Why financial news intake can hurt your portfolio – if you let it!

Why financial news intake can hurt your portfolio – if you let it!

In one of Dan Moisand’s recent MarketWatch columns, he was asked what he thought was the biggest mistake he’s seen people make with their money. Dan went with, “…people do not control all the things they can control and worry too much about things they cannot control.”

One of his examples will be familiar to our clients – “Many people fail to control their intake of news. This happens to people on both ends of the political spectrum. They watch the news, get fired up, and make poor decisions that are driven by heightened emotions. This can be tricky because we want to be informed, and we care about issues. Nonetheless, if your blood pressure seems elevated after watching the news, you could be well served to change your approach.”

We are confronted by a 24/7 news cycle, a parade of financial gurus, an infinite amount of information on the internet, a deluge of tweets and social media posts, and thousands of people pitching their products and services. That’s a lot of noise!

Moving your money around based on what you see in the news is fraught with peril. No matter how smart a prediction seems, no one is likely to be accurate enough with their predictions often enough to beat the market over time.

Speculators may want to play that game, but no true investor will pay any attention to news for the purposes of portfolio management. Markets incorporate new information and expectations very quickly and are far too complex to be distilled down into the short narratives found in today’s media.

Markets incorporate new information and expectations very quickly and are far too complex to be distilled down into the short narratives found in today’s media.

Examples of narratives that failed those who acted upon them abound.

On January 1, 2000, the S&P 500 Index, a measure of the stocks of large U.S. based companies, had increased more than 20% in each of the prior four years. Listening to the news, you may have been convinced that the reason the index had done so well was that we were in a “new economy” driven by productivity enhancements, fueled by the new era of American-made technology and the internet. (Today’s hubbub around AI sounds similar.) Because of this tech narrative and the strong performance, entering 2000 you may have wondered why you would have money in other asset classes that had not performed as well, such as smaller U.S. companies or foreign stocks.

If you acted on that narrative and moved more of your stock holdings into the S&P 500, you were “chasing returns,” the act of moving into a high performing holding believing it will continue to be a high performer. As is often the case when chasing returns, you didn’t do very well.

The S&P 500 index dropped about 50% starting in March 2000, when the high-flying internet stocks began to falter. Even after ten years of holding on, your S&P 500 holding would have lost money.

Contrast that with staying diversified. You would have done okay because stocks of smaller U.S. companies and stocks outside the U.S. made some money over the decade.

In 2010, if you listened to the news lamenting how the S&P 500 had suffered a “lost decade” and that the aftereffects of the global financial crisis would keep it from doing well, you may have given up on large U.S. companies and missed out on the excellent returns that followed.

The annualized returns for the period of 2000 to 2020 were what we would expect over any long period. Both the S&P 500 and global stocks returned a few percentage points more than inflation. Mid-cap stocks did a little better and small stocks better still with ALL these asset classes experiencing significant ups and downs several times during the period.

- 6.62% – Large U.S. companies (S&P 500 Index)

- 7.60% – Global stocks (Dimensional World Core Equity Index)

- 8.75% – U.S. Mid-cap stocks (CRSP 3-5 Index)

- 9.56% – U.S. Small-cap stocks (CRSP 6-10 Index)

Over time, being resilient is more likely to pay off than being nimble.

The power of diversification is that one can get a good result without the need to listen to pundits’ narratives, predict when a hot class will go cold, or a cold class will get hot. In any time period, diversification allows one to eliminate the risk of suffering from being solely in the worst asset class by accepting that they won’t get the return of the strongest class.

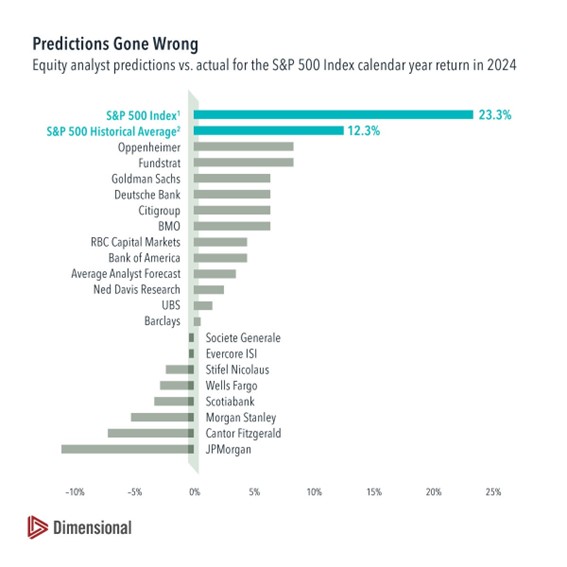

True investors do not pay any attention to news for the purposes of portfolio management. Case in point, the chart below shows graphically the predictions of major financial firms for how the S&P 500 Index would do in 2024, as told to Bloomberg in December 2023.

Pretty awful, right? All of them expected returns below the historical average and half called for a down year.

How about this example? There are 47 countries represented in the MSCI All Country World IMI Index. Which country had the best returning stock market in 2024? Given the news reports of what went on there in 2024, it may be hard to believe but the best performing stock market was Israel, up 34%.

Earlier we mentioned that nothing stays hot forever. That understates the risks of chasing returns because in financial markets, the hotter something gets, the quicker it can become icy. One example from this year is Denmark. At the mid-point of 2024, Denmark was doing the best of the 47 countries. But if you chased after that return, you lost considerably. Denmark’s stock market reacted quickly to new developments (Denmark owns Greenland) and went from #1 to #42, finishing down 11% for the year.

Predicting the fortunes of individual stocks is even more risky because the prices of individual stocks are typically more volatile than a grouping of many stocks. The S&P 500 index may have nearly doubled its historical average in 2024, but most stocks in the U.S. didn’t do very well. As is often the case, the index was driven by just a few stocks. In fact, 31% of the stocks in the S&P 500 index were down in 2024.

The narratives in the news are too simplistic to be useful in navigating the complexities of the economy or markets.

Tariffs are making news these days. Some say they are bad because they will fuel inflation. Others say they will be good for U.S. corporations. The last time Donald Trump was president, he imposed tariffs. This did not trigger inflation issues, but it wasn’t all good for U.S. companies either. US Steel was widely touted as a huge benefactor from tariffs on China but between March 8, 2018, when the tariff was enacted and election day on November 3, 2020, the company’s stock price dropped from $42.29 to $9.71, losing nearly 80% of its value. (Yahoo)

We all know the future is unpredictable. Yet, it is easy to get sucked in to thinking we can predict future behaviors in the market if we listen to the news or spend time researching and analyzing.

All this explains why a mountain of historical records show that most fail to beat the market by moving money in and out of their holdings based on their predictions of how news will affect prices. To make this trading approach work, one must predict the event and the direction, size, and timing of the market’s reaction to the event. Plus, in the case of the stock of individual companies, as you can see from our examples above, one must also predict the events that affect the health of that company and the reaction to those events. And over longer time frames, the number of those who are successful trying to outsmart or out maneuver the market dwindles and the degree of their outperformance shrinks. In taxable accounts, the results from the trading approach are even worse.

True investors do not pay any attention to news for the purposes of portfolio management. Instead, they ignore it and stay diversified, patient and disciplined with a portfolio that is designed for them and aligned with their family’s goals and needs. Remember, markets are complex and narratives in the news are simplistic and mostly noise.

At Moisand Fitzgerald Tamayo, LLC, our mission is to be “A Sanctuary from the Noise®.” Invest, don’t speculate.