-

Does stock-picking work?

Does stock-picking work? Stock-picking, the practice of selecting individual stocks to outperform the market, is far easier said than done. It is mathematically impossible for…

-

Is there a downside to diversification?

Is there a downside to diversification? Which would you have rather owned A or B? A lost an average of almost 1% per year for…

-

Moisand Fitzgerald Tamayo marks 25 years!

Moisand Fitzgerald Tamayo marks 25 years! 2023 marks the 25th anniversary of the founding of our firm. Reflecting back on these years brings a sense…

-

What “The Sting” Can Teach Us About Scams

What “The Sting” Can Teach Us About Scams Key Points: Scams are being carried out in more sophisticated ways. Technology both protects us and makes…

-

When are Roth IRA distributions taxable?

When are Roth IRA distributions taxable? From Ken in Satellite Beach: I thought once you turned 59 ½ Roth IRAs are tax free but a…

-

Managing risk

Managing risk Some of you may have been concerned about the recent failure of Silicon Valley Bank (SVB) and any ripple effects on the banking…

-

What you need to know about tax extensions and new tax rules

What you need to know about tax extensions and new tax rules Many taxpayers will not file their 2022 tax returns by the April 18,…

-

Was “Always be diversified” the most important lesson from 2022?

Was “always be diversified” the most important lesson from 2022? 2022 presented several useful investing lessons. The news was full of reports about high inflation,…

-

Everyone is a temporary owner of their assets

Everyone is a temporary owner of their assets We have all heard the adage, “You can’t take it with you.” At some point, everything…

-

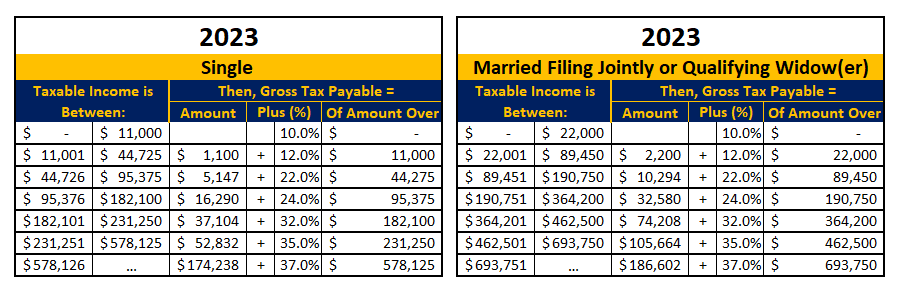

How inflation may reduce your tax bill for 2023

How inflation may reduce your tax bill for 2023 Thanks to inflation, reducing your tax bill in 2023 may be easier than you think. All…

-

How do I make charitable donations from my 401(k)?

How do I make charitable donations from my 401(k)? Direct donations from a 401(k) to charity on a tax favored basis are not possible. However,…

-

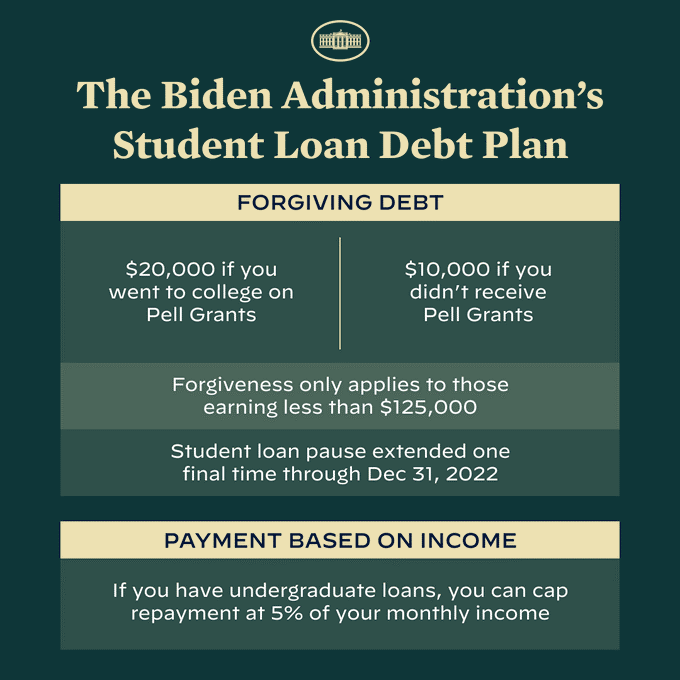

The latest from Washington, D.C.

Before we get to the personal finance related happenings from Washington D.C., we wanted to take a moment to send our thoughts and prayers…