-

Want to retire before 65? These milestones are critical.

Want to retire before 65? These milestones are critical. Many people want to retire before the traditional retirement age of 65. With enough planning, diligence,…

-

How to be a more resilient investor

How to be a more resilient investor You’ve heard us say it many times. When it comes to being a successful long-term investor, it is…

-

Changes to Social Security: What’s true, what’s false and what to expect

Changes to Social Security: What’s true, what’s false and what to expect Changes to Social Security are a favorite topic of the rumor mill and…

-

Why financial news intake can hurt your portfolio – if you let it!

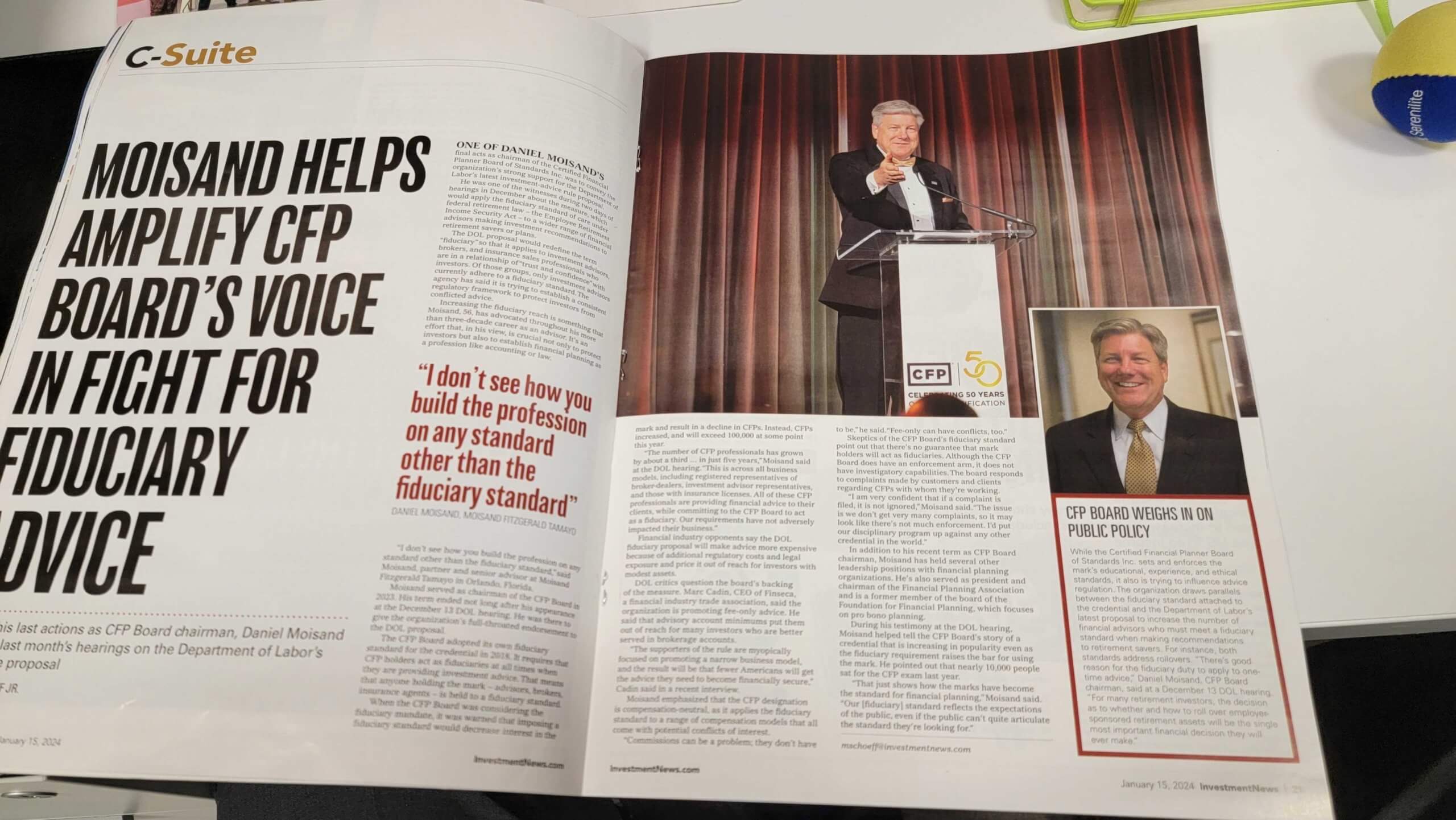

Why financial news intake can hurt your portfolio – if you let it! In one of Dan Moisand’s recent MarketWatch columns, he was asked what…

-

How will taxes change after the election?

How will taxes change after the election? Finally, the election is over! The Republican party won most seats in both the Senate and the House…

-

Will higher taxes hurt stocks?

Will higher taxes hurt stocks? The proposal to raise taxes in some capacity arises in every election. Candidates for the White House are typically the…

-

What is gain harvesting?

What is gain harvesting? “Gain harvesting” refers to the practice of selling a holding for a gain in a taxable account, triggering a taxable event,…

-

Non-financial questions to consider before retirement

Non-financial questions to consider before retirement The decision to retire is clearly predicated on one’s financial situation. We’ve been helping people retire for a few…

-

The election and your investments

The election and your investments The season many in our county dread is upon us. Even though most often no damage will occur, it’s hard…

-

When does the 60-day period for IRA rollovers start?

When does the 60-day period for IRA rollovers start? Today’s question comes from Mike in Celebration, FL. “I want to do a rollover from one…

-

Important tax changes for 2024

Important tax changes for 2024 Every year, there are changes to laws that affect our taxes. In our January newsletter, we outlined the new 2024…

-

How can I get my tax information to my preparer securely?

How can I get my tax information to my tax preparer securely? Tax season is upon us once again, and if you use a professional…