Major market related news this quarter included the increased volatility of stocks in reaction to happenings in China and speculation about whether or not the Federal Reserve would raise interest rates.

The Chinese stock market had been on a tear. In August, the Chinese government thought the economy was not growing fast enough so it decided to devalue their currency against the dollar by about 2%. This makes Chinese products a little less costly and is in theory a boost for Chinese interests. The Chinese stock market took the slower economic growth rate as a reason to burst its bubble. Many other markets around the world dipped in notable but less dramatic fashion than the Chinese market.

Meanwhile in the U.S., the economy is on the most solid ground it has been on in years. You have probably noticed housing prices are rising and there is new construction of homes and businesses throughout Central Florida. Much of the country is experiencing similar positive indicators and the official unemployment rate is down to 5.1%.

The Fed does not want inflation to come back, which can happen when the economy is particularly strong. Many believe the Fed will soon raise rates to keep the economy from getting too strong. Speculation about this has been widely cited as a contributor to the volatility we saw in September.

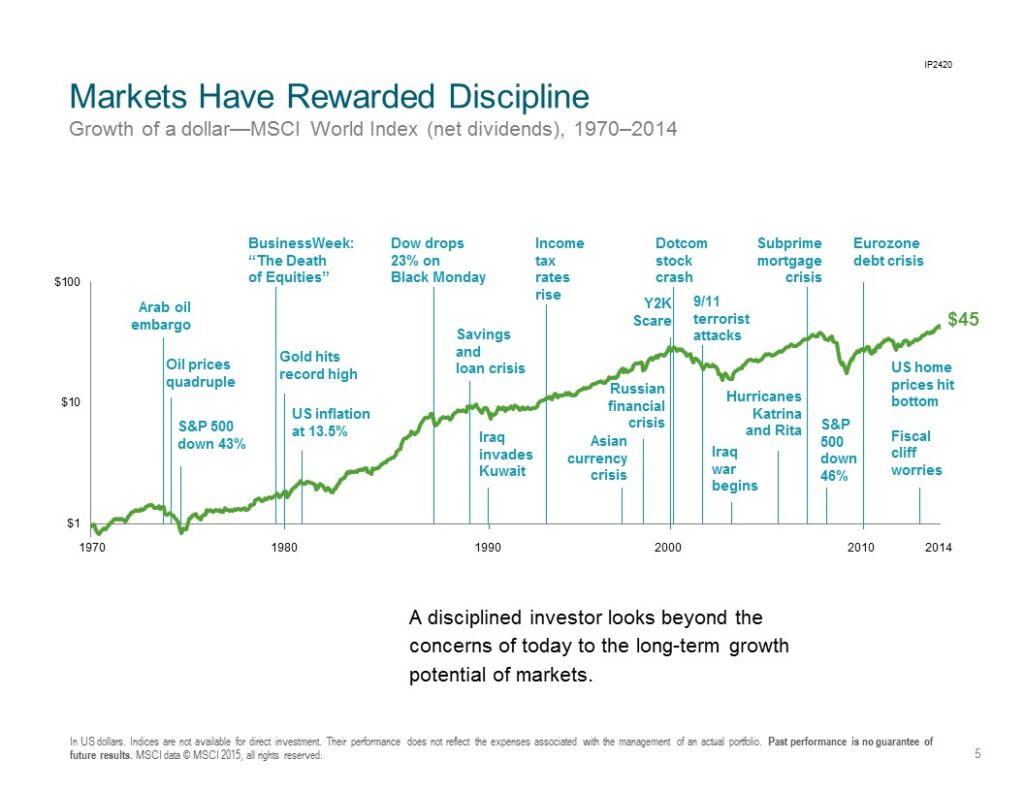

…we do not see any reason the market won’t reach new highs in the future as it has always done after every other decline in history.

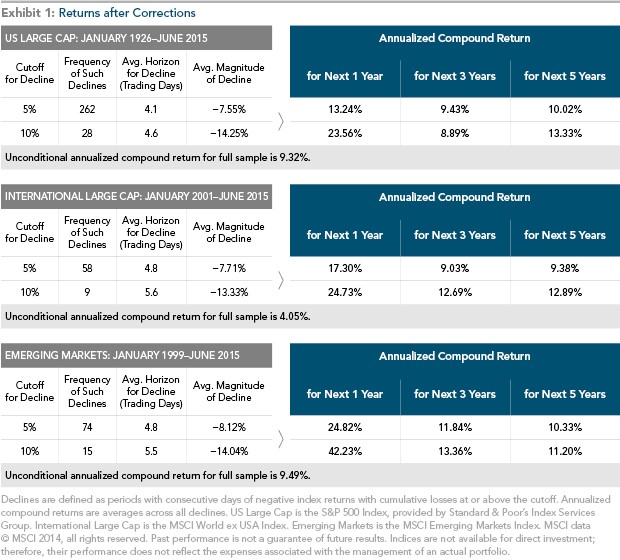

While we are always somewhat concerned about the economy as well as international and political issues, we are not more concerned than usual. The size and speed of the recent market drops are not uncommon. A recent study by Dimensional Fund Advisors showed that in the 89 ½ years since January 1926, the market has dropped on consecutive days for a cumulative fall of 5% or more 262 times. On average, that’s three times a year. A consecutive day decline of 10% or more happens every three years. Such “freefalls” are even more common overseas, as you can see from Exhibit 1 below.

