The latest from Washington, D.C.

Before we get to the personal finance related happenings from Washington D.C., we wanted to take a moment to send our thoughts and prayers to our fellow Floridians. The devastation from hurricane Ian is incredible.

While the storm weakened as it passed across Florida, it was still quite capable of causing damage. If you suffered damages from the storm, we are happy to help in any way we can. The IRS has announced some relief for Florida residents and businesses by extending to February 15, 2023 some filing deadlines including individual tax returns due Oct 17, the quarterly estimated tax payments normally due on January 17, 2023, and the quarterly payroll and excise tax returns normally due on October 31, 2022 and January 31, 2023. The same extensions are available in North Carolina and South Carolina.

If you would like to help the relief efforts in Southwest Florida, you can donate to the Florida Disaster Fund. The fund is the State of Florida’s official private fund established to assist Florida’s communities as they respond to and recover during times of emergency or disaster. They initially made grants to ten relief organizations. You may donate to any of them directly at their respective websites. The organizations are:

- Save the Children

- The Salvation Army

- American Red Cross

- Team Rubicon

- Catholic Charities

- Feeding Florida

- Midwest FoodBank

- ToolBank

- Operation BBQ Relief

- United Way Collier County

The latest from Washington, D.C.

Late summer and early fall produced several developments from Washington, D.C.. The Federal Reserve, President Biden and Congress all took some notable actions which affect personal finances.

The Federal Reserve

The Federal Reserve (the Fed) has been increasing their target rates for federal funds, the overnight lending rate the Fed uses with banks. The increases are designed to help reduce inflationary forces. Higher rates make borrowing more expensive and slows the rate of price increases. The link between interest rate hikes and inflation rates is sound, but in real time it often does not pan out in a nice straight line.

It is important to note that the Fed influences rates throughout the economy but does not dictate them.

It is important to note that the Fed influences rates throughout the economy but does not dictate them. For instance, the Fed raised the federal funds rate .75% on June 15 and an additional .75% in both July and September. Despite this cumulative 2.25% increase, rates on U.S. Treasuries have increased far less. On June 14, 1-year notes were yielding 3.15%, 5-year notes 3.61%, and 10-year notes 3.49%. On September 30, those rates were 4.05%, 4.06%, & 3.83% respectively.

A year ago, the Fed thought inflation would not persist but are now aggressively raising rates to quell inflation. The media loves to quote people who second guess or even mock the Fed. Fact is, the Fed is arguably the best-informed body when it comes to the U.S. economy. Their struggles to accurately forecast economic matters should be strong evidence to you that economic matters are extremely difficult to predict. Couple that difficulty with the lack of a need to forecast economic activity to succeed in the financial markets, and you have excellent reasons to tune out economic reporting as noise.

The President

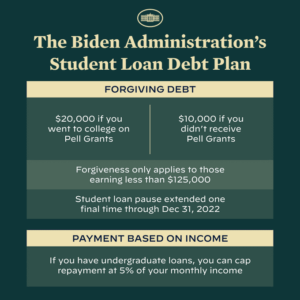

With both great praise and harsh criticism, President Biden authorized a plan to forgive some student loans for borrowers under certain income limits. To be eligible, single taxpayers must have an Adjusted Gross Income (AGI) in either 2020 or 2021 of less $125,000. For married borrowers filing a joint return, AGI must be under $250,000. The forgiveness applies to federal student loans only, not private loans. Those who received Pell grants can get up to $20,000 forgiven while those that did not receive them can get $10,000 forgiven.

In addition to the debt forgiveness provisions, the plan continued (for the final time) the suspension of loan payments through December 31, 2022 and modified the rules regarding income-driven repayment plans to cap annual payments at 5% of the borrower’s income.

Congress

On August 16th, President Biden signed into law the “Inflation Reduction Act.” The law’s direct effects on inflation are debatable but it clearly aims to promote cleaner energy use. The legislation enhances and renames two tax credits for “green updates” to a home, adds a new tax break for the purchase of electric vehicles, and revives a break for installing EV recharging equipment. If you are interested in making such changes to your home, we recommend you discuss it with our tax team prior to signing any contracts. We have seen a number of people who came to regret relying on a salesperson’s explanation of similar tax breaks.

The other tax related provision in the act that garnered a lot of attention was the allocation of $80 billion for the IRS. Proponents point to the significant need for additional staff, technology, and process improvement at the agency. Critics fear a new era of aggressive enforcement on the middle class.

On November 8, one-third of the Senate and all of the House of Representatives will be elected. As usual, we expect more proposals and legislation shortly thereafter. Rest assured, we will be monitoring developments and will be available to help you make sense of whatever comes next from Washington.

News & Notes

Our Orlando office has moved. In order to serve you better, we have steadily increased our staff over the last several years and plan to continue to do so. To accommodate additional staff, we needed more space in Orlando. As of October 1, the Moisand Fitzgerald Tamayo Orlando team has moved into a new office located in the Bank of America Plaza. The new office building is adjacent to our office of the past eight years.

- Our new office address is: 300 S Orange Ave., Ste 1170, Orlando, FL 32801

- Visitors should use the parking garage located at 13 W South St., Orlando, FL 32801 (Look for Bank of America sign above entry)

- The addresses for our Melbourne & Tampa offices remains the same

Conference season is underway. One of our core values is lifelong learning. Attending and speaking at conferences helps us stay on top of our craft. Dan Moisand, CFP® travelled to Atlanta to attend the national conference of the Association of African American Financial Advisors. While in Atlanta, he joined other representatives of CFP Board on a panel about the career opportunities in financial planning for students at Clark Atlanta University and Morehouse College.

Social Security payments and retirement plan contributions to rise. Increases in inflation measures will cause several adjustments which directly affect personal finances such as: Social Security payments, the allowable contribution amounts to IRAs and retirement plans, and the thresholds for marginal tax brackets. 2023 Social Security payments are set to rise by 8.7%. Contribution limits to retirement plans should also rise. Several other items in the tax code which are tagged to inflation readings are estimated to increase by about 7%. We will have exact figures for you in our January newsletter.

Important Dates:

November 1: Start of open enrollment for existing Health Insurance Marketplace enrollees

December 7: End of open enrollment for existing Medicare enrollees

December 15:

- End of open enrollment for existing Health Insurance Marketplace enrollees

December 16: Last date to submit paperwork to be certain processing will be complete for end of calendar tax year deadlines such as:

- Making Required Minimum Distributions from retirement accounts and IRAs

- Completing gifts and charitable donations for 2022 tax year

- Completing conversions to Roth IRAs

- Dividing retirement accounts with multiple beneficiaries in order to use separate accounting

Friday, December 23, 2022 – Monday, January 2, 2023: Offices of Moisand Fitzgerald Tamayo are closed. As has been our custom for many years, all staff have this time off so they can spend it with their families. Offices will be open on Tuesday, January 3, 2023.

January 1:

- Start of General Enrollment Period for Medicare Part A and B

- Start of Open Enrollment Period for Medicare Advantage

February 15:

- Q4 estimated payment deadline for 2022 tax year. Florida residents can extend until February 15

- Q4 estimated tax payment deadline for C-corporation and multi-member LLCs that elect to be treated as a corporation

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC