Capital gain distributions can make a difference to the bottom line of mutual fund investors. The newspaper says fund A made X% while fund B made 1% less. Many people will assume that Investment A was superior. This is not always the case for several reasons but we will focus on one in particular today – taxes.Taxes are by far the largest expense a portfolio may incur. We employ many tax management techniques but will only employ those strategies and tactics that we believe will aid a client in reaching their particular financial goals.

The databases that most publications use to list performance of various investments almost universally ignore taxes. As financial planners, we discourage ignoring taxes as much as we discourage obsessing about taxes. Either one can cause problems. Managing taxes is preferred.

…we discourage ignoring taxes as much as we discourage obsessing about taxes. Either one can cause problems. Managing taxes is preferred.

In the above example, it could be the case that the after-tax return for owning B is better than that for owning A. This can happen in several ways:

- Taxable Income: B may be invested in securities that simply do not give off much taxable income like some stocks or municipal bonds, while A may invest in things that generate considerable taxable income.

- Tax Rate: The tax rate that applies can be different too. “Qualified dividends” are taxed at low long term capital gain rates but other dividends such as those from Real Estate Investment Trusts and many foreign companies are taxed at the rates on ordinary income.

- Management Approach: Some funds are managed in a tax-efficient manner but others are not concerned with tax consequences at all. This is the time of year we see how the management approach can affect a tax return.

Why Capital Gain Distributions Exist

Stocks, bonds and mutual funds that invest in stocks and bonds are considered capital assets. When you sell a capital asset for more than its “basis,” you experience a capital gain for tax purposes. Sell for less than basis and you have a capital loss. Likewise, when a mutual fund manager sells a holding in a fund, the fund realizes the resulting capital gain or loss. Fund managers buy and sell securities at will throughout the year.

Mutual funds are required by law to pay virtually all net gains to their shareholders in capital gain distributions. When this occurs in a taxable (non-retirement) account, you pay taxes on the distributions. There is no tax consequence when this occurs in a retirement account such as an IRA. These distributions typically occur once or twice a year, most frequently in December.

When a capital gain distribution is made, the fund’s share price will be reduced by the amount of the distribution.

How Capital Gains Are Distributed

For example,a fund share sells at $10. A net profit of $2 a share has accumulated in the fund during the year from the manager’s sales. A capital gain distribution of $2 will be deducted from the share price on a specified date. On that date the price will decline to $8. The holding is still worth $10 but its form has changed. The original shares are priced at $8 but you have $2 cash in your pocket or the cash account of your brokerage account. If you automatically reinvest your capital gain distribution, it buys you $2 worth of additional fund shares at the new, lower price of $8.

If you did not know the distribution was coming, it would look as though the fund dropped $2 in value or 20% when you looked up its quote for the day. About this time every year, we speak to people who are surprised to see the value of one or more of their funds drop significantly on a day when the market hasn’t gone up or down much. A capital gain distribution is often the cause.

Note that you made no money in this example but now owe taxes on $2,000 of gains. Come April, that can be an unpleasant surprise to the unwary.

Managing Taxes From Capital Gain Distributions

Our clients are unlikely to be blindsided by such surprises. We cannot completely control what fund managers do but we can minimize surprises by exercising a high level of tax awareness and implementing tax savings techniques where appropriate. We structure portfolios intelligently and implement in tax wise ways using investment vehicles that are inherently more tax efficient in taxable accounts from the start. Furthermore, we proactively monitor your holdings for capital gain distributions so that we can make informed decisions about tax management. And, while we don’t try to trade to outguess the market’s next move, we will not hesitate to execute trades as a tactical matter in an attempt to save our clients some tax money.

We often say, “Focus on what can be controlled.” As we approach the end of 2014, we turn our attention to year-end planning. Taxes are high on our list of things over which we can exercise some control. It can get complex, but we are happy to look out for these details on your behalf. Of course, we would be happy to explain exactly which elements of this affect you individually.

