How your tax rates can change

As we enter the last part of 2021, Congress is debating a series of changes to the tax code. Whether you find the proposed changes disconcerting is largely a function of how the changes affect you specifically. From our perspective as advisors, changes in the tax code can alter both strategy and tactics employed by our clients. We are monitoring the legislation negotiations and have already contemplated what will need to be done if various provisions pass. As of this writing, while still significant, the current proposals represent a less dramatic tax increase than proposed during the presidential election.

Regardless of what Congress does, we recognize that changes to our tax profiles are inevitable. In fact, Congress could do nothing and a household’s tax profile can still change, either by what is already in the law or through changes in personal circumstances.

…Congress could do nothing and a household’s tax profile can still change, either by what is already in the law or through changes in personal circumstances.

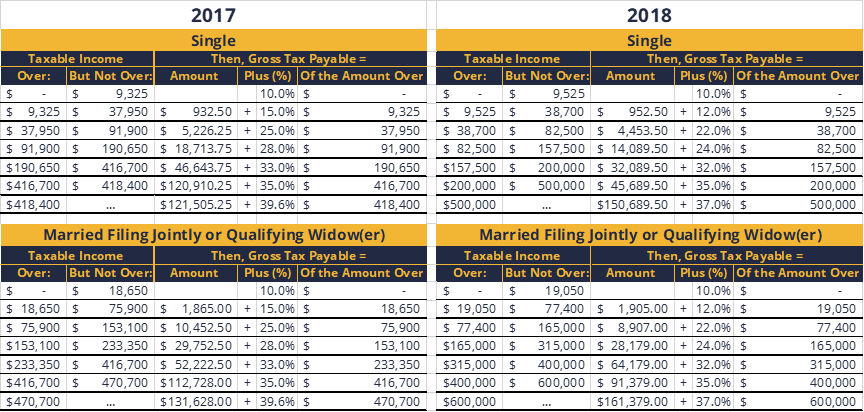

As it stands, unless Congress acts before 2026, tax brackets will revert to the brackets of 2017. All else being equal, this means every taxpayer that is currently in the 12% or higher bracket will see their marginal tax rates rise. The chart below shows the tax brackets applied to various levels of taxable income in 2017 and 2018. We can’t know exactly what these brackets will be in 2026 because the ranges are adjusted annually for inflation. Nonetheless, the chart is helpful in illustrating the adjustments to the underlying structure. Just compare the brackets and rates of 2017 to that of 2018 and you have an understanding of the potential increases should Congress make no change to this structure before 2026.

To understand how rates can fluctuate due to personal circumstances even if Congress takes no action, we will see what would happen to a hypothetical married couple, Jack and Jill, both age 65. For simplicity purposes we will ignore state income taxes and assume they live off a steady $100,000 of taxable income in 2018 dollars. Taxable income is the income after deductions are applied. Using the chart above for 2018 married filing joint returns, the tax bill on $100,000 is $13,879 ($8,907 plus 22% of the amount over $77,400). They will pay at least $220 of tax on the next $1,000 of taxable income, such as wages or a withdrawal from an IRA or retirement account.

Jack dies in 2023. Jill will file as a single taxpayer in 2024 so she must use the 2018 single chart above. Her tax bill on $100,000 of taxable income is $18,289. She would pay at least $240 of tax on a $1,000 IRA distribution.

Due to the automatic reversion to the prior structure, in 2026 her $100,000 of taxable income is subject to the single scale of 2017. Her tax bill goes to $20,982. That’s a lot more than $13,879. Further, a $1,000 IRA distribution costs at least $280.

Real life is not this straightforward and the change in a tax bill may not be as high. Single taxpayers often find they spend less than when they were married. Taxable income typically drops as Social Security and pensions adjust at the death of a spouse. If Jill got remarried, she’d use the married scale but also must include her new husband’s income. Maybe the tax bill goes down, maybe not.

Younger households are not immune to fluctuations in tax rates either. In addition to inheritances and changes in health or marital status, children can bring tax breaks that end when they are no longer dependents. Salaries, bonuses, and benefits can all fluctuate with promotions, layoffs, or job changes.

Again, all of these differences are in play even if the current tax proposals go nowhere and whether or not Congress acts in the future. This is a large part of why we emphasize that good tax planning is an ongoing process. Done well, the tax planning works in concert with other financial planning issues and is not just about reducing taxes now – it is about trying to reduce taxes over multiple years or a lifetime even.

News & Notes

Mike Salmon guests on podcast Commercial real estate services firm, Lee & Associates recently had Mike Salmon, CFP® EA on their podcast. Mike discussed some unique aspects of personal financial planning facing commercial real estate brokers such as dealing with fluctuating income, retirement savings opportunities from being self-employed, and managing taxes as an independent contractor. Mike has led our firm’s efforts in providing specialized services for commercial real estate brokers. You can listen to the show or read the transcript here.

Social Security payments and allowable retirement plan contributions to rise. The Social Security Administration has set the increase at 5.9%. The increase, a result of the increase in inflation indexes, should also raise the amounts one can contribute to retirement plans and change several other items in the tax code which are tagged to inflation readings.

Important Dates:

November 1: Start of open enrollment for existing Health Insurance Marketplace enrollees

December 7: End of open enrollment for existing Medicare enrollees

December 15:

- End of open enrollment for existing Health Insurance Marketplace enrollees

- Q4 estimated tax payment deadline for C-corporation and multi-member LLCs that elect to be treated as a corporation

December 20: Last date to submit paperwork to be certain processing will be complete for end of calendar tax year deadlines such as:

- Making Required Minimum Distributions from retirement accounts and IRAs

- Completing gifts and charitable donations for 2021 tax year

- Completing conversions to Roth IRA accounts

- Dividing retirement accounts with multiple beneficiaries in order to use separate accounting

December 24-January 2, 2022: Offices of Moisand Fitzgerald Tamayo are closed. As has been our custom for many years, all staff has this time off so they can spend it with their families.

January 1:

- Start of General Enrollment Period for Medicare Part A and B

- Start of Open Enrollment Period for Medicare Advantage

January 15:

- Q4 estimated payment deadline for 2021 tax year

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC