Why investng in global markets is important

In times of calm, the rationality of a prudent, long term strategic plan is pretty obvious. However, we can easily be forced out of our comfort zone in the face of unpleasant news. The summer of 2015 is the latest in an extensive list of time periods which provided ample opportunity for short term concern to overwhelm rational, long term strategic planning. First it was troubles in Greece and then dramatic moves in the stock market blamed on financial events in China. World markets reacted negatively and what should have been a relaxing season maybe enjoying travel or vacations, for some turned into a worrisome time.

While “smooth” is impossible, “smoother” is achievable and diversification has been a reliable way to attain a smoother ride.

What we want to achieve from an investment portfolio is a smooth growth rate. One problem: smooth is nearly impossible. Where smooth is possible the return is minuscule. To have a good chance to stay ahead of inflation, we must take risk. No risk, no return. But recent world events can make it feel like high risk, low return. We understand and we believe positioning a portion of one’s holdings in foreign markets is important despite the current perception.

Why investing in global markets is important

While “smooth” is impossible, “smoother” is achievable and diversification has been a reliable way to attain a smoother ride. Diversifying by investing globally over the long term seems particularly helpful. Why? One reason is that economic activity is more global. Most of the world’s economic activity occurs outside of the United States and many U.S. based companies derive a significant portion of their business outside of U.S. borders. International markets cannot be ignored. Even if you invest only in U.S. markets, your holdings are affected by international events.

This can be clearly seen in times of true crisis. During the 2008 financial crisis, stocks around the world lost value. Like other true crises, it didn’t last long. (Most of the time, there is no true crisis, even if there are plenty of false alarms.)

As a result of the temporary nature of crises, most of the time foreign holdings are going to behave somewhat differently than U.S. securities. Sometimes they will do better, sometimes worse. This difference or “low correlation” has a valuable smoothing effect over the long term, even if foreign holdings return less than U.S. counterparts.

The magic of diversification

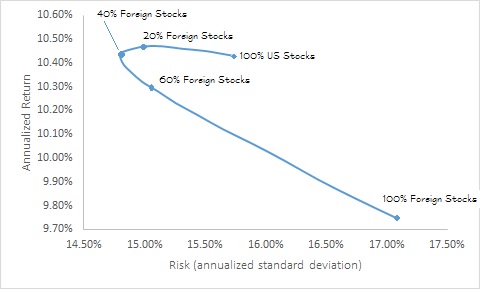

The line in the chart below represents the return (y axis) and variability (x axis) of various combinations of U.S. and foreign stocks from 1970-2014. The farther to the upper left, the better. That means higher return and a smoother ride.

Note that foreign holdings, viewed in isolation, were to the lower right. Less smooth and less return. All combinations were better than 100% Foreign Stocks, as one might expect since U.S. Stocks performed better.

What surprises many about diversification is that the effect of adding complementary asset classes is not a straight line. As Foreign Stocks are added to 100% U.S. Stocks, it does not lower the returns initially. The combinations of as much as 40% Foreign Stocks actually yielded a similar or better return than 100% U.S. Stocks but with less variability. It is the permanent combination of the two asset classes that smooths the returns. When we pair the two in various combinations and rebalance regularly, voila’, we see a range of combination percentages that got similar returns as the best of the two but with a lot less variance. Smoother. This happens because the correlations are not consistently strong.

For the chart, U.S. Stocks are represented by CRSP Total U.S. index. International stocks are represented by MSCI World ex U.S. Index. You cannot invest directly in an index. The illustration ignores costs. Past performance may not be indicative of future results. These indexes are used to help illustrate a concept and do not represent an investment recommendation.

U.S. Stocks vs Non-U.S. Stocks, January 1970 – August 2015

Allocating 40% to Foreign Stocks produced the smoothest result, while a 20% allocation produced the highest average return. This chart should not be interpreted to mean that any particular mix is ideal. In shorter time periods, the chart can look very different and the larger the percentage overseas, the more strange a portfolio’s behavior can seem. The annual difference between the two classes can be substantial.

Differences are normal and expected. For true long term investors, the short term differences shouldn’t be worrisome or prompt a change in strategy. It is counterintuitive to think of additional risk as a good thing but in this context, it has been.

Some risks are not worth taking

It is important to note not all additional risks add to returns. Currency risk is a good example. One can speculate strictly on the changes between currency values. No goods or services are exchanged at all. Every buy is offset by a sell and since there is no value added by this trading, the expected return is zero in the aggregate over the long term. After costs, the expected return is negative. The more frequently one moves in and out of foreign markets, the worse the effect: added risk and less return.

In reaction to a big drop in their stock market, the Chinese government devalued its currency against the U.S. dollar by 2%. Some called this change an awful thing, even the start of a “currency war.” It appeared to give nervous traders the excuse they had been looking for to sell stocks. But in order to get enough potential buyers to act, they lowered their asking prices and U.S. markets saw some dramatic days.

The currency rate change by China, like all changes to currency rates, will have an effect on the world economy but it won’t dictate what is to come. We may get into the economic effects another time but in all these discussions, it is useful to remember there is always another side.

What changes in currency rates mean and don’t mean

A weak Chinese currency means a strong dollar. Isn’t “strong” a good thing? You can bet many a politician will tout that a strong dollar policy is good. After all, who will vote for someone who wants to “weaken” the dollar?

Yet, it’s also a good bet the Chinese government’s action to strengthen the dollar will be portrayed as bad and that term, “currency war” will come up again. During the campaigns, listen carefully and you may hear it is both bad if the dollar is not stronger and bad if it is. We aren’t saying the U.S. is a mess either way. We are just pointing out the schizophrenia and folly of politics and media.

It is also the kind of short term fixation and hysterical media we caution against. The U.S. dollar can fluctuate quite a bit either way without long-term negative consequences. If China makes several additional devaluations of its currency, making the dollar stronger, it has not started a currency war. Likewise, if the dollar falls against the Euro, Yen or the Pound, it is not a sign the economy is heading into a recession.

The U.S. dollar can fluctuate quite a bit either way without long-term negative consequences.

Despite recent headlines and market swings, investing overseas makes sense for true long term investors. Headlines can be a distraction and we would be remiss if we didn’t mention that with the presidential election ramping up, it may be even harder to maintain perspective.

The world stock markets can react dramatically to world economic and political events. It has always been that way so we expect no difference in the future. Leave the panic to the speculators. Recent events in no way change our opinion that a prudently designed, well diversified portfolio implemented with patience and discipline is still the best defense against the world’s chaos over the long term and the best way to seek “smoother” in a world where smooth is impossible.

If the rhetoric gets to you, give us a call. We will walk you through it providing a calm, rational environment – “A sanctuary from the noise.”®

Contact Us

If you have any questions or would like to discuss this further, please give us a call or send us a note.

If you are not a client and you wish to receive emails notifications of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.