-

Is it better to leave a 401(k) account with a former employer or roll it over to an IRA?

Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine and Nerd Wallet among others. Here is…

-

Can I just live off interest?

Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine, the Journal of Financial…

-

6 Tax Planning Strategies for Better Investment Returns

A mistake we see prospective clients make is not spending enough time tax planning. Their tax planning is usually done after their taxes are filed,…

-

Overlooked aspects of Roth accounts

“Tax free earnings”- that sure has a nice ring to it! Roth IRAs and Roth accounts in retirement plans such as 401(k)s and 403(b)s are…

-

What happens to my IRA money after I die?

What Happens to My IRA Money After I Die? Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street…

-

Should I convert to a Roth IRA?

Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine, the Journal of Financial…

-

How to stay happy in retirement

Making News… We produce regular Q&A columns for Florida Today and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine, the Journal of Financial…

-

When should you file for Social Security?

Making News… We produce regular Q&A columns for MarketWatch, a personal finance website of the Wall Street Journal and Florida Today as well as columns…

-

Year-end financial planning

Although the ups and downs of the financial markets get considerable attention, personal financial planning involves much more than just managing investments. While we…

-

Estate planning was never just about taxes

One outcome of the 2013 tax code changes is U.S. citizens can leave up to $5.25 million free of estate taxes if they pass away…

-

Protect yourself against tax fraud and identity theft

March 2013 Fraud is much easier to commit when dealing with complex and confusing matters. The American Tax Relief Act of 2012 (ATRA) passed at…

-

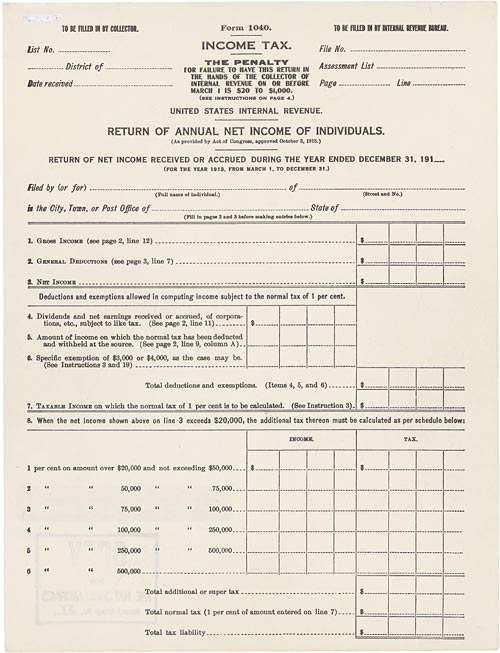

Navigating the new tax reporting requirements

December 2011 The Emergency Economic Stabilization Act of 2008 included new tax reporting requirements to the IRS mandating that certain firms report the adjusted cost…