December 2011

The Emergency Economic Stabilization Act of 2008 included new tax reporting requirements to the IRS mandating that certain firms report the adjusted cost basis of sold securities, including whether the gain or loss is short or long-term. Because of this, the Form 1099-B for 2011 from custodians like Schwab and TD Ameritrade will look different when clients receive them in mid-February of 2012.

We have tracked cost basis for clients for years for many reasons. Chief among these is that we strive to have our clients paying only taxes that are necessary. Without proper tracking, it is difficult to manage the taxation. We see the potential for these new regulations to make proper reporting easier on everyone – eventually. We say “eventually” because the requirements phase in over three years, starting in 2011. Even after all phases are complete, securities purchased before January 1, 2011 will remain “uncovered”.

The first phase took effect on January 1, 2011, covering equities (stocks) acquired on or after that date. These changes will be most noticeable on the new Form 1099-B, reporting cost basis information. Cost basis information on any equities bought and sold in 2011 will also be reported to the IRS.

The second phase begins on January 1, 2012, covering mutual funds, dividend reinvestment plans (DRIPs) and most exchange traded funds (ETFs) acquired on or after that date. Brokers will be required to report this information to the IRS for the first time in 2013 on Form 1099-B, covering the 2012 tax year.

The third and final phase takes effect on January 1, 2013, covering other specified securities, including fixed income and options. The IRS had not yet issued regulations on this phase as of the date of this writing.

Cost basis default method. The legislation requires custodians to use a default cost basis method for calculating gains and losses unless a client or advisor acting on behalf of the client chooses another method. For equities, the IRS default on sold securities is the First In First Out (FIFO) method. We can change the default method or override it for a specific trade.

Transfer of cost basis information. The legislation specifies that brokerages must provide a transfer statement when transferring assets to another brokerage firm. Transfer statements for covered securities must include the transfer date, security identifier, acquisition date, covered or uncovered status, cost basis and holding period. This will be very helpful when accounts are transferred to our care as many brokerage firms lacked thoroughness in this area.

Tracking and reporting on wash sales. The new law requires the reporting of loss deferrals and other adjustments on Form 1099-B. However, brokerages are required to analyze only identical securities within a single account to determine if a wash sale has occurred. Clients are still obligated to apply the wash sale rules across all of their accounts for substantially identical securities when preparing their tax returns. This is rarely a problem for our clients because we typically manage all of their accounts.

Average cost method. There are several methods available to optimize the gains and losses generated in taxable accounts. We often begin work with new clients that did not know this or were not made aware of this by their prior advisor and used average cost basis for their mutual funds. Normally once one uses average cost, they are stuck with that method for the life of that fund. Coming with the second phase of the legislation, clients will be able to move out of average cost to another method but only for shares purchased after the change and only if they subsequently do not use average cost for these newly purchased shares.

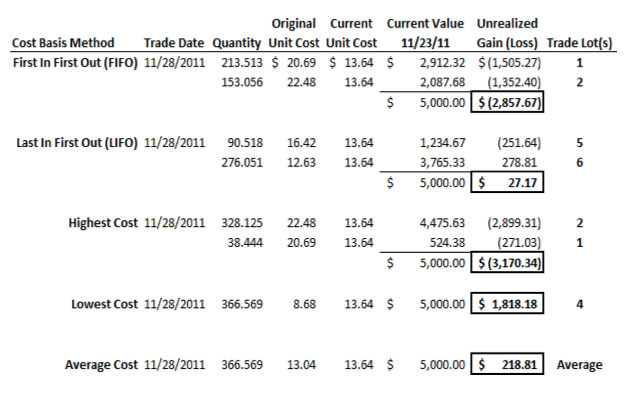

Does the method chosen make much difference? It certainly can. Here is a hypothetical example of a position in the ABC mutual fund with varying purchase dates and a $1,486.31 dividend reinvestment (Lot #6).

How is the realized gain affected by various cost basis methods?

Selling $5,000 of ABC Company on 11/28/2011

Clearly, the accounting method can make a big difference. In this case, while the total sales proceeds were $5,000, the difference between the largest gain and the largest loss is $4,988.52. The more volatile the price fluctuations, the bigger this difference can be. The unwary will never make an affirmative choice and may lock themselves into using the average cost method, eliminating the option to choose in the future.

Also of note is that the LIFO method resulted in the sale of shares less than one year after their purchase (lot 6), causing a short term gain. That $278.81 gain is taxed as ordinary income, a rate that is higher than the long term capital gain rate for every tax bracket. Taxpayers in the highest tax bracket would pay 35% instead of 15% for federal taxes and those in the lowest bracket would pay 10% instead of nothing. This transaction resulted in a modest gain but the difference in rates makes avoiding large short term gains advisable.

We have managed these decisions for clients for years so while these new reporting regulations and the variety of accounting methods can be confusing to some, we do not see them as something to be feared or a burden to navigate. It is all part of the job and we are happy to do it.

Contact Us

If you have any questions or would like to discuss this further, please give us a call or send us a note.

If you are not a client and you wish to receive emails notifications of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.