Additional market declines are certainly possible before we see the market rise to new highs again. But based on what is known now, we do not see any reason the market won’t reach new highs in the future as it has always done after every other decline in history. Notice the returns that came after the declines were typically more than adequate to make up for the declines. Patience has been rewarded.

We do want to point out one thing worth noting from the latest market gyrations. We emphasize that the purpose of bonds in a portfolio is to provide stability. During the late August market decline, we observed exactly the kind of differences we warn about between the behaviors of the short term high quality bonds we prefer and “high yield” bonds (aka junk bonds) people are drawn to when interest rates are low.

According to Morningstar, from the May 21st high point and the August 25th low point for U.S. stocks as measured by the S&P 500 index, SHY, an exchange traded fund which holds U.S. government bonds maturing in 1-3 years, rose slightly. At its lowest during this period, its price was a mere .22% below its high. By contrast, JNK, a fund that tracks junk bonds, fell 7.5% over the same time period. That is not stability. (These funds are used to help illustrate a concept and do not represent an investment recommendation.)

Certainly, the Fed will raise rates. Maybe this month, maybe next year, maybe even later. Regardless, their decisions are not worth obsessing over.

From an investment standpoint, people who are on pins and needles over the possibility of a rate hike, the economy, or the state of the Chinese markets are focusing on things that should not affect their long term financial plan. A properly structured portfolio that supports a family’s financial plan should not require an accurate forecast about such things. Successful long term investors do not get distracted by the news or the noise, so we will stay diversified, disciplined and patient.

Recommended reading for more

INTEREST RATES UP, BONDS DOWN, NOW WHAT?

HOW WILL RISING INTEREST RATES AFFECT YOUR INVESTMENTS?

FOR SUCCESSFUL INVESTING, CONTROL YOUR INTAKE OF BUSINESS NEWS

News & Notes

Trading improvements: We are always looking for ways serve you better. We are implementing some changes we believe will be an improvement.

If you haven’t seen lots of trades recently, you may see several in the coming months. No, we have not decided to become day traders. In general, trading has been more of hindrance to meeting financial goals than anything else and we believe that will always be the case. Accordingly, when we make adjustments to portfolios, we actively seek to keep trading to a minimum and make needed changes with a small number of trades.

We are still not proponents of frequent trading. However, by working with our custodial firms, we now have a lower and more flexible trading cost structure available. As we conduct our normal review, management, and rebalancing activities, we are putting portfolios through a “makeover” to take advantage of the new increased flexibility and lower costs.

…people typically hurt their investment returns by trading based on their belief of what may soon happen in the markets.

There are three main reasons to keep trading to a minimum – returns, taxes, and fees.

First, people typically hurt their investment returns by trading based on their belief of what may soon happen in the markets. Being wrong about such a trade is obviously costly but being right can be even worse. It makes people think that trying to maneuver ahead of market moves is a good way to go and they start to try to time changes in the marketplace with more of their assets. It is similar to the gambler that makes bigger bets when playing with “house money.” This kind of trading is replete with short term thinking and it is easy to fall prey to it when markets are misbehaving. But we continue to reject getting suckered into playing that game.

Second, by far, the odds of “out trading” the market over the long term is low and even lower after-taxes. The biggest investment expense can be taxes. Trades in taxable accounts have tax consequences. In general, high trading volume in taxable accounts can lead to higher taxation.

Lastly, the explicit transaction costs from trades can add up. One of our duties as fiduciaries is to manage your costs. It is this third factor that has greatly improved and the changes we are implementing could make these costs even lower going forward. In many cases, there will be no trade fees at all. We still shouldn’t be trading a lot in the future but because this cost drag could be less, there may be more trades than in the past.

The bottom line is your investment plan is intact as is our philosophy and approach. The implementation pieces and tactics will be slightly different and should save you money.

Tax & year-end planning: While we always preach the value of maintaining a well-grounded long term perspective, it is also worthwhile to consider short term tactics which can boost one’s bottom line. Year-end planning is underway. Where needed, we will prepare a tax projection for 2015 to help us be more precise about what maneuvers may benefit each of our client families. We typically start this formal tax projection process in November.

New additions to your client portal: On September 30th, we began displaying a new “Capital Flows” report in Client Portals. The graph and supporting information in the report outlines the cash flows in and out of your accounts. The balance of your account is the result of what you put in, what you take out, and investment returns. The new view illustrates the ins and outs over time. We would be happy to walk you through the report so you can better understand how to read its sections.

Also in the portal, we are now displaying the specific allocation of the mid-sized company stocks. In the past, we have combined them with the large company stocks.

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC

Contact Us

If you have any questions or would like to discuss this further, please give us a call or send us a note.

If you are not a client and you wish to receive emails notifications of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.