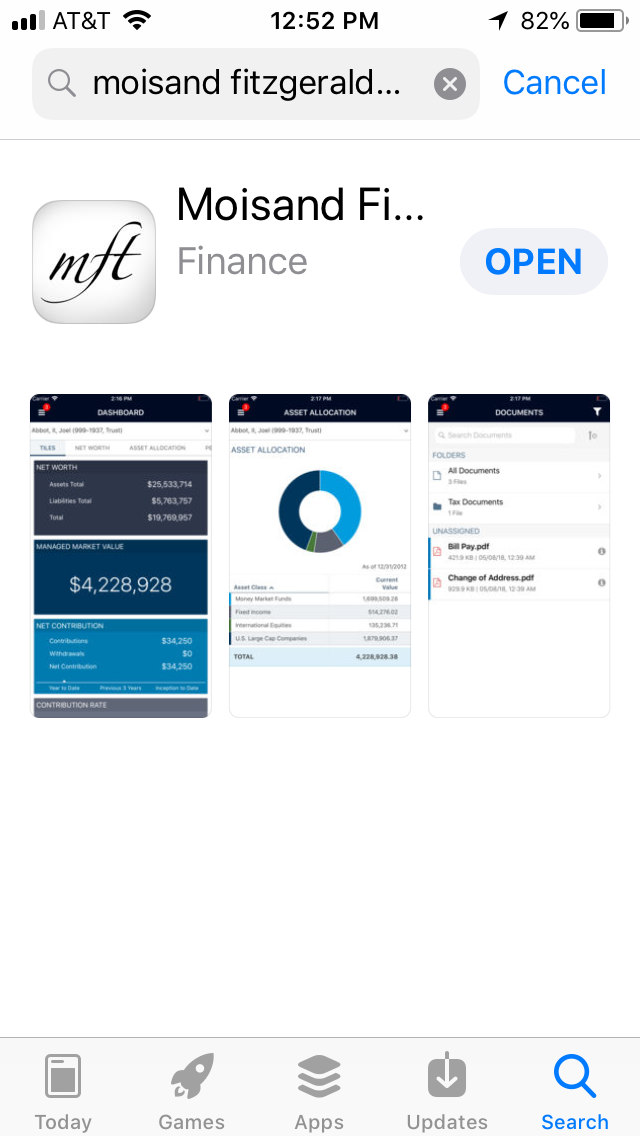

Introducing the MFT App for mobile devices

It wasn’t that long ago one would’ve needed to use a stack of printed statements and a financial calculator to determine the return on an investment. And, to find out how the market or an investment had behaved in the past, a trip to the library for historical data (probably on microfiche) was needed.

Today, when curious about these and other things, information can be obtained in mere moments via the web. This is wonderful or awful depending on the circumstances.

On the positive side, a tool such as our client portal at www.moisandfitzgerald.com/ gives fast access to basic information needed to answer many quick questions. Wonder what your accounts are worth or when a deposit or a withdrawal was made? That information is available on demand. To make getting data even easier, we have released the Moisand Fitzgerald Tamayo mobile app. Many clients will find the app more convenient than logging on through a computer.

The app is available for download from the app stores for both Apple and Android devices. The first time a client logs-in, the app will request answers to security questions but after that, it is very easy to get into your portal. The app is equipped to respond to the fingerprint function on both Apple and Android phones and tablets so using a strong password is even easier.

All that said, we would be remiss if we didn’t mention a negative to such data. Studies show that in the aggregate, people who take frequent peeks at account values and other data have a higher incidence of poor investment results. Checking in frequently often results in the creation of anxiety, false conclusions, and short-term thinking – a dangerous combination. Please try to keep in mind much of the data in your portal is just information, not actionable insight.

Checking in frequently often results in the creation of anxiety, false conclusions, and short-term thinking – a dangerous combination.

New addition to your reports

One of the primary long-term goals of an investment portfolio is to keep up with inflation. Over time, inflation erodes the purchasing power of our income and assets. A loaf of bread costs more today than it did 20 years ago and is likely to cost more in the future.

Because of its importance, we are now including data about inflation on our performance reports, as measured by the Consumer Price Index (CPI). You will see this new line regardless of whether you view your reports online, through the app or on a printed copy.

Inflation is a process of continuously rising prices and the Bureau of Labor Statistics produces many versions of the CPI. We could have used a “seasonally adjusted” measure of inflation but those numbers were nearly identical over longer time frames as the unadjusted version. Since we are long-term investors, we opted instead for an unadjusted version because it reflects the prices consumers truly pay. As the Bureau puts it, this form of CPI measures inflation “… as experienced by consumers in their day-to-day living expenses.”

News & Notes

Charlie hits the road for CFP Board As a board member for the Certified Financial Planner Board of Standards, Inc., Charlie Fitzgerald recently completed a two-city visit with the board’s CEO, Kevin Keller. They provided updates on the recent accomplishments of the board and fielded a wide array of questions. The most recent and significant accomplishment is the board’s release of its new Code of Ethics and Standards of Professional Conduct. Most notable is that starting in October 2019, CFP Board will hold all 82,000 CFP® professionals in the U.S. to a fiduciary standard for financial advice, benefiting all clients.

Selling a home? Don’t forget portability Since 1992, annual increases in the assessed value of property receiving Homestead Exemption have been capped at 3% or the percentage change in the Consumer Price Index, whichever is lower. This limitation is commonly referred to as the “Save Our Homes” cap. The SOH cap became portable in 2008, which means the dollar value difference between the assessed value and market value of your prior Homestead property, up to $500,000, can be transferred to a new Homestead property anywhere in the state of Florida. Portability enables relocation while retaining the limitation on assessed value. Apply for Portability when applying for Homestead Exemption by using form DR-501T (Transfer of Homestead Assessment Difference). This application is required in addition to the Homestead Exemption application and is due March 1st.