What does an inverted yield curve mean for your investments?

What does an inverted yield curve mean for your investments? The short answer to this question is “almost nothing.” The longer answer is because our clients’ portfolios are well constructed, clients can use this episode to gain more confidence knowing they will make good decisions whenever bad markets arise.

What is an inverted yield curve?

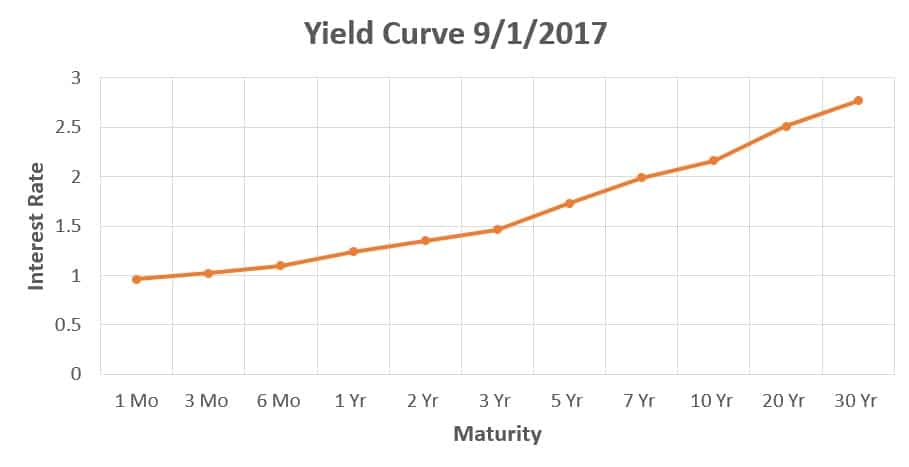

Most of the time, long-term income investments like U.S. Treasury securities, bonds and CDs pay more interest than comparable short-term holdings as shown in the graph below of yields reported by the US Department of the Treasury as of September 1, 2017.

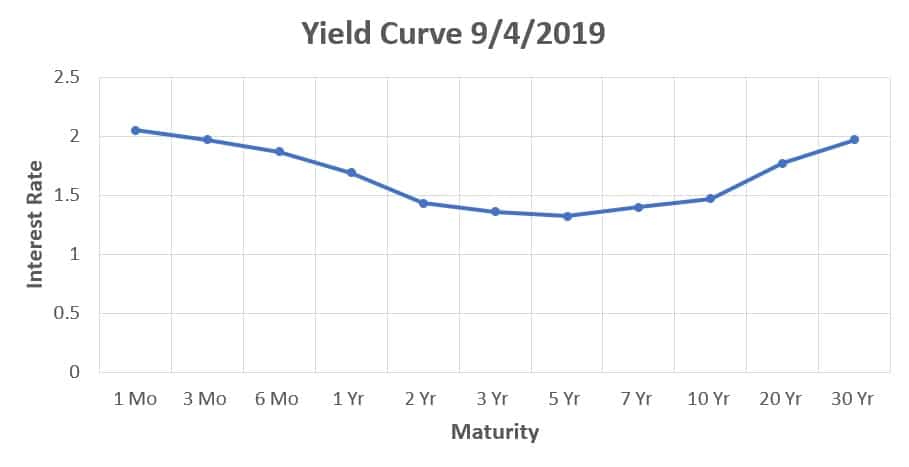

When short-term rates rise above long-term rates, the curve becomes inverted, as you can see in this graph of the yields for the same maturities as of September 4, 2019.

Who should care about an inverted yield curve?

On one level, we should all care because academic studies suggest inverted yield curves tend to foreshadow future recessions. When the economy slows, unemployment tends to rise, it is harder for people to qualify for financing (whether they are employed or not), and interest rates on savings accounts and money markets tend to be low.

Why true investors shouldn’t care about an inverted yield curve

Caring about the health of the economy does not mean we should fear damage to our investment portfolios. As we mentioned in our December post, Five financial articles you should always ignore, the markets haven’t actually behaved badly after an inversion.

The link between an inverted yield curve and the start, duration, severity, and end of a recession is inconsistent. Economists do not even agree on which maturities to monitor for an inversion or how long the curve needs to stay inverted to qualify as an indicator. Further, the link between recessions and the start, duration, severity, and end of market declines is even more inconsistent.

These inconsistencies mean if you try to trade around a possible decline, you have both a short time horizon and a low probability of making the moves with enough precision to profit. You are speculating, not investing.

A new study conducted by Nobel Prize winner Eugene Fama, and his long-time collaborator Ken French, confirms the challenge of trying to predict market moves. Fama and French tested twenty-four different strategies, using six different varieties of inversions in six countries going back to 1975 and twelve countries since 1990. They examined the results of these trading strategies over one, two, three, and five-year periods after the yield curve inverted.

According to the authors, “…some investors, fearing that an inverted yield curve predicts low stock returns, reduce their equity exposure when the term spread is negative. We test whether the fear is justified. The answer is no.”

