How do I protect my portfolio against inflation?

We pay more than double for most things we buy these days than we did 25 years ago. This loss of purchasing power, otherwise known as inflation, is a reality that investors must deal with prudently. Inflation is a fact of life.

Inflation seems to be getting more and more press these days. If you are concerned about rapidly rising inflation that persists for a long time like we had in the 70s, that may happen, but it doesn’t look likely. Inflation is rising. April’s year over year comparison was up 4.2%.

If you are concerned about rapidly rising inflation that persists for a long time like we had in the 70s, that may happen, but it doesn’t look likely.

That is hardly a surprise. In fact, inflation readings are likely to get worse over the coming year. Remember what was happening a year ago? The economy had hit the brakes and hard. The inflation rate was just 1.4% in 2020. The recent uptick in inflation could be little more than a natural bounce off a low point. The Federal Reserve itself believes the increases we will see are not likely to last more than a year or two.

Of course, the Fed could be wrong about the transitory nature of the uptick in inflation or its confidence they can keep inflation in check. The recent rise could be more than just a bounce back. However, there are many elements of the economy that would make it difficult for inflation to spike to significant levels. These elements may explain why the marketplace is placing the expected inflation rate over the next decade at about 2.5% according to prices of inflation adjusted bonds and non-inflation adjusted bonds. That is higher than the last ten years but still below the long term average of roughly 3%.

Regardless of whether this recent uptick will continue or not, we must consider inflation in our portfolio management.

By far, the most reliable way to stay ahead of inflation over time is to own a diversified portfolio of stocks. This has NEVER provided stability in the short term but has always provided a return in excess of inflation over longer periods. U.S. stocks (as measured by the CRSP 1-10 index of the total U.S. market) even beat inflation over the 1970s, the most inflationary decade in modern times, during which the inflation rate averaged a tad over 7%.

By far, the most reliable way to stay ahead of inflation over time is to own a diversified portfolio of stocks.

Looking at calendar years going back to the inception of the CRSP 1-10 Index in 1926, there have only been four periods of more than ten years in which stocks did not beat inflation and none longer than twelve years. Stocks have done so well because corporations are able to adapt to higher prices for raw material, labor and the like and the value of the shares in the aggregate reflect the changes – over time. Stocks prices in the aggregate should ALWAYS be expected to be volatile in the short term and profitable in the long term.

Because stocks are a wild ride, most people need a diversified array of bonds and other fixed income in their portfolio. Such holdings are good at maintaining more stable values than stocks but their record against inflation is weak. Despite rising interest rates, bonds lagged inflation during the 1970’s. In many periods, whether rates rose or not, bonds lagged inflation. Even when bonds beat inflation, they did not do so by much.

Treasury Inflation Protected Securities (TIPS) are U.S. government bonds that increase in value automatically when inflation rises. That sounds good but as is the case with all investments, these bonds pose trade-offs. These bonds cost so much that unless inflation exceeds market expectations, they will lag non-inflation adjusted bonds and inflation rather than protect against it. Second, they are terribly unfriendly tax wise and should only be used in tax favored accounts.

Longer term bonds typically pay more interest than short term bonds, but the extra interest is often no defense against inflation. Long term bonds tend to sink significantly in value when interest rates rise in reaction to inflation so they are not a good choice for the more stable portion of the portfolio.

If you have a bond that pays you $100 in interest, that $100 doesn’t go as far after inflation. The more years until maturity, the less valuable that stream of $100 payments becomes. The price of the bond will drop and you will only be sure to get the face value back at maturity many years from now.

Shorter term bonds by contrast won’t drop in price much because they mature sooner. This allows one the opportunity to reinvest the maturity value at the higher rates typically available when inflation is higher.

While we do not know what inflation will be in the future, a diversified portfolio that contains stocks for long term growth and an intelligently structured array of fixed income holdings is likely to provide a return that will be adequate for an investor with reasonable goals and expectations if the portfolio is managed with discipline and patience. There should be no need to make a prediction about changes to the inflation rate.

