Why and how markets recover

Why and how markets recover

Why the stock market has always recovered

Since cases of Covid-19 have spread and panic has struck financial markets around the world, we have repeatedly pointed out the simple fact that stocks have always recovered. Today, we want to provide background on why markets have always recovered and what those recoveries have looked like.

Forgive the length of this commentary but we hope by addressing aspects of recoveries, it reinforces the wisdom of our approach to the markets, allows you to maintain a true investor’s perspective, and helps you resist the urge to speculate. Bottom line: if you believe you will eat in a restaurant again, you believe markets will recover again.

Market behavior is anything but rational at times. Expectations and perceptions change quickly with every piece of new information, thus causing stock prices to change quickly. Lately, stock prices have rapidly decreased.

Every share of stock of every company is owned by someone. Stockholders with lower expectations can put their shares up for sale in the market at any time and they will sell to a new owner who has a higher expected return than that of the seller. Today’s lower prices mean expected returns going forward are higher, not lower.

Today’s lower prices mean expected returns going forward are higher, not lower.

Despite higher expected returns, even in good times many businesses fail. Yet in the aggregate, stocks in general have a perfect record of rising over time and a spectacular record of staying ahead of inflation regardless of whatever adverse conditions have arisen. Every time there has been a downturn it has been because of unprecedented events. Yet every time recovery came. Why?

In one word – adaptability. Markets come back because when conditions change, so do businesses.

No one knows how long it will take to develop effective treatments for Covid-19, how long we will be practicing social distancing, or when a vaccine will be ready. Similarly, no one knew for certain when the economy would get going again after the financial crisis or 9/11 or the bursting of the internet bubble or the energy crisis of the 70’s or any of the other events which caused dramatic declines.

What is happening now is that businesses are looking to do whatever they can to generate profits or be ready to generate profits when conditions allow.

What is happening now is that businesses are looking to do whatever they can to generate profits or be ready to generate profits when conditions allow. They can cut costs, improve efficiency, and raise prices, among other things. They adapt in anticipation of an improving economy and in many cases, the adaptations themselves improve the economy.

Take your neighborhood restaurant. As business slowed, they cut back, then eliminated sit down dining and many have completely closed, for now. Those businesses look worthless, but they are not. Right now, smart restaurateurs are exploring ways to be ready to reopen when the social distancing need ends. Isn’t there a good chance that when we believe it is safe to go out, we will go to a restaurant? Of course, we will. And we will again gather at church, concerts, and sporting events as well as travel.

It is true that when we are out and about again, some of today’s restaurant owners won’t be able or want to reopen. The longer we sequester ourselves, the more this will happen. However, this provides an opportunity for new people to open restaurants to meet the demand. That is how capitalism works. When profits are hard to earn, the profit motive becomes more powerful, not less.

The new and surviving restaurants will be worth more than today’s restaurants. This dynamic applies to every industry. It is why with all prior crises, stocks in the aggregate have recovered. Actually, markets have frequently gone up before profits resumed.

The adaptability of businesses in the quest for profits is another reason why stocks stay ahead of inflation. As the costs of raw materials, services, wages, and other factors rise, only stockholders can react to these inflationary pressures.

Stocks, by their nature, are riskier than bonds and thus have higher expected returns. Earning these higher expected returns is an imperfect, often maddening, process full of anecdotes seeming to contradict the underlying fundamentals. Many failed businesses were good businesses run by good people. Restaurants in general will come back but betting on any one restaurant to survive and thrive is risky.

By owning broadly diversified stock holdings, we mitigate the risk that the market’s perception of struggles or possible failures of one particular business will turn negative. Such diversification allows us to participate in the higher expected returns which come from stocks in the aggregate over time.

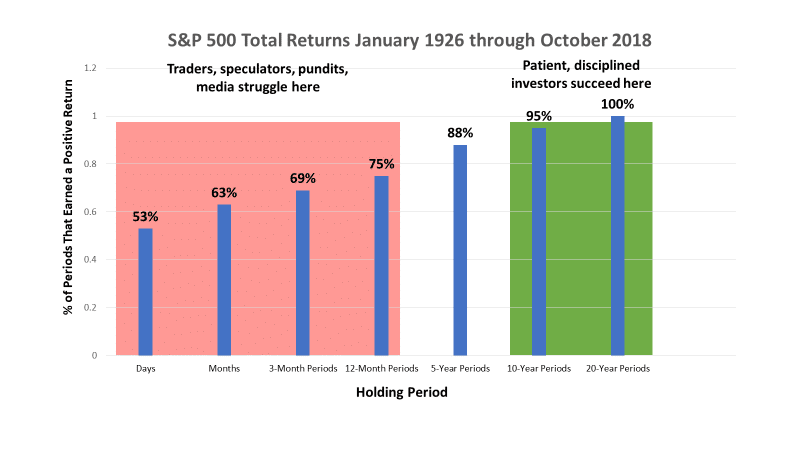

These are strange times indeed. (Tom Brady now plays for the Buccaneers?!) This time is different but only in the sense of how exactly the market drop happened. There is no guarantee but based on the overwhelming weight of the evidence, the fundamentals of markets are no different than past crises. We remain steadfast in our belief that the best way for clients to be successful is to allow markets to do their thing rather than make bets about short term market movements. The below graph from our January 2019 post “What to expect from financial markets,” illustrates this belief well. (Since few people are 100% in stocks, the length of time it takes to get a positive return is even better than the chart suggests.)

