Do spikes in the national debt cause market crashes?

It’s an election year. Hang on to your hats!

Every four years, we hear from both sides of the aisle about the terrible things that are sure to happen to us and to our country if the candidate from the other party wins the Presidency. Our December commentary warned that trying to time the market based on how one feels about a Presidential candidate and their party has not paid off in the past. For a true investor, market-timing shouldn’t be attempted in any year and remember, the time frame of a true investor is longer than any President’s time in office.

One topic sure to arise is the level of debt the U.S. carries and how due to budget deficits, such debt will continue to rise. The pundits note that the national debt reached 121% of the Gross Domestic Product (GDP) last year when usually the debt level is below 100% of the GDP. Although that is true, the pundits mistakenly think a high debt to GDP ratio is some sort of trigger for a market crash. Historical data does not support that.

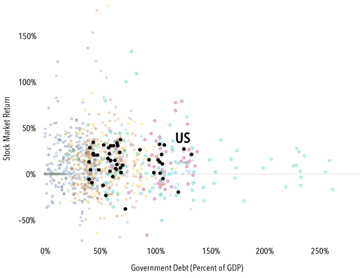

Below is a graph from Dimensional of developed market countries plotting the debt to GDP ratio on the horizontal axis against the return of that country’s stock market on the vertical axis. Each country gets a different color with the U.S. highlighted in black. If you see a pattern or a correlation, you are fooling yourself.

We can’t see this amongst the blob of dots but since 1975, there have been 153 times a country’s debt exceeded their GDP in a given year. How often was there then a crash? Not many times. Regardless of how we define “crash,” most occurred when debt levels were below 100%. In fact, in 104 of the observations, the market was up that year. Italy and Belgium have both been over 100% debt/GDP in more than 30 of the past 48 years, yet their stock markets have returned an average of 10.8% and 12.0% per year, respectively.

These results are not that surprising. Markets absorb information efficiently and debt levels do not change quickly. Think about it: is our high and rising debt a new issue? No. This well-known information is already incorporated into prices of stocks, bonds, and other instruments.

The debt level is difficult to accept but governments do not operate like households do. Markets know this and adapt to debt levels along with thousands of other data points.

The 2024 election media barrage is just getting started and if you let it upset you too much, it may test your discipline. Yes, the national debt is a large number and worthy of concern but to turn that concern into a bet on how the market will behave is speculative. The better odds of success come from truly investing not speculating, which is what we do for you.

News & Notes

Moisand Fitzgerald Tamayo, LLC was named to the list of America’s top 250 independent financial planning and wealth management firms by Forbes. This is a new list for the firm, which has been similarly recognized at various times by Financial Advisor, the Financial Times, Advisor HQ, and RIA Biz. We credit these recognitions to the quality of our team. More information and full details about the methodology can be found here.

And what an experience it was. Dan spoke at events all over the country and as far away as Singapore, shook hands with the President at a White House announcement of new investor protection rules, testified before the Department of Labor and capped off the year at a black-tie event in Washington D.C. celebrating the 50th anniversary of the first CFP® certification class.

In December, Dan was named to InvestmentNews’ 2023 Hot List honoring “the top movers and shakers in wealth management.” The list includes Gary Gensler, Chairman of the Securities and Exchange Commission and the CEOs of Fidelity Investments, Morgan Stanley, JP Morgan, Raymond James, and Vanguard. Winners were nominated in August by wealth management professionals across the country and narrowed down to the top 100 based on their contributions helping to shape the industry.

MFT sponsors student reception: MFT was instrumental in organizing a visit and reception for students in the UF Wealth Management program, which Charlie Fitzgerald helped start by speaking with Dr. John Banko in 2014. This was the second year we hosted students in our Orlando office and our first hosting the reception. About 70 people attended the reception, 30 students and faculty plus about 40 local financial planners. We received a pleasant surprise during it when Charles Schwab recognized MFT for our 25-year relationship with them – a relationship which is truly independent, i.e., we are not employed by Schwab, obligated to use them, and receive no financial remuneration. This successful relationship has helped us deliver on our fiduciary duty to our clients.