Making News…

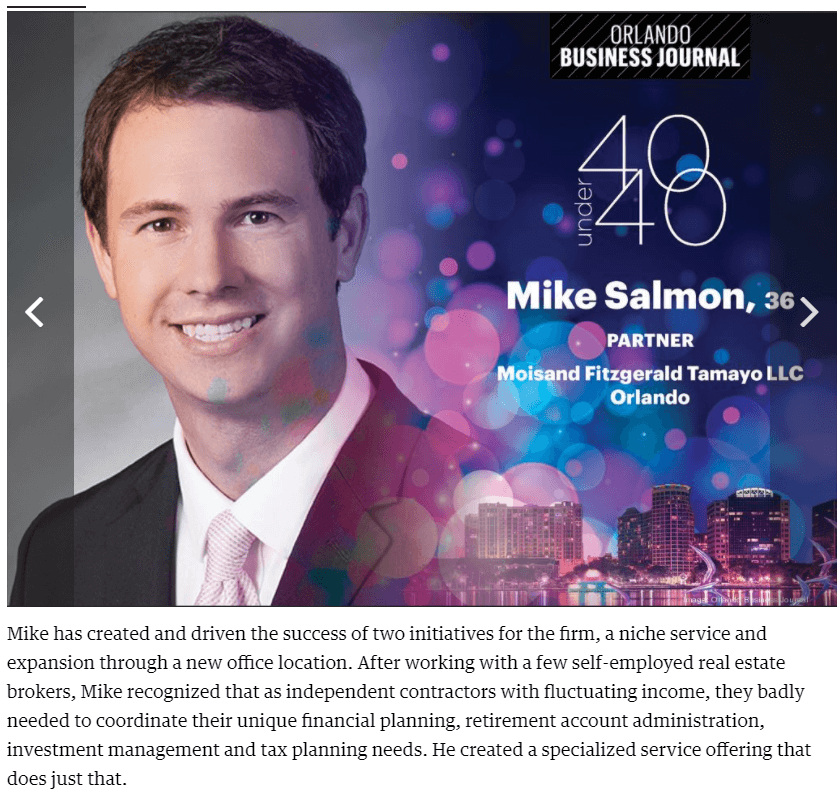

We continue to help the Orlando Sentinel with reader questions by participating in a free call-in hotline and its Ask An Expert feature. (Some links require a subscription to view.) Mike Salmon, CFP®, Charlie Fitzgerald, CFP®, Derrick Chandler, CFP®, and Tommy Lucas, CFP® participated in and answered questions from callers and some of their answers have been published in recent issues of the paper.

Charlie explained how capital gains are calculated when one inherits an investment.

Mike served as a source for the Orlando Sentinel “Recent college grads are getting $1800 stimulus checks as they file tax returns.”

Dan Moisand,CFP® continues to write for MarketWatch, Florida Today, and Financial Advisor:

Are there new RMD rules this year?

I took advantage of the 2020 RMD rule but now my 1099-R looks wrong — what should I do?

When are Roth IRA distributions taxable?

I’m 73, single and work part time, should I put money into an IRA?

Roth IRA solid choice for young earners

In the News…

Charlie was quoted extensively in an Investment News cover story marking Financial Literacy month, “GameStop’s saga: What the stock surge proves about financial (il)literacy” Our favorite is “…speculating doesn’t make one an investor any more than betting on a football game makes one a football player.”

Moisand Fitzgerald Tamayo, LLC has been named on of the “Top 12 Financial Advisors in Orlando, Altamonte Springs, & Winter Park” for 2021-2022 by Advisory HQ. We have made similar lists from them every year since 2016. Their methodology can be found here.

and long la

Things We Found of Note

Satellite Beach was named #24 in a list of the “Top 50 Beach Towns to Live In” by the Chicago Tribune.

If you had $20 billion, would you take so much risk with it that you could lose it in a matter of days? That’s what Sung Kook “Bill” Hwang did in late March. It is only the most recent example of how speculation can be addictive. If Mr. Hwang gave away a million dollars a day, it would take over 54 years to go through $20 billion. “I’ve never seen anything like this — how quiet it was, how concentrated, and how fast it disappeared,” Mike Novogratz, a career macro investor and former partner at Goldman Sachs told Bloomberg News. “This has to be one of the single greatest losses of personal wealth in history.”