Will a stock market correction ruin my financial plan?

September 2014

“With the stock market at an all-time high, a devastating correction is imminent.” This is a common warning these days that has some people nervous about their investments. We have our own warning – don’t be distracted by prognosticators.

Stock market corrections are not more likely at market highs. The frequency of declines in the U.S. stock market after the market reaches an all-time high is virtually identical to the frequency of declines after any other period.[i] This does not mean a correction will not occur. Stock market corrections and “bear markets” are quite common. So common, that experiencing them should be expected as a normal part of being a long term investor, not something to hope will not happen. So, it’s best not to worry about whether the bear is going to growl, because growl it will and often. That is the nature of the beast.

Stock market corrections and “bear markets” are quite common. So common, that experiencing them should be expected as a normal part of being a long term investor, not something to hope will not happen.

According to Yardeni Research, since 1928 the S&P 500 index has experienced 46 corrections, defined as a decline of 10% or more. That’s more frequent than once every other year. In 20 of those cases, more than once every five years on average, the decline was over 20%. The longest stretch between market corrections was just eight years.

But, what if the market is heading toward a correction? Will a stock market correction be devastating?

In our view, if your life will be devastated by a market correction, you have a lousy plan. A market correction should be inconsequential and a bear market should be something you can weather.

Why Good Plans Can Make Stock Market Corrections Inconsequential

Second, a good plan expects the gyrations of the market. It is astounding how many people put money in stocks and then are shocked, shocked we tell you, when stocks drop in value. These folks were either unaware of how the market behaves, believed their research uncovered holdings that were somehow immune, or thought they could get out before a decline.

Third, good planning recognizes risk comes in many forms and is unavoidable. Therefore, the focus is on managing risk rather than wishing it didn’t exist. For instance, stocks have been terrific when used to earn a return in excess of inflation over long periods of time. Stocks are not good at maintaining a steady value. Good plans never forget this contradiction and use stocks to fund long term goals, not short term needs.

You Can Succeed Without Depending on Predictions

Consider the hypothetical balanced investor that owns a simple mix of 60% in stocks (represented by the S&P 500) and 40% in 1-month treasury bills, rebalanced annually[ii]. Such an investor makes no attempt at predicting market movements and does not try to maneuver in and out of the market based on predictions. Historically, such an approach has been quite resilient.

Using monthly data through June 2014, the S&P 500 provides 1,062 months between January 1926 and June of 2004 that one could have started a ten year period of investing. Of those 1,062 months, we identified 99 months in which one could have begun a ten year period with the S&P 500 losing 10% or more in the first six months. In only five of those 99 unfortunately timed start dates, all between September 1929 and June of 1930, did the hypothetical balanced portfolio lose value over ten years.

The worst result was a annualized loss of just 1.14% for the ten years starting in September of 1929. That is also the only loss of more than 1% per year. Keep in mind there were significant additional declines past the infamous September 1929 crash that kicked off the Great Depression. The S&P 500 index dropped nearly 83% in total over 33 months from September of 1929 through June of 1932. Nonetheless, the average result for the other 94 periods that started with a correction after June 1930 was 6%.

Is Timing the Market Really That Difficult?

It is highly unlikely that one will predict stock market corrections with enough accuracy over an investing lifetime to produce a good result after costs. First, you must sell and incur the costs of selling, including taxes.

Second, the market must decline fast enough and far enough below your selling price to make up for the costs. If after the sale the market instead rises, the higher it rises, the more severe the correction must be to provide profit potential from the timing maneuver.

Lastly, you have to buy when the market is down and then hold on for a long enough period of time for the market to rise and before you get nervous and want to sell for fear of the next correction. Remember, the premise that started this discussion was that when the market goes up, a 10% drop in the stock market is likely and such a drop in value would be a problem requiring evasive action.

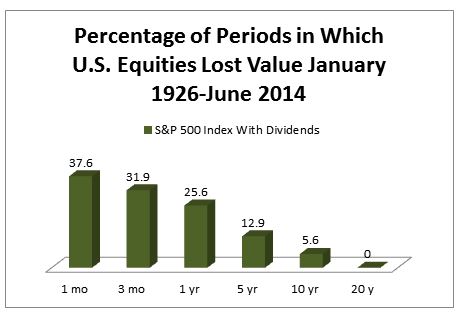

Taking into account all these factors and the chances of timing market buys and sells accurately enough several times during one’s investing lifetime are slim. The odds are bleak because of the simple fact that stocks have gone up more often than they have gone down. Whether it is better to be in or out has not been a 50/50 proposition.

If you had a coin that came up heads in 51% of tosses, the smartest, most reliable way to win would be to bet a consistent amount on heads over and over again. Any given flip could be tails, and tails would come up often, but the more bets you made on heads, the more likely you would come out ahead – as long as you didn’t fight the odds. Markets rise more often than they fall. Staying invested over the long term is like betting heads every month but with a better than 60% probability. The chart shows how the strategy has played out.[iii]

Earlier we stated, “A correction should be inconsequential and a bear market should be something you can weather.” Reflect on your own experience and you should now be confident in this truth. If you had a good plan and stayed with it, your life has not been devastated because of the stock market. In the last 15 years, you weathered two of the worst bear markets since the depression (burst bubbles in tech stocks and real estate). Heck, just in the last five years you have experienced three corrections. Done right, buy and hold doesn’t mean buy and ignore.

No one likes it when stock market corrections come, but prudent investors know that making decisions with the long term in mind has always proved wise, even if it did not immediately alleviate the short term pain. As often as corrections occur, it is a near certainty that the portfolios of long term investors with any stock holdings will lose value periodically.

Corrections of all magnitudes ended and reversed themselves. All of them. No one knows what the future holds, but this is an encouraging track record.

Ignore the Media Pundits

When the next stock market correction comes, whether it is soon or after additional gains, you should be more inclined to buy a little more stock, not sell. This may not be easy. Almost daily, the media will tell you, “Be afraid of stocks.” As the media has done in all previous corrections, the farther stocks fall, the louder the “be afraid” refrain will be.

Remember, the financial media is not there to help you make prudent decisions about your money. They exist to sell ads. They know nothing about you, your family, your dreams, your resources, your constraints, your temperament, your tax profile, or your plans.

As a prudent long term investor, they aren’t even talking to you. They are addressing people who have put themselves in the precarious position of needing to predict the unpredictable. Ignore them. Ignoring all their prior calls of doom has been sensible, so chances are ignoring them the next time will also be sensible.

Focus on what you can control. Ignore the noise. Invest, don’t speculate.

Contact Us

If you have any questions or would like to discuss this further, please give us a call or send us a note.

If you are not a client and you wish to receive emails notifications of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.

[i] Study by Dimensional Fund Advisors, 2013

[ii] For illustrative purposes only. You can not invest directly in an index. Returns are gross and investors that try to replicate the hypothetical portfolio described will incur costs not reflected.

[iii] Data from Center for Research in Securities Pricing, University of Chicago