-

Lessons from the 2008 financial crisis

Lessons from the 2008 financial crisis In September 2008, the brokerage firm Lehman Brothers collapsed due to risky trading in poorly designed securities. This kicked…

-

What hasn’t changed in the new tax law?

With so many changes passed in the new tax code, it is easy to get confused. Many are asking, “What hasn’t changed in the new…

-

Making sense of the new tax laws

Making Sense of the New Tax Laws That’s right “laws.” Plural. A bill was passed last fall (and largely overlooked in the media) which…

-

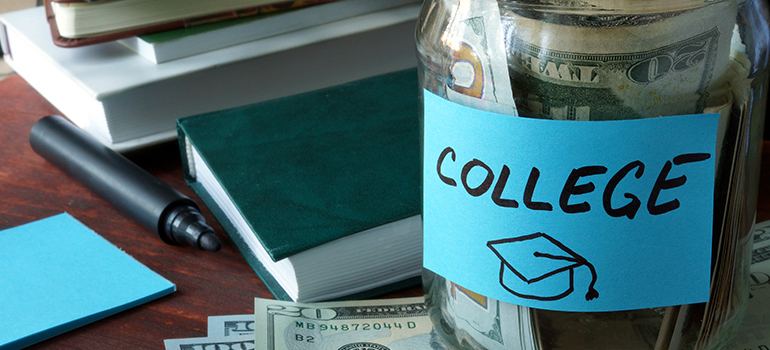

Pros and cons of 529 college savings plans

Pros and Cons of 529 College Savings Plans Paying for the college education of a child or grandchild is one of the most common…

-

How can I do tax planning when the tax code is about to change?

With so much uncertainty surrounding tax proposals, many are asking, “How can I do tax planning when the tax code is about to change?” You…

-

What to do about the Equifax data breach and Irma-related tax relief

What to do about the Equifax data breach While many of us were dealing with hurricane Irma, Equifax had its own disaster affecting 143 million…

-

How is the sale of a house taxed?

Most people own more than one home during their lives. How is the sale of a house taxed? Making News… We frequently produce Q&A columns…

-

Why many investment managers deliver poor results

Moisand Fitzgerald Tamayo, LLC Again Named an Elite Firm by the Financial Times: We are pleased to share that for the second straight year, the…

-

How to avoid gift taxes

How to avoid gift taxes We have received several inquiries this year from clients who want to make a financial gift to a family member…

-

What are you telling nervous clients to do now?

With the world’s stock markets having a rough start to 2016, the most common question of late from business and personal finance reporters has…

-

Major changes to Social Security: How do they affect you?

Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine and Nerd Wallet among others. Here is…