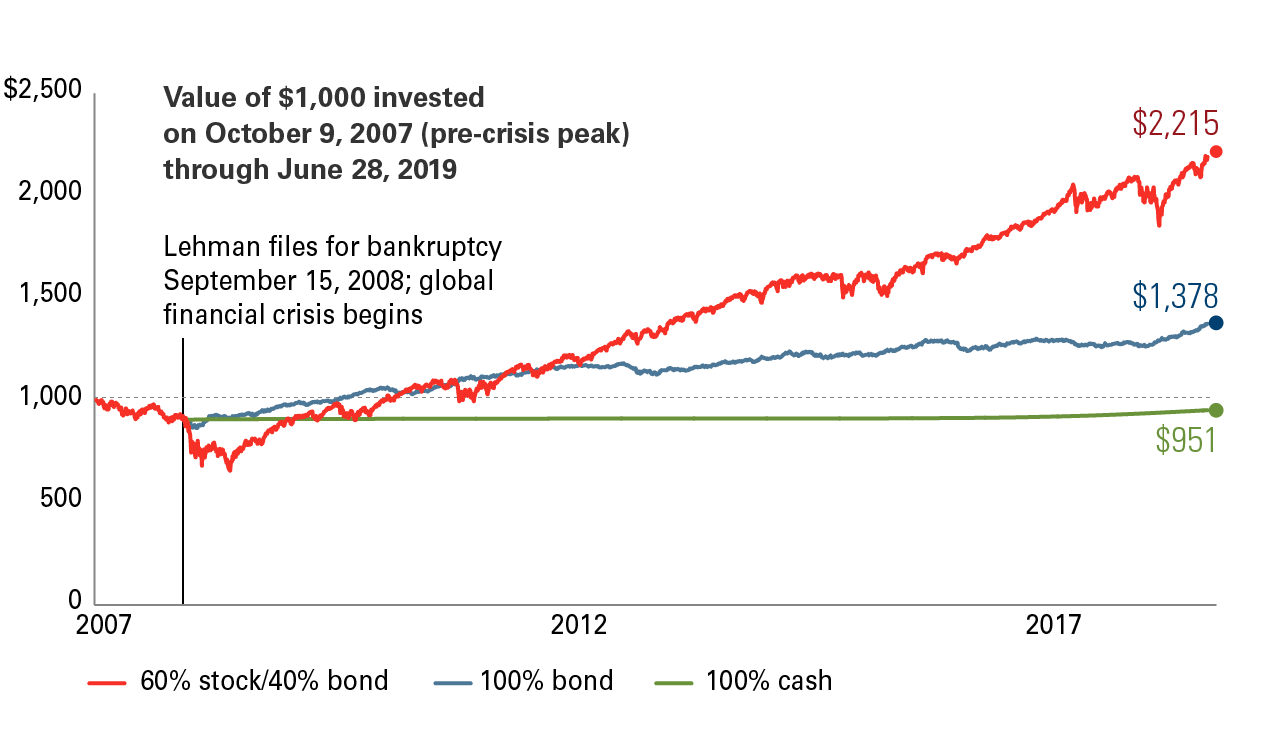

Also note how relatively quickly the balanced portfolio (red line) passed the results for going to cash (green line) or an all-bond portfolio (blue line). Switching entirely to bonds was not easy either. For the entire period shown, the narrative was that defaults would rise because of the bad economy and interest rates had to rise so bonds were therefore risky. We’ve always avoided bonds which had a meaningful probability of default or would suffer greatly from interest rate increases.

This time is different. Every past downturn was different too. Yet the decisions to be made are the same. Holding or buying worked best. Selling was risky. We are confident when we look back on this, you will be very happy that we were steadfast in our advice to act like investors, not speculators and to stay diversified, patient, and disciplined.

Coronavirus Aid, Relief, and Economic Security (CARES) Act

The stimulus measures passed, dubbed the CARES Act, has many aspects. The four impacting our clients the most are the stimulus checks, the waiving of Required Minimum Distributions from retirement accounts, relief for small businesses, and penalty relief for Covid-affected persons under age 59 ½ withdrawing from a retirement account.

Eligibility for stimulus checks is based on your tax returns. If your 2018 adjusted gross income (AGI) was high, defined here as over $75,000 for a single filer or $150,000 for joint filers, but your 2019 will be near or below those amounts, you may want to file your taxes as soon as possible.

Required Minimum Distributions (RMDs) that would have been taken in 2020 are no longer required. If you have already taken distributions from retirement accounts, there is some ability to return funds and avoid the taxes which come with such distributions.

Small businesses have a variety of resources to help them weather the crisis, from forgivable loans to payroll tax breaks. The details are beyond the scope of this forum.

If a taxpayer is under 59 ½, the customary 10% penalty for retirement plan and IRA distributions is waived if the taxpayer qualifies as affected by Covid-19.

Our team is available to help you sort through your options.

Beware of Covid-19 scams

Times of crisis and rapid change can bring out the best in people as we have seen with the world banding together in many ways to stifle Covid-19. Unfortunately, times like these also bring out the scam artists. Scammers may promise high paying work from home opportunities, bogus treatments, vaccines, toilet paper and sanitizing products. The government will not request payment, nor will anyone reach out requesting personally sensitive health or financial information.

The government will not request payment, nor will anyone reach out requesting personally sensitive health or financial information. Fake stimulus checks are already appearing in mailboxes.

Fake stimulus checks are already appearing in mailboxes. Watch for letters or emails claiming to be from the Centers for Disease Control and Prevention (CDC) or experts claiming to have inside information on the virus. Do your homework prior to donating to charities or crowdfunding sites. Be suspicious of urgent demands and emergency requests. Do not click on links or open attachments from sources you do not know. Obtain your news from a trusted source. If it sounds too good to be true, it likely is.

News & Notes

“Dan’s long and distinguished record of achievement and leadership, coupled with his passion for advancing the profession, will help FPA continue to deliver innovative and thought-provoking content for one of the most respected publications in the financial planning profession,” said FPA Executive Director/CEO Lauren M. Schadle, CAE. “As practitioner editor of the Journal, Dan will bring new perspectives that will inspire, excite and empower practitioners to drive their personal and professional development forward.”

MFT named to “Seminole 100” for third time: Our firm was named to the Seminole 100, a program run by the Jim Moran Institute for Global Entrepreneurship at FSU’s College of Business, which recognizes the 100 fastest-growing privately held businesses owned or co-owned by a graduate of Florida State University. FSU alum Dan Moisand accepted on behalf of the firm at a banquet in March. MFT has received this recognition all three years since the program began.

Need a diversion? While we are all cooped up a bit and trying to avoid getting too stir crazy, we saw this compilation of 100 fun things to do at home. It includes virtual tours of some of the worlds greatest museums, new meals and cocktails to try, live-streams from NASA, and even virtual rides from Disney.

Form ADV and Privacy Policy: You should have received a copy of page 2 of our 2020 firm disclosure brochure ADV Part 2A. We must provide this summary of any material changes and a copy of our firm’s Privacy Policy at least annually. At any time if you would like a full copy of our disclosure brochure, contact Sara Nash at ext. 114 or email her at [email protected]/.

[i] Sources: Vanguard calculations, using data from FactSet. All data as of June 28, 2019.

Notes: This is a hypothetical illustration. Balanced portfolio is represented by 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index; bonds are represented by Bloomberg Barclays U.S. Aggregate Bond Index; and cash is represented by Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.