It was hard to find a financial issue that got more attention in May than the Initial Public Offering (IPO) of Facebook (FB). Amid the hoopla, there are many lessons to be learned from the events leading up to and since FB went public on May 18th.

Chasing what’s hot can get you burned. It has never been a high probability way to make money, but losing money by doing so is almost a cliché. Hype and urgency don’t make for good decisions. How much was lost chasing tech stocks in the late 90’s for fear of “missing out?” How much was lost chasing the hot real estate markets of just a few years ago?

It doesn’t have to be something as grand as these bubbles were to be an issue. Several times, we have chronicled the folly of chasing hot mutual fund sectors and the tendency for money to flow into funds that have done well lately. Our commentary, “You Are the Key”, cited studies by DALBAR showing that the average mutual fund investor underperformed the market by 7% per year in part due to using weak funds but largely because people bought after rises and sold after drops. All other studies by the group before and since show the same pattern.

We highlighted a spectacular example of this dynamic in a single fund in a 2010 newsletter when we discussed CGM Focus, the best performing fund in the decade ended 12/31/2009. Morningstar analyzed the behavior of the “investors” in this highly volatile fund and determined that while the fund averaged an extraordinary 18% per year, the average dollar invested in the fund lost 11% per year over the ten years.

A stock is only worth what someone is willing to pay for it. Leading up to the IPO, much of the chatter was about what Facebook stock was really worth. On one hand were people that pointed to data such as that with over 900 million users, if Facebook were a country it would be the third largest behind only China and India. Further, each user spends an average of 20 minutes a day on Facebook, 48% of 18 – 34 year olds check their Facebook account as soon as they get up in the morning, and 2011 – 2012 revenue growth for Facebook was 88%, generating $3.15 billion in advertising revenue.

On the other hand, critics pointed out that over half of users have never clicked an ad and most probably won’t because they are considered a distraction not relevant to the user’s purpose of connecting with friends. General Motors just pulled $10 million in advertising off Facebook due to ineffectiveness. All the glowing things about Facebook were also said about Friendster and MySpace.

FB made only $1 billion yet came to market with a market capitalization bigger than McDonald’s. McDonald’s is one of the world’s most recognizable brands with a proven steady business model and management team. It made $5.5 billion in profits last year.

Facebook must grow exponentially to justify such a lofty valuation. Buyers think that will happen but the sellers from whom they are acquiring the stock have better places for their cash. That is how it is every day. People are guessing what a stock should be worth. At any point in time though, the reality is that any stock is only worth what a buyer will pay for it.

The people most likely to make money when a company goes public are the insiders who took on the substantial risk in funding the company before it became successful enough to go public. Any buyer of FB once it goes public will only make money if they subsequently sell it for more than they paid for it. The majority of current owners are insiders and big institutions who got their shares for the $38 price or less, far less in the case of the founders and early investors.

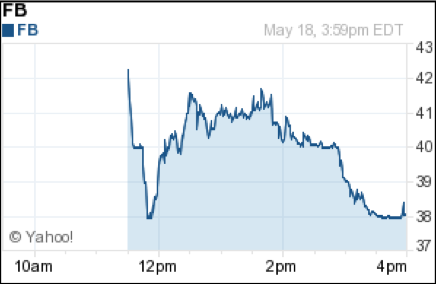

Anyone rushing in on that first day likely ended the day with a loss since almost all the trading activity occurred above the $38.23 closing price. See chart of first day trading in FB.

By the end of the first 5 trading days FB was down to $32 and $26 by early June.

Facebook is not at all unusual in this regard. The biggest IPO’s of the last year or so were Groupon, Pandora, LinkedIn, and Carbonite. All but LinkedIn were trading below their IPO price. Longer term results are generally weak too. Jay Ritter at UF studied IPO’s over a 23 year period and found that they lagged similar sized firms by 5.6% a year. Another study by Dealogic found even in the tech-fuelled 1990’s, IPO’s lagged the S&P 500 by 7.9% per year.

This should not be surprising since the insiders selling their shares to the public want to do so at the best possible price. A degree of excitement and anticipation helps in that effort even if it doesn’t reach the level of hype we see with some IPO’s. Regardless of what happens to the price of FB from here, Facebook has $16 billion in cash from the $38/share offering price.

From now on when you hear the term IPO instead of “Initial Public Offering” think of “It’s Probably Overpriced.”

Much of the financial news is really entertainment. With today’s 24/7 media, the press can go bonkers on just about any issue. Business and finance are not exciting subjects for most people, so when a cultural phenomenon like Facebook meets big money, media frenzy is almost inevitable. Media had no shortage of angles before and since the IPO. By noon on opening day, people were already speculating on why there wasn’t a “pop” in price when some had predicted spikes as high as $100/share. Given the lawsuits filed the first week of trading, FB will stay in the news a long time.

Hype and urgency can make fertile ground for fraud. We saw several scams aimed at getting the unsuspecting “in” on the IPO, these scams are common with well publicized IPO’s. We believe there is a chance they will be even more prevalent due to the Jumpstart Our Business Startup (JOBS) Act signed into law April 5th. One part of this legislation permits “crowd-sourced” funding. This allows firms to sell shares to the public at lower costs. That is a fine intention indeed but the JOBS Act also loosens regulatory controls. The opportunity to hype tiny stocks on the internet is a fertile breeding ground for a whole new set of scams.

The IPO didn’t matter to real investors. Media loves to use the term “investor” to describe anyone who buys any security. A real investor bears no resemblance to the people trying to trade FB on opening day. Most dictionaries include terms like “commitment” and “long term” to define investing but use terms like “short term”, “trading”, and “risky” to describe speculating. Real investors are diversified, disciplined, and patient and smart ones would never make their financial success contingent on answering a question like “should I buy Facebook stock?” To real investors, the fate of any one company or its stock should be irrelevant.

American capitalism is beautiful, warts and all. As headlines appear regarding how the IPO was “botched” or “failed”, coverage of the lawsuits arise, and commentators complain that Wall Street once again stuck it to Main Street, it can be easy to forget that a kid with an idea about a new way to communicate started this enterprise in his dorm room. With some financial backing and a lot of hard work, that kid made himself and many of his backers rich. He also has given many of his employees a chance to be financially secure. America’s financial system has flaws and our economy has its struggles, but it is still a place where people can start businesses, compete, and if people find value in what the business provides, improve their standard of living and provide jobs that help multitudes of people beyond the company. God Bless America.