-

What do high valuation differences in the market mean for your portfolio?

What do high valuation differences in the market mean for your portfolio? One way to characterize stocks is by the ratio of its price to…

-

When are Roth IRA distributions taxable?

When are Roth IRA distributions taxable? From Ken in Satellite Beach: I thought once you turned 59 ½ Roth IRAs are tax free but a…

-

What you need to know about tax extensions and new tax rules

What you need to know about tax extensions and new tax rules Many taxpayers will not file their 2022 tax returns by the April 18,…

-

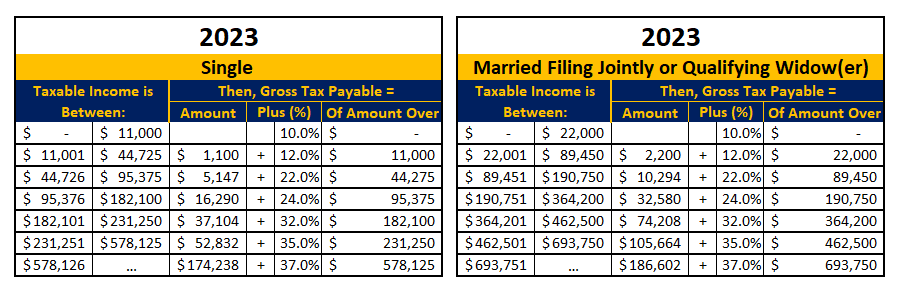

How inflation may reduce your tax bill for 2023

How inflation may reduce your tax bill for 2023 Thanks to inflation, reducing your tax bill in 2023 may be easier than you think. All…

-

How do I make charitable donations from my 401(k)?

How do I make charitable donations from my 401(k)? Direct donations from a 401(k) to charity on a tax favored basis are not possible. However,…

-

Will my tax return be processed quicker this year?

Will my tax return be processed quicker this year? The 2021 tax filing season was the worst in memory. There was a slew of legislation…

-

What are the new RMD rules?

Have RMD rules changed? Required Minimum Distributions (RMD) are back in 2021 after a one year COVID-related waiver in 2020. No changes were made this…

-

How your tax rates can change

How your tax rates can change As we enter the last part of 2021, Congress is debating a series of changes to the tax code.…

-

Can I rollover mom’s IRA into my IRA?

Can I rollover mom’s IRA into my IRA? Only a surviving spouse may rollover a deceased’s IRA account into their own IRA. After the SECURE…

-

Six common misconceptions empty nesters have about retirement

Six common misconceptions empty nesters have about retirement We have been advising retirees and aspiring retirees for over 20 years. Recently a conversation occurred…

-

How do I protect my portfolio against inflation?

How do I protect my portfolio against inflation? We pay more than double for most things we buy these days than we did 25 years…

-

What does the recent stimulus package include?

What does the recent stimulus package include? The Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA) aka “Coronavirus Stimulus 2.0” passed Congress…