Before we get into what Moisand Fitzgerald Tamayo thinks about the Brexit vote, we wanted to share some news. We are pleased to share that the Financial Times has named Moisand Fitzgerald Tamayo, LLC to their FT 300 list as one of America’s top 300 independent Registered Investment Advisor firms. We take pride in the quality of our team and find it particularly gratifying when others take note of what we do. For more details see Moisand Fitzgerald Tamayo, LLC Named One of America’s Elite Firms by the Financial Times

What is all the fuss about Brexit?

Brexit is short for Britain Exiting the European Union (EU). Leaders of the U.K.’s establishment campaigned to remain in the EU and most pundits predicted the U.K. would stay. Instead, 52% voted to leave on June 23rd, amid high voter turnout of 72%. Markets don’t typically like surprises. The next day, the British Pound lost over 10% of its value, marking a 30-year low. Declines in U.S. stocks were less severe but still over 3% with the Dow Jones Industrial Average falling an attention grabbing 610 points. News outlets spent the weekend speculating about what the surprise meant going forward.

Why did the U.K. do this?

The EU is a 28-member common market that allows free trade among members. It also allows citizens of member nations to easily live, travel, and work within those countries. Those pushing the “leave” vote suggested that leaving the EU would not harm the economy terribly or for very long but would help stem the tide of immigration. The influx of immigrants has become a bigger concern over the last year in light of the Paris and Brussels attacks and the Syrian refugee crisis. The vote highlights the global trend toward rising nationalism.

It is important to note the government did not announce it is leaving the U.K. In fact, the U.K. government is not obligated to make such an announcement. The vote is non-binding, a fact lost on many commenters and many of those who panicked over the weekend.

What is next for U.K./EU?

While the vote is non-binding, it is also the will of the people. The U.K.’s Tory Party Prime Minister David Cameron resigned and Labour Party leader Jeremy Corbyn lost a no confidence vote by a wide margin. New leaders of both parties will be selected.

Further political fallout may occur. Various minority factions in the Netherlands, Italy, and France took the vote as an opportunity to stir the “leave” pot. Scotland and Northern Ireland both voted to stay in the EU so independence advocates there are trying to use the vote to rally support for breaking away from Great Britain.

We believe Brexit could stay in the news for an extended period of time. First, the U.K. will try to negotiate new trade deals with the EU and the rest of world. Expect plenty of tough talk from U.K. leaders to show they listened to the people and tough talk from the EU to try to make leaving unattractive to those in the areas we mentioned earlier. If new trade deals are made, U.K. leaders may say that because of new terms, there is now no need to leave.

If U.K. leaders do follow through on the vote and formally declare a departure, the EU agreements require a two-year negotiation process. Thus, these issues are not likely to go away soon.

Will this cause a recession?

No one knows and it is far from certain but most economists generally expect the U.K. to fall into a near-term recession, as many take a wait and see stance. It is also possible continental Europe could experience a recession as well. The U.K. is the world’s fifth-largest economy and the fastest-growing of Europe’s large economies. However, statistics can be misleading.

The U.K.’s 5th place position represents less than 4% of the world’s economy. As little things can become big things, the slowdown in Britain can possibly spread to Europe, the U.S. and the rest of the world. However, the U.K. and to a lesser extent Europe will likely bear the brunt of any economic fallout.

How will my investments be affected?

We think it reasonable to expect Brexit related news to cause or be blamed for some market volatility. Corporations will blame the vote if they have a rough quarter. Speculation will fuel market fluctuations as will the actual results. The media will love it.

We would still expect stocks to outperform bonds in the coming years. The uncertainty will likely make the Fed hesitant to raise interest rates anytime soon as they will wait to see how negotiations unfold. Bonds and CDs should continue to offer rates below historical averages.

