-

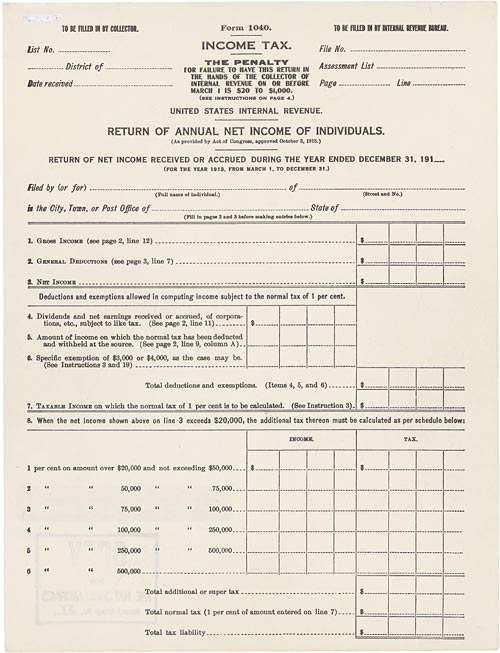

Protect yourself against tax fraud and identity theft

March 2013 Fraud is much easier to commit when dealing with complex and confusing matters. The American Tax Relief Act of 2012 (ATRA) passed at…

-

Tamayo talks ID theft prevention on WFTV Channel 9: NEWS & NOTES Winter 2013

Making News… Ron Tamayo wrote an informative column on year-end tax planning for the Winter Park/Maitland Observer. Dan Moisand’s monthly Q&A columns for Florida Today…

-

For successful investing, control your intake of business news

For successful investing, control your intake of business news To make investing a good experience, you must control your intake of business news. In many…

-

NEWS & NOTES Fall 2012

Making News… Ron Tamayo wrote a column on how markets may or may not have been affected by the results of presidential elections for the…

-

Should I prepare my portfolio for a post-election drop?

September 2012 Beginning in late summer of every election year, the media begins to predict how the markets may behave for the two major political…

-

News and notes – Summer 2012

Making News… Ron Tamayo contributed a piece to the Winter Park/Maitland Observer that explained the new taxes slated to take effect in 2013 from the greatly debated…

-

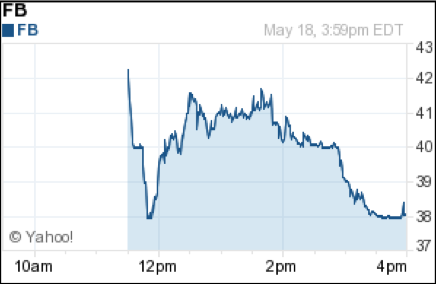

What the Facebook IPO teaches us about investing

June 2012 It was hard to find a financial issue that got more attention in May than the Initial Public Offering (IPO) of Facebook (FB).…

-

Beauty is in the eye of the beholder

March 2012 Buy low, sell high. This simple concept is far from easy because it is often difficult to assess whether or not a potential…

-

Navigating the new tax reporting requirements

December 2011 The Emergency Economic Stabilization Act of 2008 included new tax reporting requirements to the IRS mandating that certain firms report the adjusted cost…

-

Easing stress during uncertain times

September 2011 “People don’t plan to fail, they fail to plan.” The principals at Moisand Fitzgerald Tamayo have had their Certified Financial Planner designation since…

-

Portfolio strategies to counter inflation

June 2011 With high government spending and rising national debt, many people are asking how they can prepare for potentially higher inflation. There are two…

-

Municipal bond default risk way overblown

March 2011 With debt levels of many governments around the world at high levels and several states and municipalities also struggling to contain their borrowing,…