How inflation may reduce your tax bill for 2023

Thanks to inflation, reducing your tax bill in 2023 may be easier than you think.

All things being equal, lower inflation readings are preferred but there are aspects of higher inflation readings that work in your favor. And inflation-induced tax savings can help offset inflation’s higher prices.

Due to increases in the standard deduction and a favorable shift of tax brackets, if your 2023 gross income is identical to your 2022 gross income, your 2023 tax bill will be reduced without you doing anything differently.

Due to increases in the standard deduction and a favorable shift of tax brackets, if your 2023 gross income is identical to your 2022 gross income, your 2023 tax bill will be reduced without you doing anything differently.

Bigger deductions

The most simplistic description of taxable income is gross income minus deductions. The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700, up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900. Those increases are more than double the changes from 2021 to 2022. (Note: each spouse in a married couple that is over age 65 or blind gets an additional $1,500 and blind or over 65 single filers that are not a surviving spouse get an additional $1,850 added to their standard deduction.)

The other place many taxpayers find an attractive deduction is via retirement savings. Here too, inflation adjustments provide additional savings opportunities.

Common retirement plan contribution and other limits for 2023:

- 401(k) Deferral Limit – Increases to $22,500 from $20,500

- 401(k) Catch-up Deferral Limit – Increases to $7,500 from $6,500

- Defined Contribution Plan Maximum Annual Additions – Increases to $66,000 from $61,000 (or $73,500 with catch-up)

- IRA/Roth IRA Contribution Limit – Increases to $6,500 from $6,000

- IRA/Roth IRA Catch-up Contribution Limit – Is not adjusted for inflation; remains $1,000

- Lifetime estate and gift tax exclusion – Increases to $12,920,000 per person from $12,060,000

- Annual exclusion for tax free non-charitable gifts – Increases to $17,000 from $16,000

Though not strictly a retirement plan, allowable contribution limits to a Health Savings Account (HSA) have increased. For those with eligible high-deductible health insurance plans, the limits are $7,750 for family coverage and $3,850 for singles. An additional $1,000 can be added for those 55 or older in 2023.

If you are inclined to increase your retirement savings, the easiest time to increase your contribution levels is at the beginning of the year. A worker over age 50 maximizing their 401(k) contribution over 24 pay periods in 2023 would only see a $125/per check gross decrease. The reduction in take home pay would be even less after factoring in the tax deduction.

Wider brackets reduce your tax bill in 2023

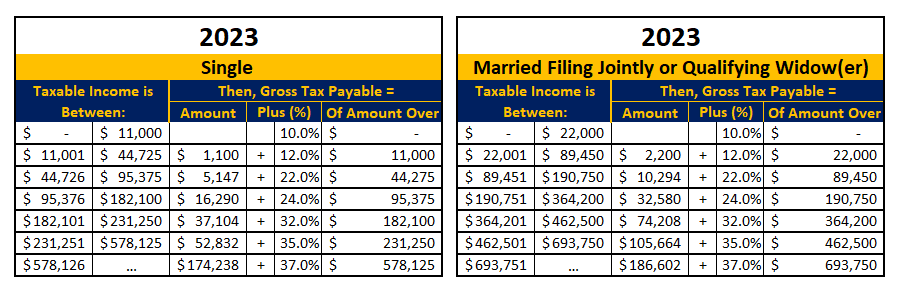

The IRS also released the 2023 Tax Tables and Brackets. The rates have not changed but the brackets have been adjusted for cost-of-living increases.

Implications for workers

Let’s look at a simple example of how this would affect a two-earner empty nest couple, each with a salary of $100,000, who use the standard deduction. Both spouses are 56, both have a 401(k) and they want to maximize their retirement savings. The gross income did not change but the 2023 tax is $2,335 less than 2022.

Implications for retirees

Retirees don’t contribute to retirement plans; they take distributions from them. For those age 72 or older in 2023, these distributions are subject to Required Minimum Distributions (RMDs). Many of our clients only take the minimum because other income sources like Social Security, pensions and investments cover a lot of their bills. RMDs tend to increase over time because the proportion of the account that must be paid out increases every year with age.

In addition to age, the other factor in determining an RMD is the end of year account balance. Therefore, when markets decline, the RMD amount decreases. Combine that with the larger standard deduction and expanded tax brackets for 2023 and many retirees will see a lower bill.

Say a single retiree had an IRA worth $1,000,000 on December 31, 2021, had gross income of $100,000 before their RMD and turned 75 in 2022. Now, if we assume that gross income does not change before factoring in RMD and the IRA is worth $850,000 on December 31, 2022 due to the removal of the 2022 RMD and the market decline, the 2023 tax bill drops $1,824

Not all inflation adjustments are calculated the same. In fact, some items in the tax code do not get an inflation adjustment at all such as the IRA catchup contributions, thresholds for Social Security payments becoming taxable, and the trigger for the 3.8% surtax on net investment income. For more details about the inflation adjustments see Rev. Proc. 2022-38. For a more detailed and complete list of retirement savings provisions see Notice 2022-55.

Of course, high inflation is not good, but it isn’t all bad either. Although our examples may be simplistic, tax planning is not. Our tax team is available to help you develop and execute strategies which make sense for your family’s financial plans and your goal to reduce your tax bill for 2023 – and beyond.