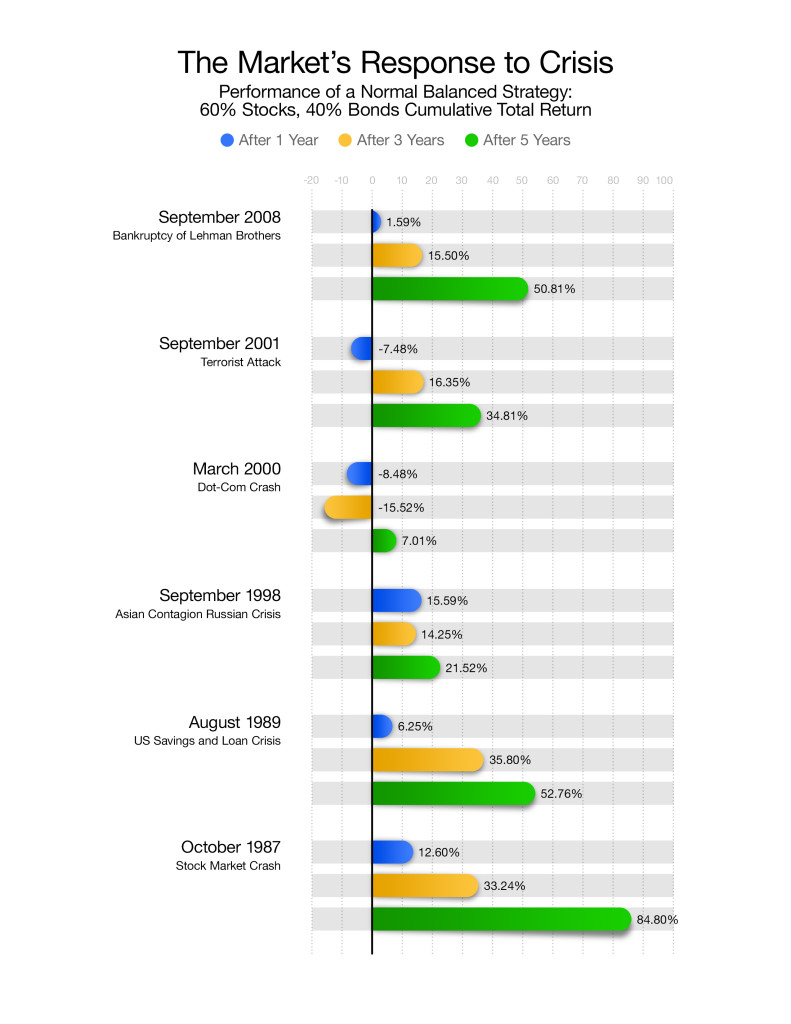

Markets have proved amazingly resilient despite significant bouts of volatility and ongoing macroeconomic and geopolitical headwinds over the centuries. We do not know if Brexit fallout will result in the next major market decline but we do know that in all prior cases, markets adapted and recovered and owners of balanced portfolios should have fared well without having to place bets on when the recoveries would unfold. The chart below describes the behavior of a simple mix of 60% S&P500 index and 40% 5-year U.S. Treasury Notes rebalanced annually beginning at the end of the month after the incident noted.

Recoveries often begin long before things “look better.” This happens because markets can adjust quickly. Businesses will change course as they continue to seek profits. U.K. firms will still do business with the EU and the EU and the rest of the world will continue to do business with the U.K. Global corporations will continue to seek profits and make changes in order to do so in a much nimbler manner than any government can.

What should I be doing now?

Stick to your plan. Try to tune out the media. Remember market timing may sound tempting after a notable drop but keep in mind how quickly the market can change. On June 22nd, the day before the vote, the Dow Jones Industrial Average closed at 17,780. Barely a week later, on June 30th, it closed at 17,930. The U.K. market actually rose even more over the same time period. Those who watched the news all weekend and listened to pundits argue about what it all means wasted a nice weekend stressing out. Those who actually succumbed to the negativity and sold on Monday cost themselves money they can only get back if the markets drop again AND drop far enough AND they buy in at the lower levels.

Investing in a diversified portfolio and managing it with discipline and patience remains the best approach to uncertain markets in large part because the need for short term predictions are explicitly rejected. News events can be unnerving but we strongly believe that panic is a terrible option best left to traders, speculators, the uninformed, or the unprepared.

We will leave you with an excerpt from our posting in September 2011, “Easing Stress During Uncertain Times” in which we outlined seven guidelines to shape your thinking about investing.

There are no crystal balls. I will not change my investments based on a short term forecast about the economy or the markets. I will recognize that the urge to form an opinion will never go away, but I won’t act on it because no one can repeatedly predict the future. It is, by definition, uncertain. Being correct is not enough. To profit one must be right by enough to compensate for the costs of acting on the prediction. Over my time horizon, it is highly unlikely to be that accurate. When I hear “in this market….” or “because x is about to happen, you should …”, I will recognize the short term nature of the statement and remind myself that I am an investor with a good plan and I will ignore the suggestion.

Recommended additional readings:

A tale of two calls about Brexit

Why rebalancing can help when markets decline

Why diversification among asset classes is so important

Why investing globally is important

Why stay in one fund when another is performing better?

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC