-

What is the difference between qualified dividends and ordinary dividends?

Taxes rates differ between qualified dividends and ordinary dividends A reader of one of Dan’s MarketWatch columns asked why there were two kinds of dividends on his…

-

The election and your investments

The election and your investments The season many in our county dread is upon us. Even though most often no damage will occur, it’s hard…

-

With the Fed raising rates, how high will rates go?

With the Fed raising rates, how high will rates go? The media keeps front and center the issue of how many interest rate increases…

-

You’ve got this

You’ve got this! Key Points: If watching the news gets you riled up, turn it off. If you can’t, try to remember they are stirring…

-

Can I rollover mom’s IRA into my IRA?

Can I rollover mom’s IRA into my IRA? Only a surviving spouse may rollover a deceased’s IRA account into their own IRA. After the SECURE…

-

How do I protect my portfolio against inflation?

How do I protect my portfolio against inflation? We pay more than double for most things we buy these days than we did 25 years…

-

Decision making in the face of uncertainty

Decision making in the face of uncertainty When markets rise or fall ten percent in a day and your account values oscillate by thousands of…

-

Moisand Fitzgerald Tamayo wins prestigious national award

Moisand Fitzgerald Tamayo Recognized by Schwab Advisor Services with 2019 Trailblazer IMPACT AwardTM November 4, 2019 – (Orlando) – Moisand Fitzgerald Tamayo, LLC was…

-

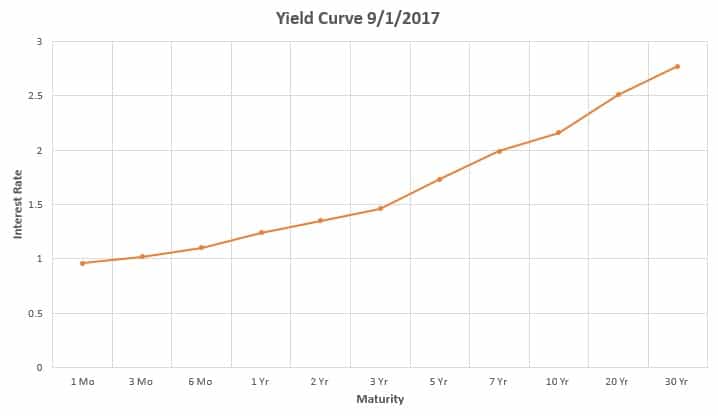

What does an inverted yield curve mean for your investments?

What does an inverted yield curve mean for your investments? The short answer to this question is “almost nothing.” The longer answer is because our clients’…

-

Managing investment taxes

Managing investment taxes Managing investment taxes is an essential part of any good financial plan. For most clients, by far the largest expense incurred during…

-

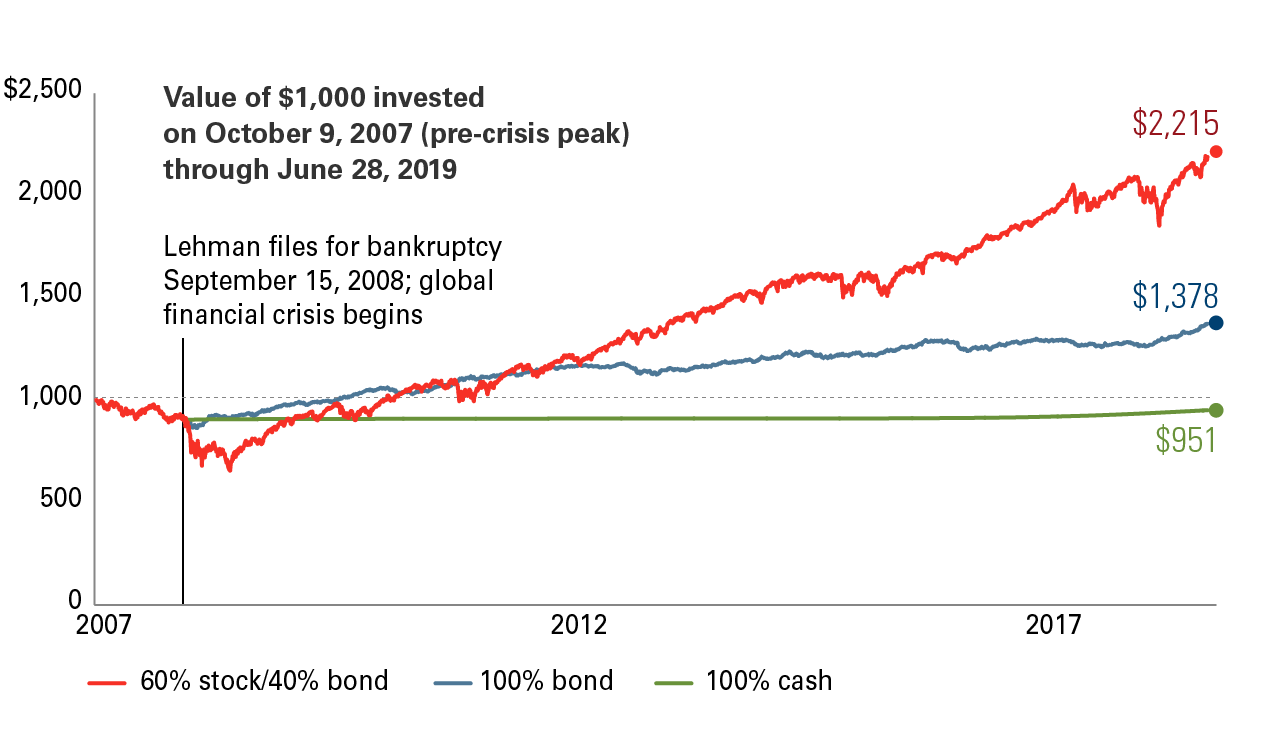

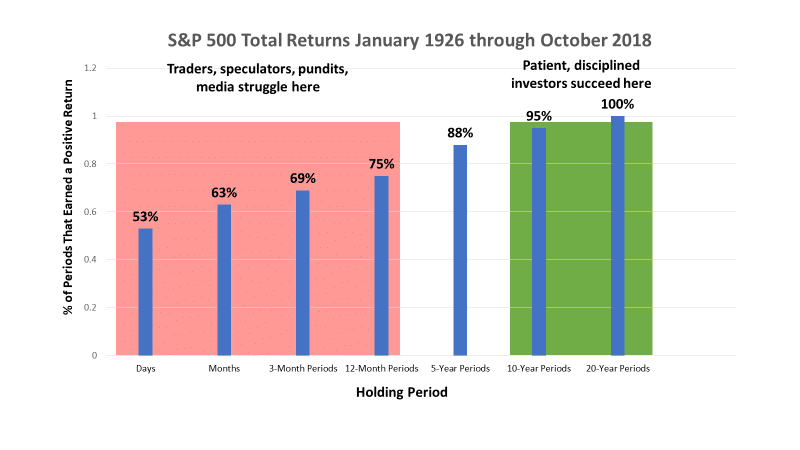

What to expect from financial markets

One of the keys to successful investing is understanding what to expect from financial markets. 2018 marked the first calendar year the Dow Jones Industrial…