For the last few years, we have heard numerous predictions of large losses for bonds, particularly if interest rates were to rise. In May, the yield on a 10-year U.S. Treasury Bond rose from 1.67% to 2.16%. If the headlines were to be believed, one would think owning bonds meant suffering catastrophic losses as the “bond bubble burst” or “bond market Armageddon” descended upon the land. Fear not. With interest rates as low as they are, we expect the returns on bonds will not keep pace with recent years. Higher interest rates will have a negative effect on your bonds but the effect is likely to be both modest and temporary. This is by design. Some bonds are at great risk, some are not.

Our philosophy about bonds is well suited to mitigating risks…Based on the modest durations of most client bond portfolios and how far down interest rates have come, we foresee modest returns and good, relative stability.

Which Bonds Are At Great Risk

There are two common ways to lose money on a bond. The first way involves credit risk. If a bond issuer defaults – fails to make an interest or maturity payment – or the market fears a default is likely to occur, the price of the bond can plummet. This recently happened with bonds from Greece. This risk is greatly reduced by buying bonds from solid issuers and monitoring their financial condition.

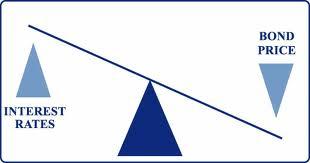

The second way to lose money on a bond is from a drop in price when interest rates rise. To understand how we mitigate this risk, let’s review the basic structure of a bond. For example, on June 30, 2013 you pay $10,000 for a bond with a 2% coupon, a maturity value of $10,000, and a maturity date of June 30, 2014. On Dec. 31, 2013, you will receive $100 in interest (half of 2% of $10,000) and on June 30, 2014, you will receive another $100 and the $10,000 maturity value. At the moment you bought the bond, you knew your return would be 2%. This is called yield to maturity (YTM).

Notice that though rates went up and the value of the bond went down, you are still getting exactly what you thought you would get when you bought the bond. The drop in value was merely temporary. Any rise in value due to falling rates would be temporary too. It quite literally does not matter whether rates rise or fall, or how quickly or slowly they do, you get your YTM either way as long as you hold the bond until it matures and the issuer makes the payments.

That caveat “as long as the issuer makes the payments” is exactly why we favor high quality investment grade bonds and avoid junk bonds, a.k.a. high yield bonds. The yields are higher with junk bonds precisely because there are doubts about the issuer’s ability to pay.

One percent in one day on 1-year bonds is a dramatic jump, yet our example shows a mere $100 decline in market value. This modest drop is a function of the short time until maturity. Longer term bonds have a much more painful drop in price. For example, 30-year U.S. Treasury securities LOST 26% in 2009, the worst result in its 82 year history because market rates on that debt rose from 2.69% to 4.64%.

Which Bonds Are Not At Great Risk

Because we advocate for bond holdings comprised of good quality issuers and shorter terms, a rise in rates will cause far less of a decline in value for a shorter period of time than holders of longer term debt. Unless an issuer defaults, we should get exactly what we expected over the period between purchasing a bond and its maturity. Additionally, as the shortest term bonds mature, the proceeds can be used to buy new bonds at the higher rates.

Some clients have individual bonds while others have various mutual funds that invest in bonds. Bond funds provide broad diversification and can often be sold more easily than an individual bond. Bond mutual funds invest in individual bonds and are subject to the same risks we just described. As a result, the strategy the bond fund manager employs can sometimes add additional risks. Through our research, we favor funds that do not add additional risks such as making big bets on the timing of interest rate changes.

The ultimate short term holding is cash, so some say to sell out of bonds now and wait until rates rise. This strategy is deeply flawed, however. In order for that to be superior to our approach, rate increases must come fast and furious AND the timing out of bonds and then back in later would have to be excellent if not extraordinary. The list of poor performing bond funds over the last few years is littered with folks who tried this tactic.

Why Owning Bonds Is Crucial

We cannot predict much with respect to the short term behavior of financial markets, but with bonds we have a much better idea of what to expect. Our philosophy about bonds is well suited to mitigating risks. We look for bond holdings to provide some income but their primary function is to provide relative stability to balance the ups and downs of long term growth investments like stocks. The instability of stocks provides all the excitement most of us need or can handle. Based on the modest duration of most of our clients’ bond portfolios and how far down interest rates have come, we foresee modest returns and good, relative stability. There is almost no possibility of stock market type losses from the bond portion of our client portfolios.

True, some bonds will do poorly in a rising rate environment and therefore owners of those bonds should worry. However, we are not fearful of damage to our client’s bond portfolios because of the types of bonds we buy and how we have structured those holdings. As always, if you have questions, please feel free to give us a call.