How do higher interest rates affect personal finances?

How do higher interest rates affect personal finances?

The most obvious effects of higher interest rates are that savers earn more interest income and borrowers pay more interest due to higher rates on loans, such as mortgages. But how else can higher interest rates affect personal finances? Our team came up with a few notable ways.

Kevin McDermott, CPA points out that higher mortgage rates make investment properties, rental real estate, and commercial properties less attractive. Mortgage rates on such properties tend to be higher than those on traditional mortgages for personal residences.

Mike Salmon, CFP® EA sees higher rates benefiting Defined Benefit Plans (and other pension funds). These plans have liabilities that are often discounted at a rate related to interest rates. While the payments to pensioners will not be affected, higher rates mean the plans can earn more, improving the funding status of these pensions. With higher interest rates, it takes less money to fund the payouts.

A similar dynamic can be seen with lottery payouts. The headline numbers touted by the lotteries are the sum of annual payments. Winners can instead opt for a lump sum. With rates higher, a winner of a $1 billion drawing today would receive a smaller lump sum than a billion-dollar winner in the past, because less money is needed to make the annual payments.

Earning more interest is not always a purely positive experience.

Earning more interest is not always a purely positive experience. As Tommy Lucas, CFP® EA explained to a CNBC reporter, “Everyone thinks it’s kind of a free lunch, but you’ve got to consider the tax man.”

See, as interest income rises, so does Adjusted Gross Income (AGI). As AGI increases, certain tax provisions can kick in such as additional taxes on investment income, higher Medicare premiums for retirees, and a decrease in some deductions such as medical expenses.

Speaking of taxes, when one underpays their taxes, they can be subject to interest and penalties. In the past, the penalty has often been minimal. That may not be the case now. Ryan Osborne, CFP® EA notes that the rates used to calculate penalties by the IRS have more than doubled from 3% in March of 2022 to 7% in 2023.

Ron Tamayo, CFP® EA also highlighted a government driven rate used by the IRS, the Applicable Federal Rate (AFR). The AFR is used for “related party” transactions such as unstated interest, Original Issue Discounts and certain charitable trusts.

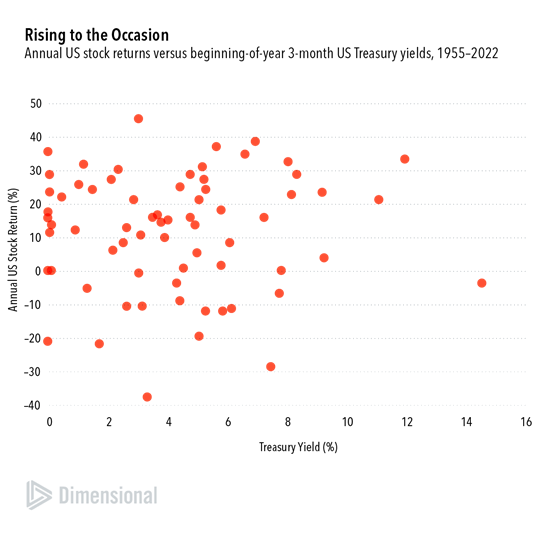

One thing higher rates have not meant is low returns in the stock market. Interest rates simply have not been meaningful predictors of stock returns. In years with above-median interest rates since 1955, during which the average 3-month Treasury yield was 6.7%, US stocks returned an average of 12.1%. This is slightly higher than the average return in below-median interest rate years (11.6%), although the averages are statistically indistinguishable from each other.

Plotting annual US stock returns versus Treasury yields further emphasizes the lack of a meaningful relation between the two as shown in the graph below courtesy of Dimensional funds. The level of interest rates is of little help in predicting stock returns.

Making News…

We continue to help various media outlets provide sound information to their audiences. (Some links may require a subscription to view.)

Charlie Fitzgerald, CFP®, appeared in the Orlando Sentinel’s an “Ask An Expert” feature by answering a question about helping children get started with investing.

DJ Hunt, CFP® wrote Tax Savings for Your Small Business Clients for Rethinking65, a publication for advisors working with clients that are retired or soon will be.

Dan Moisand,CFP® continues to write for MarketWatch and Florida Today.

I’m getting laid off. Should I roll my 401(k) into an IRA? – MarketWatch

What’s the best way to give to charity?- MarketWatch

I just got a raise. How can I max out my 401(k)? – MarketWatch

Is an inherited IRA the best option when a spouse dies? – MarketWatch

I want to access my 401(k) early. Is a loan the only way? – MarketWatch?

Your financial future isn’t a game — don’t treat investing like one – Florida Today

How trusts are taxed – MarketWatch

In the News…

As noted in our July newsletter, Sara Nash and DJ Hunt became co-owners of the firm. Local media in Brevard County picked up on the announcement. Nash, Hunt added to Moisand Fitzgerald Tamayo ownership group – Florida Today

If you are a member of an organization in need of a personal finance speaker, we are happy to talk with your group’s organizers about helping out at no cost.

Dan Moisand’s service as 2023 Chairman of the Board of Directors of CFP Board, the body that confers and administers the CERTIFIED FINANCIAL PLANNER™ and CFP® credentials for the 96,000+ CFP® professionals in the U.S., has him speaking at several events and conferences during the year. He recently spoke at CFP Board events in Seattle, Portland, Walnut Creek, San Francisco, Washington DC, Baltimore, Philadelphia, New York, and Boston as well as the XY Planning Network conference in Atlanta, the national conference of the Financial Planning Association in Phoenix, the Tiburon CEO Summit in San Francisco, and represented the the United States at the annual meeting in Singapore of the FPSB, the association of the organizations that administer the Certified Financial Planner designation around the world.

DJ Hunt, CFP® helped a syndicated writer grapple with the question “Can you time the housing market?”

Charlie Fitzgerald, CFP® Investors should know these two risks: ‘It’s kind of like yin and yang,’ says advisor – CNBC

Tommy Lucas, CFP®, EA provided financial tips for Forbes in this piece, New Rule Requires Broadway Scalpers To Reveal Sales and assisted CNBC reporters on the following topics:

3 things you can learn about taxes from San Francisco 49ers’ Arik Armstead’s paycheck

Notable

A government shutdown may be a nuisance, but history suggests it’s probably not cause for concern in your portfolio. The appropriations process through which the federal government budget is allocated became stricter about shutting down government operations in the event of a funding gap after legal opinions issued in 1980 and 1981. Since 1981, the US government has faced 14 funding gaps, ten of which resulted in shutdowns. Four shutdowns lasted at least one week. The US market ended higher at the conclusion of three and was flat in the other.

At least 200: Number of stocks in a portfolio to more reliably achieve the full potential of the stock market and avoid significant potential shortfalls in terminal wealth according to recent study by Dr. Yin Chen and Dr. Roni Isrealov

The CFA Institute reports that there are now 3 million! stock and bond indexes worldwide, many of which cover very narrow portions of the markets, with wildly varying returns. The broad index fund was one of the great innovations of the last 50 years but clearly, if they think people will buy it, the brokerage industry will create a product to sell whether it has a chance of being a good product or not.