The effect of speculation on financial security

Invest, don’t speculate. We have made that admonition more than a few times over the years and it is usually followed with information or insights on investing. But today, we want to talk about speculation and more importantly, what effect speculation has on one’s financial security.

“Invest, don’t speculate” is a simple mantra yet no matter how successful the track record of prudent investing may be, the temptation to speculate is sometimes hard to ignore.

…no matter how successful the track record of prudent investing may be, the temptation to speculate is sometimes hard to ignore.

Speculation comes in many forms. Some, like betting on a tiny startup company, are obvious speculations. Others, like market-timing, can seem sensible at the time. Market-timing is often done in the name of preservation or in an environment that feels like the near-term direction of the market is clear.

Easy money isn’t easy

Two tell-tale traits of speculation are a short time frame and an expectation of extraordinary returns. In the case of something such as bitcoin, flipping houses, or tech stocks back in the day, there is an element of both speculation traits. The sentence “You have to get in now or you’ll miss out on easy money,” is uttered frequently and passionately by those touting whatever seems hot at the time.

Really, who wouldn’t want to make a lot of money quickly? The financial press is full of stories about people who made it big and made it there quickly too. It makes for good content and the rags-to-riches story is one of the aspects of capitalism which helps the system create wealth.

Still, we must keep in mind the subjects of these stories are featured precisely because their success is unusual. If it were easy to make a lot of money quickly, doing so wouldn’t be worthy of highlighting. For most financially secure households, and households well on their way to being financially secure, we offer the following reasons why we believe speculation is a bad idea.

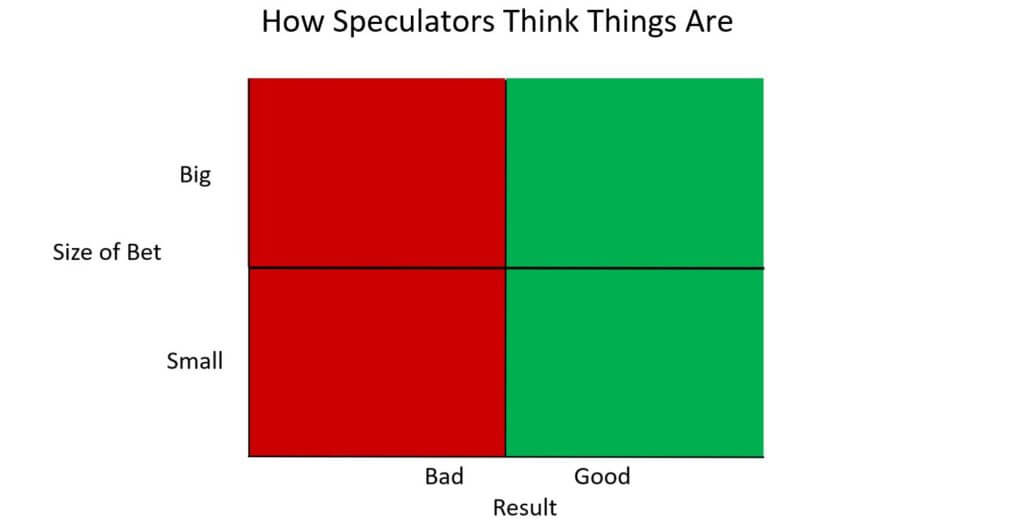

There are two aspects of speculation which impact financial security: the size of the bet and the result of the bet. For most people, the first instinct is to think that any bet that goes bad has a negative effect (as indicated in red in the below image) and any bet that has a good result has a positive effect (as indicated in green).

If the bet is from the top left quadrant – a big bet gone bad – it can be financially devastating. This is betting too much of one’s life savings on any single outcome. It may be moving to cash because one is “sure” a market crash is eminent or getting in or out of some portion of the market because of a forecast about the economy, interest rates, or politics. It could also be loading up on the stock of a single company because of some new technology or new drug, or “taking a flyer” on an intangible like a cybercurrency.

Regardless, the subtler element of speculation is that good results are often not a lasting positive. The green sections of the image paint a picture which overstates the possible positive effect of speculations.

Feeding your inner-speculator

In the short term, a successful speculation can add to financial security but can also turn dangerous because a successful bet feeds our inner-speculator. If you invest in some obscure company with “the next big thing” or make a move based on a short-term feeling about the market and it pays off, you are more likely to be tempted to try it again.