That’s “no” with zero mitigating language or caveats. Fama and French found a consistent “negative active premium.” That’s Nobel professor-speak for “attempting to outsmart the markets reduced returns compared to what would have resulted by just sticking with a sound long-term plan.”

Also, from the paper, “The simplest interpretation of the negative active premiums we observe is that yield curves do not forecast the equity premium. This interpretation implies that investors who try to increase their expected return by shifting from stock to bills after inversions just sacrifice the reliably positive unconditional expected equity premium.”

In other words, trying to outfox the markets based on the yield curve is more likely to cost you money rather than protect you from loss.

Real investors deal with markets as though they will always be unpredictable and volatile, and do not indulge the fantasy of good returns without volatility.

As we pointed out before the last presidential election cycle in our post, Which presidential candidates will be good, or bad, for the markets?, recessions and bad markets happen with such frequency that they are viewed by true investors as just part of life. Both are to be expected rather than feared and both have always proved temporary. The trend is not one toward a soup line. It is toward economic growth and rising markets. The historic record overwhelmingly supports this assertion. Real investors deal with markets as though they will always be unpredictable and volatile, and do not indulge the fantasy of good returns without volatility.

What to do now

First, ignore the financial news. It is not designed to help you make good decisions. (See For successful investing, control your intake of business news) The 800-point drop in the Dow on August 12 made for excited headlines, as the media was quick to blame the inverted yield curve (justified or not).

Keep in mind that an 800-point drop equates to only a 3% decline. That’s unpleasant, but 3% declines in a single day have occurred three hundred and seven times in the last one hundred years, or an average of three times per year. Hardly a rarity. Nonetheless, the media presented the down day as unusual, connected it to this inversion, and stoked fears – all in the name of ratings.

Maybe we will have a bad market immediately, maybe not. Trying to discern the onset, duration, and end of a bad market is folly. Since 2009, there have been twenty-five declines of at least 5% in the S&P 500 index.[i] Twenty-five! The declines have averaged losses of 8.4% over periods as short as five days and as long as one hundred and fifty-five days. The largest drop was 21.6%.

What did all these frequent losses do? These drops provided speculators ample opportunity to profit from trading ahead of market moves. Yet, there is no credible party with a verifiable track record indicating they were successful over any long-term time horizon. Some were “right” in spots, but they gave up what gains they made with bad subsequent bets.

…the most likely thing to cause a true investor a bad outcome is not the markets, but their reaction to the markets and the news around its behavior.

True investors, on the other hand, had a bumpy journey but unless they panicked, they should be sitting on balances near an all-time high today. The issue isn’t whether the financial market will be volatile, but how one reacts to that volatility. Put another way, the most likely thing to cause a true investor a bad outcome is not the markets, but their reaction to the markets and the news around its behavior. This sounds simple, but it has not been easy for those who ingest financial news regularly and it won’t be easy going forward either.

During the last decade, each of those twenty-five declines were accompanied by at least one narrative as to why markets were down and how it would only get worse.

Starting in 2009, the reasons the media touted for causing the twenty-five declines were: concern the market had gotten ahead of itself, a world bank negative forecast, worries the recovery was not really a recovery, fears over China’s lending curbs, fears over Obama’s bank regulation plan, fears over Europe’s debt crisis, the “flash crash,” slow global growth, Libyan civil war, dire predictions of municipal bond defaults, Japan’s earthquake and nuclear spill, European debt, fear of another recession, U.S. debt downgrade, more European debt, fears European debt would cause trouble elsewhere, fiscal cliff, U.S. elections, fears over the Fed’s tapering strategy, European deflation fears, emerging market currency turmoil, Ebola virus, falling oil, strong dollar, weak corporate earnings, Greece default concerns, China stock market crash, Arab spring, North Korean nukes, Brexit and the British pound dropping, election jitters, inflation fears, rising interest rates, China slowdown, tariffs and a “trade war,” housing slowdown, an inverted yield curve, and recession fears from a global slowdown. Whew! Notice the word “fear” is used many times in that list.

Properly diversified investors who exercise patience and discipline should again prove that being resilient is better than trying to be nimble.

Properly diversified investors who exercise patience and discipline should again prove that being resilient is better than trying to be nimble. Fama and French are just the latest to demonstrate that with data.

The key task today is to reconfirm your goals. If your goals haven’t changed materially, it is unlikely you should materially change your portfolio and thus, you should recommit to your plans. This recommitment will help you act with resiliency while others stress about being nimble. Your best bet is to control your news intake and no matter the temptation, resolve to stick to your plans. For the question, “What should I do in light of the financial news?,” the answer is never to turn into a trader.

This most recent media hubbub about the yield curve is just the latest example of how news can affect mood. It can also serve as a boost to the confidence you have in your portfolio, if you choose to see it our way. Invest, don’t speculate.

[i] Charlie Bilello