Stock market highs: Six things to consider now

The U.S. stock market has recently reached all-time highs. Through the Q&As we write for various publications, we hear from a fair amount of people who either do not have an advisor, or their current advisor is not very good. Many seem to think that because we are in uncharted territory, drastic action is necessary.

Because our firm works only for our clients, not any entity in the financial services industry, we must focus on what is best for each client’s unique needs and circumstances. Hence, we find ourselves in disagreement with the drastic action recommendations.

Because our firm works only for our clients, not any entity in the financial services industry, we must focus on what is best for each client’s unique needs and circumstances.

In any market and economic environment, there are actions likely to pay off and others likely to be costly. When warranted, we take the actions we believe to be in your best interest. That said, the end of a strong year is an appropriate time for some reflection. Here are a few considerations gleaned from the correspondence we have had with readers of our Q&A columns.

Smile

It is unfortunate that some lament, “A new high? Oh no!” To this we say, “Smile.” An all-time high is a good thing. All-time highs are what we want when we enter the market. Stocks are supposed to go up. New highs are a cause for celebration, not anxiety or fear.

True, stocks do not go up forever but it is also true that stocks have never failed to recover and reach new highs after a decline. Never. Not once during the many times we were told, “This time is different.” We will see a drop in the markets, maybe soon, maybe not. Regardless, the longer the time frame, the more likely you will see more new highs not long after a decline and you will be rewarded for owning stocks.

Enjoy your profits

Depending on many factors unique to each family, if we have not rebalanced your portfolio recently, there is a good chance we will before year-end or early in 2014. Tax rates on capital gains are low, even non-existent for some taxpayers. We will pick the most favorable tax year to reduce the tax impact further if we believe incurring taxable gains is in your best interest.

Been out of the market? Get in prudently

There are some tactics one can use that may help minimize anxiety as one enters the market, such as dollar cost averaging, but those things are only a temporary possible remedy. The best thing to do is learn what it means to be a true investor. We are happy to teach how markets work and how to keep them from making one nervous. Hint: if you expect the markets to be crazy, when they act up, it won’t be all that disturbing. It will be normal.

This is one reason why financial planning and goals-based investing is so valuable. We have certainly heard from a number of readers of our Q&As who have been afraid to get into the markets since the financial crisis. It is a near certainty that their investment assets will not support their long term goals. After inflation and taxes, safe holdings simply should not be expected to return much. Until they align their investments with their goals, their odds of success are poor.

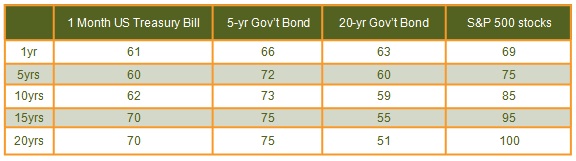

Even at all-time highs, stocks are more likely to stay ahead of inflation over time, and do so by a larger margin, than safer, more stable investments. Stocks are for the long run. The longer your time frame, the better your chances of a good result. No one will ever have a longer time frame than they do today. To the extent there is a need for assets to maintain one’s purchasing power over time, there is a need to own stocks. If someone has been out of the market because of concern that the market is about to drop, they are focusing on the short term. A short term focus is a key characteristic of speculating. Invest, don’t speculate.

Percentage of Periods in Which Pre-tax Returns Beat Inflation (CPI)

Rolling periods January 1926-October 2013. Data derived from the Center for Research in Securities Prices, University of Chicago

Note: The average pre-tax annual return over inflation for T-bills has been approximately 1/2% while the pre-tax return for stocks has been over 7%.

Maintain perspective

In addition to hearing from those nervous about the markets, we hear from those quite enthusiastic about the market continuing to rise. They want to put more money into stocks, especially since interest rates are so low. This viewpoint is another example of how there are always both buyers and sellers. The enthusiastic can buy from the nervous.

Why accept ½% interest when stocks are paying off so nicely? Well, because the stable holdings like cash, CDs, and bonds pay little interest but are not as likely to drop significantly in value as stocks often do. Those holdings are in the portfolio expressly because they provide stability. Stocks are simply not a good substitute for stable holdings.

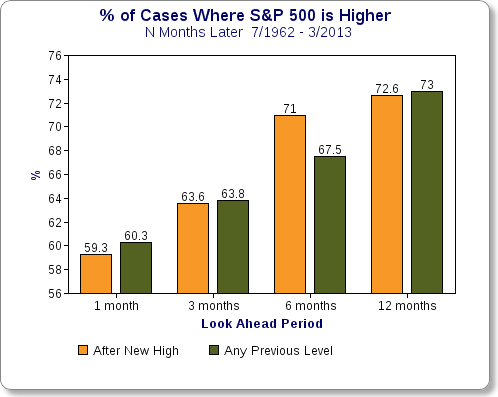

According to a study in 2013 by Dimensional Fund Advisors, the attainment of a new market high has not resulted in a statistically significant difference in the frequency of either a fall or a rise in the market compared to days when the market had not been at a high. How much of a household’s assets go into stocks should be a strategic decision, not a tactical one based on what one hears or feels today about the near term.

Tune out the pundits

Whether you are fearful of a market decline or excited because you think the market has further to climb, a significant contributor to your belief is likely something you read or heard a pundit say. The unadvised tend to find pundits fascinating. Do not take the pundits too seriously. Economist John Kenneth Galbraith said it well, “The only function of economic forecasting is to make astrology look respectable.”

There are those that like to take the opposite view of whatever any particular commenter has to say. It has to be that way. Differing opinions are the normal state. If it seems like everyone is nervous or enthusiastic, you may be exposing yourself too much to one side.

Tuning into market predictions can make you very bullish or very bearish. Financial media is designed to grab your attention and stir your emotions while sounding sensible and important. This is so you will keep consuming it and advertisements can be sold.

Remember, the frequency of rises and falls has not been affected by the attainment of new highs. If you think it is, you are probably paying too much attention to financial news. Actually, most of it is not news, it is just noise. Tune it out or at least refrain from taking it so seriously.

Focus on your goals

The best portfolio decisions are made with relevant information, proper perspective, and emotions kept in check. A thorough process methodically and objectively assesses the situation and demands evidence, not anecdotes or opinion.

Sound financial planning intelligently chooses what type and how much risk in a portfolio makes sense for reaching a given family’s goals. If the goals have not changed, a sound portfolio does not require an overhaul. If the goals have changed, portfolio changes should be made based on the new needs, not a guess about near term market movements.

If you have any questions or would like to discuss this further, please give us a call or send us a note. We would be happy to hear from you.

To receive emails notifying you of new posts – no more than monthly – fill out the subscription information in the sidebar to the right.