Tax filing alert

Many taxpayers will not be able to file their 2023 tax returns by the April 15, 2024 deadline. Done properly, such taxpayers can receive a six-month extension of time to October 15, 2024 to file and avoid any interest charges or penalties from the IRS. What does “done properly” mean, what are the benefits and downsides of an extension, and should you extend your tax return this year? Our Tax Manager, Kevin McDermott, CPA, explained the basics of how extensions work in our commentary last March.

Important numbers and dates for 2024

Marginal tax brackets for tax year 2024

Married filing jointly

| Taxable income | Taxes owed |

| $0 to $23,200 | 10% of the taxable income |

| $23,201 to $94,300 | $2,320 Plus 12% of the amount over $23,200 |

| $94,301 to $201,050 | $10,852 Plus 22% of amount over $94,300 |

| $201,051 to $383,900 | $34,337 Plus 24% of amount over $201,050 |

| $383,901 to $487,450 | $78,221 Plus 32% of amount over $383,900 |

| $487,451 to $731,200 | $111,357 Plus 35% of amount over $487,450 |

| $731,201 or more | $196,669.50 Plus 37% of the amount over $731,200 |

Table: Gabriel Cortes / CNBCSource: IRS

Single individuals

| Taxable income | Taxes owed |

| $0 to $11,600 | 10% of the taxable income |

| $11,601 to $47,150 | $1,160 Plus 12% of amount over $11,600 |

| $47,151 to $100,525 | $5,426 Plus 22% of amount over $47,150 |

| $100,526 to $191,950 | $17,168.50 Plus 24% of amount over $100,525 |

| $191,951 to $243,725 | $39,110.50 Plus 32% of amount over $191,150 |

| $243,726 to $609,350 | $55,678.50 Plus 35% of amount over $243,725 |

| $609,351 or more | $183,647.25 Plus 37% of the amount over $609,350 |

Table: Gabriel Cortes / CNBCSource: IRS

The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan, is increased to $23,000, up from $22,500. The catch-up contribution limit for employees aged 50 and over in the plans remains $7,500 for 2024.

The limit on annual contributions to an IRA increased to $7,000, up from $6,500. The IRA catch-up contribution limit for individuals aged 50 and over was amended under the SECURE 2.0 Act of 2022 to include an annual cost‑of‑living adjustment but remains $1,000 for 2024.

For 2024, the limit on Qualified Charitable Distributions from IRAs increased to $105,000, up from $100,000.

For more information, including limits on IRA deductibility, see the IRS release.

Upcoming Important Dates

February 15 –

- Form W-4 filing deadline for taxpayers who claimed an exemption from income tax withholding for the prior year to continue their exemption in the current year

- Q4 2022 estimated tax payment deadline (This is a one-month extension from the usual January 15 date for taxpayers in areas affected by Hurricanes Ian and Nicole.)

March 15 –

- Income tax return (Form 1120S) filing and payment deadline for calendar year S-corporations

- Income tax return (Form 1065 or 1065-B) filing and payment deadline for calendar year multi-member partnerships and multi-member LLCs (default)

- K-1 issuance deadline

- Request for automatic six-month extension (Form 7004) filing deadline to extend filing Form 1120S, 1065, and 1065-B

- S-corporation election (Form 2553) filing deadline to be treated as an S-corporation in the current year

March 31 – End of Medicare General Enrollment Period

April 1 – “Required Beginning Date” which is the deadline to complete the first Required Minimum Distribution (RMD) from an IRA or retirement account for anyone who turned 72 in 2023.

April 15 –

- Income tax return (Form 1040) filing and payment deadline

- Gift tax return (Form 709) filing and payment deadline

- Request for automatic six-month extension (Form 4868) filing deadline to extend filing Form 1040 and 709

- Q1 estimated tax payment deadline

- Deadline to contribute to an IRA or HSA for prior tax year

- Income tax return (Form 1040) filing and payment deadline for sole proprietorships and single-member LLCs

- Income tax return (Form 1120) filing and payment deadline for calendar year C-Corporations and multi-member LLCs that elect to be classified as a corporation

- Request for automatic six-month extension (Form 7004) filing deadline to extend filing Form 1120

- Q1 estimated tax payment deadline for sole proprietorships, single-member LLCs, C-corporations, and multi-member LLCs that elect to be treated as a corporation

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC