Why true investors don’t worry about their portfolios on Election Day

A recent study by asset management firm Janus Henderson indicated that half of those surveyed are “very concerned” about the 2024 U.S. presidential election. Only a third of those surveyed are highly worried about inflation, the possibility of a recession, or higher interest rates.

Insurance company Nationwide polled 2,404 investors and found, regardless of political affiliation, they believe the economy will be hurt if the party they are less affiliated with wins the White House. In fact, 32% think if their party loses, the country will plunge into a recession within a year.

These survey results are surprising to us. We are surprised the percentages are so low! We have been around long enough to have experienced several election cycles and the angst about who will win and what will happen has seemingly increased each time. The rise of cable news and social media surely haven’t helped.

We do not know who will win on November 5, 2024. We don’t even know for certain who the candidates will be. What we can say with confidence is the outcome should not dictate what you do with your investments. The world’s stock markets trend up and the longer the time frame, the more reliable the results. The time frame for most true investors is longer than a presidential term.

The time frame for most true investors is longer than a presidential term.

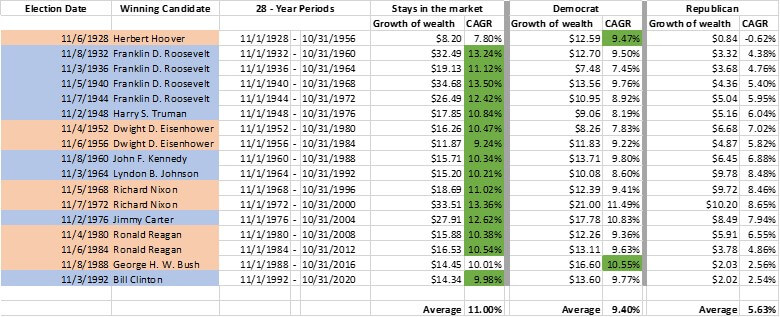

Nonetheless, we thought it would be interesting to see what would happen if one got in or out of the market based on who won the Presidency. Let’s pretend we correctly predict on November 1st who will win the election a few days later and invest accordingly. We will use the CRSP 1-10 index of the entire U.S. stock market and one-month Treasury bills as our cash proxy.

If we are die-hard Republicans who think a Democrat will ruin everything, we stay in cash when a Democrat heads to Pennsylvania Avenue and remain in cash until a Republican wins, at which point we go all-in on U. S. stocks until the next Democrat becomes President and so on.

If we are die-hard Democrats who think a Republican will ruin everything, we do the opposite. In other words, we get in the market when our party wins and out of the market when our party loses the election.

We looked at every election since 1928 and simulated getting in and out based on the election results over the following 28 years, an even seven terms to make it easier on us. Who do you think wins, market-timing Democrats or market-timing Republicans?

Market-timing Democrats did better in every one of these 17 periods and substantially so in many cases. Does this mean investors should be rooting for a victory by the Democratic party because they will make more money? No, it does not.

We used the term “market-timing Democrats” and “market-timing Republicans” deliberately. The best returns came from those that did NOT try to time the market no matter how enthusiastic they were about their party or how much they detested the other party. They simply held on.

The best returns came from those that did NOT try to time the market no matter how enthusiastic they were about their party or how much they detested the other party.

Of the 17 periods, the non-timers that stayed in the market (a.k.a. true long-term investors) did better than the market-timers in 15 of those periods, highlighted in green below. The only two failures came due to the massive market decline that kicked off the Great Depression and the other in one of the periods that included the 2000s, a decade in which there were two roughly 50% declines in the market. That most recent period’s Compound Annual Growth Rate (CAGR) lagged the market timer by a mere .45% per year. In addition, in only 3 of the 17 periods did the long-term investor experience a CAGR less than 10%. The market-timers fell short of a 10% CAGR in 14 of the 17 periods. The average result for the long -term investor was 11.00%. The market-timing Democrats average result was 9.40% and the market-timing Republican recorded an average of 5.63%.

These results make perfect sense. Markets have gone up during the service of most Presidents so being out has meant missing out on that growth. This is no accident.

When you own a broadly diversified array of stocks, you own a share of many companies. You invest in those companies, not political parties. Companies focus on serving their customers and growing their businesses, regardless of who is in the White House or which party controls the houses of Congress. The President certainly has influence on the economy and the businesses that operate in it, but there are hundreds of other factors which impact market returns.

It is the constant focus on being profitable that makes the track record of diversified stock holdings so compelling. The profit motive spurs adaptation and innovation and explains why markets have always recovered from downturns and trended up over time. It is why it is said that time in the market is the better approach than timing the market.

This is great news for true investors that are patient and disciplined. It means you don’t need to predict short term market events or read the tea leaves on the election, interest rates, tax rates or the myriad of other factors which may influence the markets.

It is also important to realize that many important personal financial decisions have little or nothing to do with the markets. The breadwinner of a young family who carries no life insurance or the retiree who takes a large sum out of their IRA to buy a sure thing rental property for “passive” income are making questionable decisions regardless of who is in any political office.

So many things are sold based on fear because fear-based selling works. This is true of financial products and true when selling the public on a candidate for office. The reason so many campaign ads are attack ads or otherwise negative is because they get a better result than touting the nice things about a candidate.

Your political fears may be warranted, but letting those fears turn a sound plan into a speculation about the near-term market behavior is a recipe for poor results. As soon as you notice someone trying to sell you a product or candidate based on these fears, the best thing you can do is maximize your level of skepticism. It is highly unlikely to be as bad as it is made out to be.

Success in personal finance hinges on focusing on what you can control and recognizing what you can’t. Diversification, discipline, and patience have an excellent track record that should be replicable – if we don’t work ourselves into a frenzy and inappropriately shrink our time frames. True investors have time frames longer than presidential terms. Invest, don’t speculate.

In the words of David Booth, founder of Dimensional funds, “Vote with your ballot. Not your life savings.”

Additional reading on the “News & Posts” page of www.moisandfizgerald.com

How to invest for your goals – not for headlines

How can I protect my portfolio from a post-election drop in stocks?

Will the election cause a market crash?

Five financial articles you should always ignore

What to expect from financial markets