-

Can I buy real estate in my IRA?

Can I buy real estate in my IRA? You cannot buy a personal residence in your IRA but you can buy other properties. For most…

-

Looking back and looking forward

Looking back and looking forward The turn of the calendar is a natural time to reflect on the past year and look forward to the…

-

Should I pay off my mortgage?

Should I pay off my mortgage? One of the most common questions we get, especially as people near retirement is, “Should I pay off my…

-

Can I convert a 401(k) to a Roth IRA?

Can I convert a 401(k) to a Roth IRA? Before we look at whether you can convert a 401(k) to a Roth IRA, it is…

-

Moisand Fitzgerald Tamayo wins prestigious national award

Moisand Fitzgerald Tamayo Recognized by Schwab Advisor Services with 2019 Trailblazer IMPACT AwardTM November 4, 2019 – (Orlando) – Moisand Fitzgerald Tamayo, LLC was…

-

Avoiding financial scams

Avoiding Financial Scams People are concerned about cybersecurity and avoiding financial scams. This is of little wonder considering the headlines about data breaches and the…

-

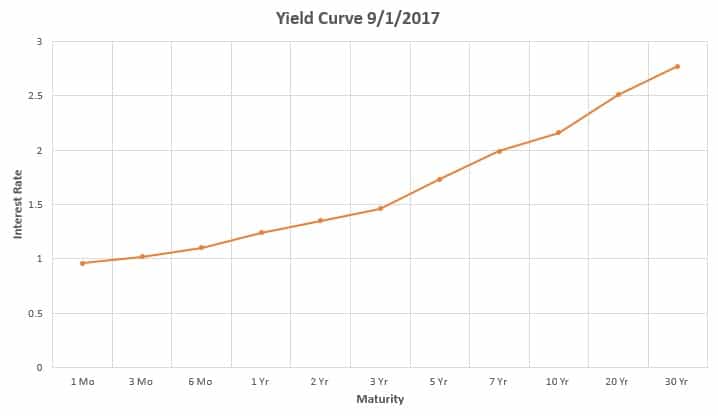

What does an inverted yield curve mean for your investments?

What does an inverted yield curve mean for your investments? The short answer to this question is “almost nothing.” The longer answer is because our clients’…

-

Should I buy or sell foreign stocks given today’s conditions?

Should I buy or sell foreign stocks given today’s conditions? Today’s Q&A combines two related questions into one, “Should I buy or sell foreign stocks…

-

Will the election cause a market crash?

Will the election cause a market crash? On June 18, no one in our Orlando office came to work. They didn’t go on strike or…

-

Estate planning documents needed regardless of net worth

Estate planning documents needed regardless of net worth There are several estate planning documents needed regardless of net worth. For the last few decades, the…

-

What do I do if I miss my required minimum distribution?

What do I do if I miss my Required Minimum Distribution? Required Minimum Distributions (RMDs) are just that – required. The penalty for failing to…

-

Orlando Financial Advisor Firm Named A Best Place To Work

Orlando Financial Advisor firm, Moisand Fitzgerald Tamayo, Named a Best Place To Work for Financial Advisors by InvestmentNews Our firm has been fortunate to earn…