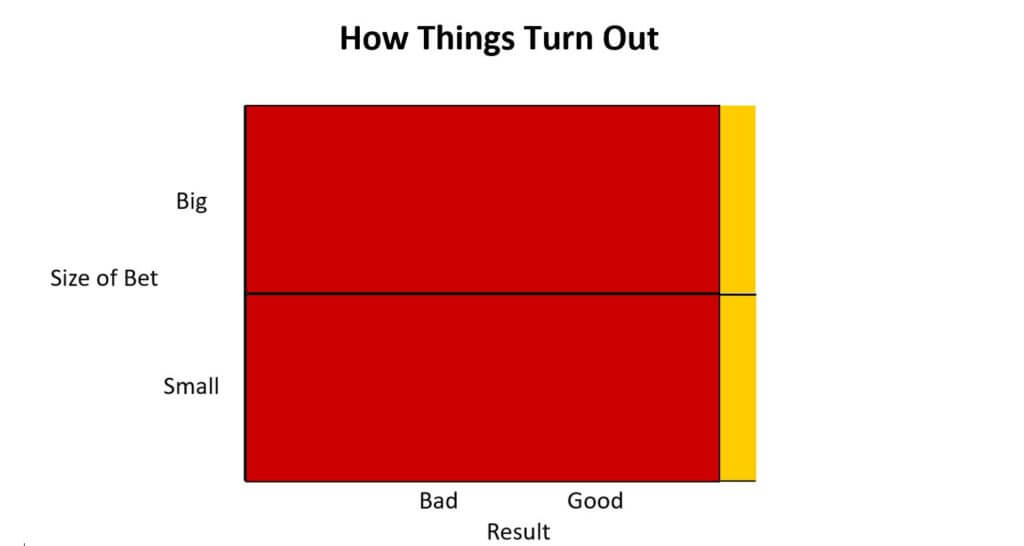

This tendency to speculate again is one of the reasons casinos make so much money. When a player wins, they want to keep playing and usually with more money. In the end, we are left with the adage, “The house always wins.” Because of this dynamic, a cautionary yellow is a better color choice than green.

The other flaw in the image is the proportion of good results to bad. People make speculative bets because they think the odds of success are good or at least not terrible. The chart implies a 50/50 probability of success. Reality indicates the odds are far lower.

A chart that better reflects reality looks like this:

We believe the odds of successful speculation are poor because the outcomes of some of the more common forms of speculation are observable. Few speculators produced outsized returns. So much so, for instance, that it has been said the market-timing hall of fame is an empty room.

Investing can be hard but speculating is harder

Money managers who tout their ability to deftly get in and out of markets have a poor track record of delivering on that promise. In 2016, Luke Delorme at American Investment Services refreshed a similar examination made four years earlier by Jeffrey Patek of Morningstar[i]. Both studies show unequivocally that the purported skill of “tactical allocation” managers is highly suspect. Returns failed to keep pace with a steadier approach. Further, Delorme’s review showed the lower returns came with greater risk and likely larger tax bills.

A third review by Sellwood Consulting revealed that very few tactical managers seemed to add any value during major market downturns. Of the few that did, not much value was added and then that value quickly disappeared. In other words, few got out of stocks before declines and none got back in at a good time or failed to stay in long enough during market advances to profit from their forecast.

Another common way to speculate is to try to hold more winning stocks or fewer losing stocks. Good luck trying that. Roughly one-third of the stocks in the S&P 500 index outperformed that index in 2017 and two-thirds did not. In fact, about one-third lost value despite it being a strong year for the index.

The more frequently one places weak bets, the higher the odds are of getting a poor result.

The more frequently one places weak bets, the higher the odds are of getting a poor result. You can see this effect in the Sellwood review and in a study by Heaton we mentioned a few months ago.

Sellwood looked at the track record of the entire universe of tactical allocation funds since Morningstar began tracking the category in 1976. Of these managers trying to move in and out of the markets or parts of the markets, not one bested a simple benchmark of 60 percent global stocks and 40 percent investment-grade U.S. bonds over the long term.[ii]

The Heaton study we highlighted in Why many investment managers deliver poor results is a clear manifestation of how speculating on specific stocks over time is unlikely to result in a superior result. Picking some of the year’s top performing stocks is great but then what does one bet on the following year and subsequent years after that? Getting adequate investment results over many years is the goal. Heaton calculated that over its history, the S&P 500 index was driven by the stellar performance of just four percent of stocks.

The odds of successful speculation in financial markets over any significant time span are simply not good. If your family is financially secure or on track to be secure, speculating is far more likely to undermine your efforts and, in some cases, can literally destroy that security. We don’t see the point of taking on the added risk, so we will continue to recommend our clients invest and not speculate.

[i] “How ‘Tactical Allocation’ Mutual Funds Fared Over the Last Five Years”, August 9, 2016 Advisor Perspectives

[ii] “The Right and Wrong Way to Design a Portfolio”, May 22, 2107, Sellwood Consulting