News & Posts...

Home »

Moisand Fitzgerald Tamayo, LLC

Non-financial questions to consider before retirement

Non-financial questions to consider before retirement The decision to retire is clearly predicated on one’s…

Read MoreThe election and your investments

The election and your investments The season many in our county dread is upon us.…

Read MoreMost Common Investing Mistakes

Most Common Investing Mistakes A recent conversation with the son of a client and a…

Read MoreImportant tax changes for 2024

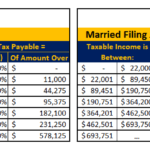

Important tax changes for 2024 Every year, there are changes to laws that affect our…

Read MoreHow can I get my tax information to my preparer securely?

How can I get my tax information to my tax preparer securely? Tax season is…

Read MoreDo spikes in the national debt cause market crashes?

Do spikes in the national debt cause market crashes? It’s an election year. Hang…

Read MoreWhy true investors don’t worry about their portfolios on Election Day

Why true investors don’t worry about their portfolios on Election Day A recent study…

Read MoreHow do higher interest rates affect personal finances?

How do higher interest rates affect personal finances? The most obvious effects of higher interest…

Read MoreMoisand Fitzgerald Tamayo, LLC named to list of America’s top 250 independent financial planning and wealth management firms by Forbes

FOR IMMEDIATE RELEASE Moisand Fitzgerald Tamayo, LLC named to list of America’s top 250 independent…

Read MoreWhat do high valuation differences in the market mean for your portfolio?

What do high valuation differences in the market mean for your portfolio? One way to…

Read MoreDoes stock-picking work?

Does stock-picking work? Stock-picking, the practice of selecting individual stocks to outperform the market, is…

Read MoreIs there a downside to diversification?

Is there a downside to diversification? Which would you have rather owned A or B? …

Read MoreMoisand Fitzgerald Tamayo marks 25 years!

Moisand Fitzgerald Tamayo marks 25 years! 2023 marks the 25th anniversary of the founding of…

Read MoreWhat “The Sting” Can Teach Us About Scams

What “The Sting” Can Teach Us About Scams Key Points: Scams are being carried out…

Read MoreWhen are Roth IRA distributions taxable?

When are Roth IRA distributions taxable? From Ken in Satellite Beach: I thought once you…

Read MoreManaging risk

Managing risk Some of you may have been concerned about the recent failure of Silicon…

Read MoreWhat you need to know about tax extensions and new tax rules

What you need to know about tax extensions and new tax rules Many taxpayers will…

Read MoreWas “Always be diversified” the most important lesson from 2022?

Was “always be diversified” the most important lesson from 2022? 2022 presented several useful investing…

Read MoreEveryone is a temporary owner of their assets

Everyone is a temporary owner of their assets We have all heard the adage,…

Read MoreHow inflation may reduce your tax bill for 2023

How inflation may reduce your tax bill for 2023 Thanks to inflation, reducing your tax…

Read MoreHow do I make charitable donations from my 401(k)?

How do I make charitable donations from my 401(k)? Direct donations from a 401(k) to…

Read MoreThe latest from Washington, D.C.

Before we get to the personal finance related happenings from Washington D.C., we wanted…

Read MoreDoes it matter if we go into a recession?

Does it matter if we go into a recession? Key Points: Determining when an…

Read More

When does the 60-day period for IRA rollovers start?

When does the 60-day period for IRA rollovers start? Today’s question comes from Mike in…

Read More