With interest rates low, should I buy dividend paying stocks instead of bonds?

No. Dividend-paying stocks are stocks not bonds and cannot be counted on to provide the stability good quality bond holdings have provided. Dividend paying stocks are every bit as risky as the rest of the stock market. Why?

Dividend-paying stocks are a minority in the market, and for good reason. The cash to pay the dividend comes from coffers filled after corporate taxes were paid and the distribution is not deductible to the corporation. By paying a dividend, that cash is not available to be reinvested in staff, facilities, research, development, marketing or any other activity management may want to undertake to improve the health of the business. Paying dividends can put a company at a disadvantage in our highly competitive marketplace.

Dividends payments are a voluntary action. Management can cut or eliminate dividends at any time. Some companies hurt themselves by continuing to pay dividends because they fear a negative reaction from the market or make themselves less competitive. That’s a lot of uncertainty.

Unfortunately, there is a lot of press out there suggesting dividend-paying stocks are dramatically safer than non-dividend paying stocks. That is just not true.

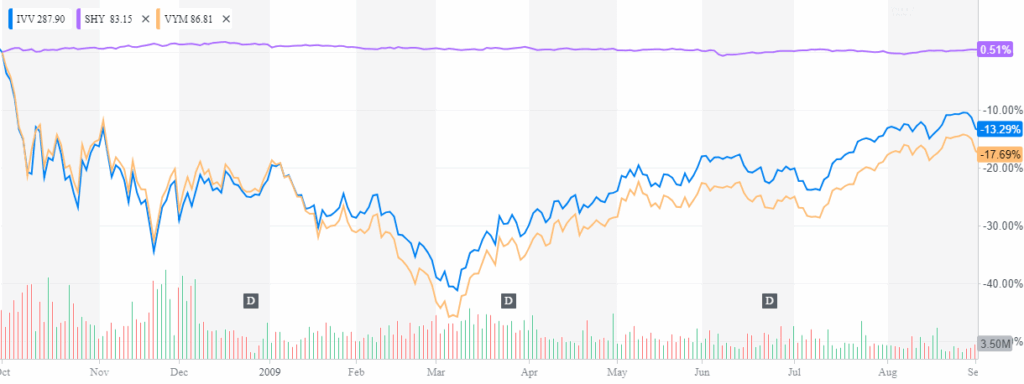

Look at just about any mutual fund focused on dividend paying funds and it is clear, those stocks sank right along with the rest of the market. For example, below is a chart of three ETFs. IVV tracks the S&P 500 (Blue), VYM is Vanguard’s highest rated, dividend focused fund, the High Dividend Yield Index Fund (Orange), and SHY tracks US Government Bonds maturing in 1-3 years (Purple) over the 12 months ended 9/30/2009.

Making News…

We frequently produce Q&A columns for Florida Today, Investopedia and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine and others. Here is a sampling from the last three months.

Mike Salmon provided a few answers to readers of the Orlando Sentinel for it’s “Ask the Expert” series. Mike chimed in on how tax filing changes when one is widowed, why most people should prefer term life over whole life insurance, and why some people over 70 should still own diversified stock funds.

In the News…

Things We Found of Note

75% of American’s have at least one big financial regret. (Bankrate)

70% of people regret spending on restaurants. (Common Cents Lab)