News & Notes

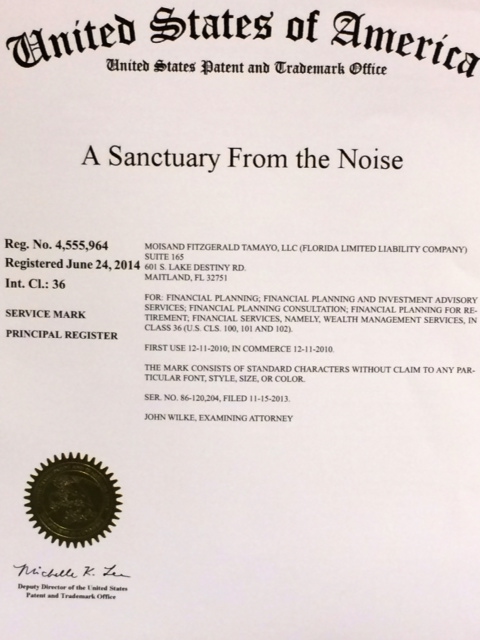

It’s Official: Moisand Fitzgerald Tamayo, LLC, received final approval from the U.S. Patents and Trademark Office for a service mark registration of the firm’s slogan, “A Sanctuary From The Noise®.” Registration formalizes the firm’s right to exclusive use of the phrase for business purposes. The public is inundated with information, much of it incorrect, impractical, or irrelevant to making sound personal financial decisions. We are one of the few firms from which people can get objective, personalized advice from a truly independent source and our slogan embodies that mission.

More Evidence That Market Timing is Not Smart: Richard Bernstein Advisers (RBA) tracked the buying and selling of mutual funds over the 20 year period from 12/31/1993 to 12/31/2013. According to research notes from RBA, the performance of the typical mutual fund investor was “shockingly poor.” How bad is “shockingly poor”? Of the 42 asset classes RBA considered, the typical investor beat only two: Asian emerging markets and Japanese stocks.

We do not define “asset class” exactly the same but the point is still clear. The typical result was worse than what could have been obtained by simply leaving the money in cash. With the ups and downs of markets such as they are, it can be tempting to try to anticipate the market’s next moves. This study is just the latest reminder that this strategy is unlikely to work. An investor who bought and simply held on would have done better in 40 of the 42 asset classes. Diversifying by owning several asset classes, something we advocate strongly, would have made the odds of beating the typical result even better.

Healthspan vs Lifespan: In a recent article by Fred Vettese, an actuary, the assertation is made that the baby boom generation has a narrower window in which to travel and engage in other active pursuits than they may expect. He looked at European data but his conclusion should be applicable to Americans in a similar fashion. Vettese notes that while the life expectancy of a 50 year old male is 79 and a 50 year old woman is 84, on average they are only expected to make it to 67 or 68 before they are moderately or severely limited due to a disability of some kind. Spending more early in retirement because of concern over “healthspan” is a sentiment we hear often. The financial implications are many but we are adept at navigating that terrain and would be happy to discuss the less conservative approach to finances often required to pull this off.

Apple Pay: The much hyped iPhone6 was unveiled in September with most of the attention focused on the bigger screen size. What caught our eye though was the debut of Apple Pay. If you have travelled internationally recently, especially to Asia, you may have noticed many items can be bought using a cell phone. Apple is trying to make such an arrangement mainstream in the U.S. with Apple Pay. This function will be available in October to iPhone 6 users and iPhone5 users in early 2015. The security measures are interesting.

When the phone is near a supporting terminal, the user approves the suggested transaction by using the fingerprint sensor on the phone. Credit and debit card info is stored only on the phone in the Passbook app. New cards can be added simply by snapping a photo of the card. During transactions, instead of the device transmitting card numbers to the receiving terminal, it will only send over a Device Account Number for each card and a “transaction-specific dynamic security code.” The store’s personnel will never even see the cards being used. Apple will not store purchases history on any devices or in the cloud, and only provide the user with a recent transactions list for convenience purposes. As with other data on iPhones, it can be “wiped” remotely if lost.

At this point, Apple says to expect to see the needed terminals atApple retail stores, Babies R Us, Bloomingdale’s, Disney Store, Duane Reade, Macy’s, McDonalds, Nike, Petco, Staples, Subway, Toys R Us, Unleashed, Walgreens, Walt Disney Parks and Whole Foods as well as in some phone apps.

Contact Us

If you have any questions or would like to discuss this further, please give us a call or send us a note.

To receive emails notifying you of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.