Protect yourself against tax fraud and identity theft

March 2013

Fraud is much easier to commit when dealing with complex and confusing matters. The American Tax Relief Act of 2012 (ATRA) passed at the eleventh hour of the “fiscal cliff” drama did little to reduce the complexity of our tax code. But confusion with tax changes does not have to result in fraud. By being aware, diligent, and working with reputable professionals, you can make it difficult for scam artists. The IRS maintains a “dirty dozen” of common tax scams. Here is a recent list with brief descriptions:

1. Identity Theft Refund Fraud – Scammers use your legitimate identity and personal information to file a tax return and claim a fraudulent refund before you have filed your actual return. Ron Tamayo discussed this issue on the evening news in a WFTV Channel 9 report in January. If you have been a victim of identity theft, you can call the IRS Identity Protection Specialized Unit at 1-800-908-4490 to obtain a special ID number to use when you file your return.

2. Phishing – No matter how legitimate it may look, the IRS does NOT alert taxpayers of problems or ask for personal information via email. If you get an email you suspect is phishing, forward a copy to the IRS.

3. Tax Return Preparer Fraud – A few tax return preparers try to steal parts of refunds, charge a percent of your refund rather than a flat fee, or promise large refunds. Avoid any tax preparer who won’t provide a copy of your return, lacks a tax preparer number or won’t sign your return as the preparer.

4. False or Inflated Income or Expenses –Popular versions involve fuel tax credits or maximizing earned income credit to generate a fraudulent refund.

5. “Free Money” and Social Security Tax Scams – Common with the elderly and low income earners, a fraudster will promise a high refund and charge a fee for advice that provides a refund by breaking the law.

6. False Form 1099 Refund Claims – Scammers play to conspiracy theorists and use this form to get refunds from a secret account that the IRS insists does not exist. Of course, if you are a conspiracy theorist, you don’t trust the IRS and may believe the scammers. This one put actor Wesley Snipes behind bars.

7. Hiding Income Offshore – It is illegal to hide income in offshore accounts. Advice to the contrary is suspect.

8. Frivolous Arguments – These scams are based on stories of secret loopholes in the tax code. Among the favorites are pretending you are not a U.S. citizen or that paying taxes is voluntary or unconstitutional. Checkout a full list of what the IRS considers “frivolous” arguments at http://www.irs.gov/Tax-Professionals/The-Truth-About-Frivolous-Tax-Arguments-Introduction.

9. Disguised Corporate Ownership – Sometimes used for money laundering, these scams seek to underreport income and inflate deductions under a complex web of false employer ID numbers and corporate entities.

10. Bogus Trusts – Trusts can be ideal management and tax planning tools but if the pitch for one includes hiding assets or income, it is probably a fraud.

11. Claiming Zero Wages – Usually based on frivolous arguments (see #8 above), a Form 4852 (Substitute Form W-2) or a “corrected” Form 1099 is used to reduce taxable wages to zero.

12. Unqualified Charitable Organizations and Inflated Deductions – Some charities are not particularly charitable and in fact don’t even qualify as a charitable 501(c)(3) organization. Avoid any charity which claims there are no restrictions on the value one can claim for a donated item.

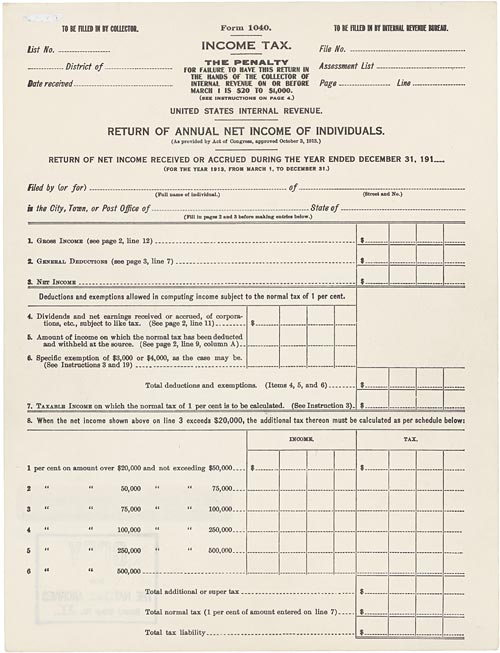

It seems most people want a simpler tax code but its complexity has increased steadily since its inception. Below is a copy of the very first Form 1040. You will notice it is only one page and the highest rate charged is just 6%. Today, only 1 in 10 Americans prepare their own return. National Taxpayer Advocate Nina Olson estimates that including corporations, it takes 6.1 billion hours to prepare and file all our tax returns. As Congressman Dave Camp put it, “The code is 10 times the size of the Bible with none of the good news.”

Identity Theft

Your best defense to prevent identity theft is to be diligent and guarded about giving out personal information. If you receive correspondence requesting personal information, contact the company directly by looking up the telephone number separately from the correspondence, or check your last bill or statement. Do not rely on the correspondence, since scammers often provide phone numbers or web addresses that lead to bogus personnel. Always look over your bills and statements for any unusual activity.

In addition, diligent financial firms will monitor accounts for unusual activity. Some of our clients have received phone calls from us to verify that an unexpected check was indeed valid.

If you do see unusual activity, what should you do? Our clients should alert us immediately. We can guide you through the things that need to be done, such as the items below:

• Put a fraud alert on your credit report(s) right away. Once you do it with one credit bureau, it should automatically be logged with all three of the credit bureaus: Experian, TransUnion and Equifax. Usually good for 90 days, this alert will prevent anyone (including you) from opening a new bank or brokerage account without extra ID.

• If your state allows it, and most do, freeze your credit file with all three bureaus so the bad guys can’t apply for new credit. In Florida, it is free for fraud victims and anyone over age 65. Otherwise, there is a $10 fee to freeze or unfreeze your file. You will have to unfreeze your report to apply for new bank and credit accounts, cell phone contracts, etc., but if frozen, no one can get your report or open credit in your name.

• Review ALL credit and bank accounts online to determine if transactions are accurate, and then change your passwords.

• Consider calling all creditors to ask for their guidance on the issue.

• Review what you are carrying in your wallet; removing unneeded credit cards and your Social Security card (NEVER carry that!).

• Check out the Identity Theft Resource Center for other consumer tips. They are available by phone and email if you have questions and have sample letters to use when corresponding with creditors.