How markets recover

In addition to understanding why markets have always recovered, it is important to understand how markets have recovered. While the stock market has never failed to recover, these recoveries have never been smooth. Every time there has been a downturn it has been because of unprecedented events. Yet every time, recovery came.

“Should we sell now and get back in when things look better?” The odds of that working well are very low.

One question we receive in each market pullback is, “Should we sell now and get back in when things look better?” The odds of that working well are very low. Think about how things look now. What would lead us to believe “things look better?” – no more lockdowns, less cases of the disease, a vaccine, restaurants and theme parks opening, and concerts, conferences, and sporting events resuming? Under those circumstances, wouldn’t the expectation be stocks would be higher than they are today and not lower? Selling at one level to buy at a higher level is dead wrong.

Also consider we have had several disease outbreaks over the years which didn’t cause large market declines. If the Dow were not down so far, would you think things looked as bad? Probably not. The lower prices on stocks in and of themselves add to today’s bad feelings.

Most people simply cannot achieve their goals if they keep everything in stable holdings such as cash and high-quality bonds. Most people must own stocks to have any reasonable chance of growing their asset base and staying ahead of inflation. Sure, if you went to cash early in the Covid-19 outbreak, you would not be down now but you would be losing later as you spent through your assets with no real chance of increasing your nest egg.

The only way selling stocks when their prices are down helps you financially is if you buy again at lower prices. For this to happen three things need to occur: stocks must drop further, you must buy at those lower prices, and you must hold on long enough for the recovery to unfold. Buying is extremely difficult to do for those who fear lower prices. If stocks do go down further, the lower prices don’t create a sense of optimism; lower prices reinforce the fear. Things don’t look better at the bottom, they look worse.

Most recoveries begin before it seems things are looking better.

The data about recoveries further highlights the need to stick with stocks. Most recoveries begin before it seems things are looking better. Also, a large portion of the recovery is realized quickly and early.

The bottom of the market drop associated with the Great Recession was March 9, 2009 with the Dow at 6,547. On March 10, nothing of substance was different. Markets rallied quickly, rising 58% from the low to finish 2009 at 10,428. The rally started months before the recession was declared over and the economy was anemic for years to come. It took many years for things to look better but markets rose long before things looked better. True investors who remained disciplined and patient were rewarded.

It is also important to note nearly 30% of the 58% rebound in 2009 happened by the end of May, when the Dow closed at 8,500. This is not unusual. If fact, Ned Davis research looked at all the 30% declines in the history of the S&P 500 index and found the average one-year return following such a drop was 37.1% and all but 7.6% of that increase came in the first six months of that 12 month period.

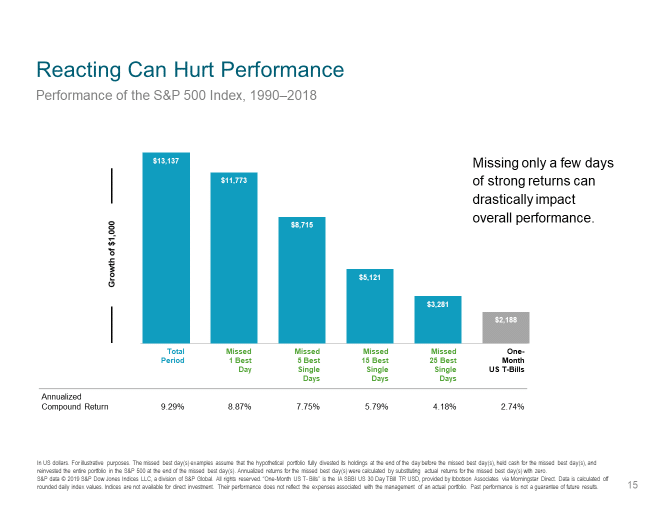

When markets move, they can move fast. We have seen this lately with a precipitous decline, but it happens on an increase too. The best way to catch the bottom is to simply stay invested. Missing even one good day can impede results as the below chart illustrates.

Since most recoveries start before the consensus believes they should and markets move quickly, a disproportionate amount of recoveries usually come early in the rally. Thus, the cost of being out of the market during good days is high. The most reliable approach is to act as an investor and stay invested. Doing so ensures the portfolio benefits from the recovery, no matter in what form or how long it takes to materialize.

One point made lately is that for markets to recover fully, they must rise a greater percentage than they fall. For instance, a 33% decline requires a 50% increase to get back to whole. This point can lead people to believe recovery will take a very long time. This type of statistic is usually followed by a “therefore you need to invest in … (whatever the salesperson is selling.).” Buyer beware.

…the needed recoveries have never failed to materialize, haven’t usually taken as long as people feared, and most importantly, taken less time for diversified investors to recover.

What is rarely mentioned is that although the math is accurate, the needed recoveries have never failed to materialize, haven’t usually taken as long as people feared, and most importantly, taken less time for diversified investors to recover.

It seems likely the economy will take considerable time to recover from the social distancing and other steps being taken to quell Covid-19. However, as we saw coming out of the Great Recession of 2008-2009, markets often don’t wait for the economy to look better. This market may indeed take longer to recover, but no one truly knows.

What we do know is our planning treats high volatility as a feature of investing rather than a problem with no solution in sight. None of the unique aspects of the pandemic and its fallouts indicate it will be better to turn into a trader and speculator.

As challenging as it may be today, we believe being a trader at this time would be more stressful than sticking to a well thought out plan. It remains far more important to be resilient than nimble. Diversification, patience, and discipline should come through once again. Invest, don’t speculate. And as always, please remember we are here for you.