One of the keys to successful investing is understanding what to expect from financial markets. 2018 marked the first calendar year the Dow Jones Industrial Average dropped since 2015. On Christmas Eve, the S&P 500 Index (S&P) was 20% lower (excluding dividends) than its high point. The S&P tracks so-called “blue chip” stocks, stocks of some of the largest and best-known companies in America and is often used as a proxy for the U.S. stock market.

It is fair to say 2018, like most years, was choppy. Unfortunately, the media seems to think 2018’s behavior either gives a clue of what will come or was very odd.

Neither is true. The data is clear. There is no “serial correlation” in returns, meaning past returns have no predictive value. In fact, a Vanguard study showed the amount of rainfall had more predictive power about future returns than did prior returns. There are no patterns and there are no reliable market timing indicators.

How noteworthy was 2018’s market behavior? It was choppier than average but far from an oddity. There is usually plenty of drama in the stock market and the shorter the time frame, the more up and down the behavior becomes. To have a successful experience, an investor must understand the basics of how markets behave. Possibly the most fundamental characteristic of the markets is that the long-term track record of stocks is excellent, but the short-term behavior can be very challenging.

To have a successful experience, an investor must understand the basics of how markets behave.

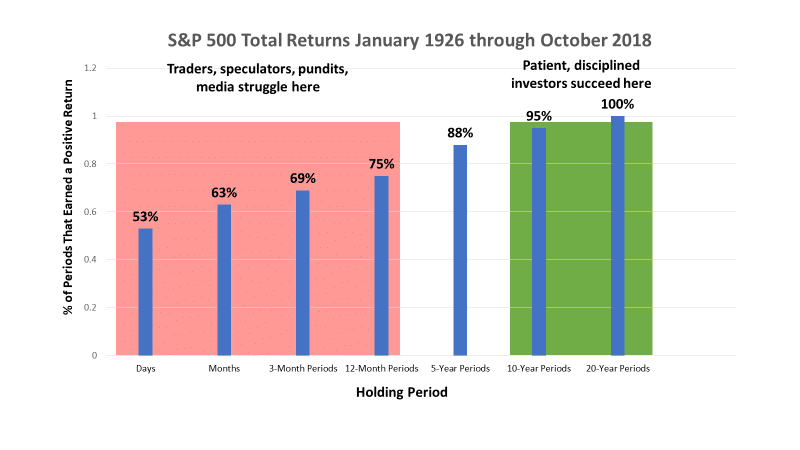

On a daily basis, owning stocks is little better than a coin flip. Extending the time frame lowers the odds of losing money and increases the odds of being rewarded. From January 1926 through October 2018, the S&P 500 has closed up on[i][ii]:

53% of days

63% of months

69% of 3-month periods

75% of 12-month periods

88% of 5-year periods

95% of 10-year periods and

100% of 20-year periods.

Further, stocks dropped cumulatively more than 10% at some point during 38% of the calendar years between 1926 and 2018. 20% declines occurred in 25% of the calendar years and the average intra-year drop was over 13%.

.

Diversify with other stocks

We don’t believe investing solely in blue chip stocks is the best way to deploy assets. The evidence suggests strongly that diversifying with other stocks can reduce risk or increase return for the same level of risk. You can see the risk reduction in the returns of a more diversified portfolio.

For instance, we will create a hypothetical mix of asset classes (“mix”) and see the resulting returns. One cannot invest directly in any of these indexes but referring to them helps illustrate the concepts. The mix will consist of 30% S&P500, 30% DFA Large Value Index, 10% DFA Small Company Index, 10% DFA Small Value Index, and 20% of the EAFE Index. EAFE stands for Europe, Americas, and Far East and is the oldest broad index of international stocks with data going back to 1970. We include dividends and assume rebalancing annually for any time frame longer than 12 months. From January 1970 through October 2018, the mix has closed up on[iii]:

65% of months vs. 63% for S&P only

72% of 3-month periods vs. 69% for S&P only

82% of 12-month periods vs. 75% for S&P only

95% of 5-year periods vs. 88% for S&P only

100% of 10-year periods vs. 95% for S&P only and

100% of 20-year periods.

Investment returns are chaotic

We find at least one of these three classes failing to beat the S&P in 56% of one-year periods, in 53% of five-year periods and in 38% of 10-year stretches. Further, on average, in one out of four years, none of them have beaten the blue chips. Nevertheless, as noted above, mixing these asset classes into the portfolio reduces the frequency of losses.

For stability, diversify with high quality, short to intermediate term bonds

The alternative to riding the stock market roller coaster is bonds. From January 1926 through October 2018, the 5-year U.S. Treasury Note has had a positive return over[iv]:

70% of months vs. 63% for S&P

77% of 3-month periods vs. 69% for S&P

90% of 12-month periods vs. 75% for S&P

100% of 5-year periods vs. 88% for S&P

100% of 10-year periods vs. 95% for S&P and

100% of 20-year periods.

As you can see, bonds are much more stable than stocks. This is precisely why they have produced much lower returns than stocks. So low that bonds are very risky when it comes to inflation risk. 5-year notes have failed to keep up with inflation in 26% of 10-year periods and 23% of 20-year periods. Stocks have never failed to beat inflation over 20-year periods and have beaten inflation by almost 7% on average.

Combining stocks and bonds

The most sensible approach to the financial markets is to use stocks for long-term goals that are most vulnerable to inflation and use bonds for stability and to fund short-term goals. A proper ratio of stocks to bonds in a portfolio depends on that individual’s particular situation and is best determined through financial planning.

Regardless of whether stocks are a small or large part of one’s holdings, the stock market will get most of the attention. Consider a 30-year time frame. That’s a good time frame for a short working career or a long retirement. Based on the historical behavior just described, one should expect at least:

133 monthly statements in which stocks were down,

8 calendar years in which stocks dropped at least 20% at some point in the year,

17 years in which at least one diversifying asset class lagged the S&P 500,

8 years in which all the diversifying asset classes lagged the S&P 500, and

1 period in which stocks drop in half or more.

That’s a lot of starts, stops and step backs. It would be easy to feel as though no progress was being made. Patience is critical. In fact, according to an analysis by Tacita Capital, it will feel like stocks are falling 33% of the time, recovering lost ground 38% of the time and progress being made toward new highs in only the remaining 29% of the time.

This time is different. This time is not different.

Historically, financial markets have provided many unsettling periods. Yet despite the drama, markets also produced enough return to sustain those with sound financial plans and reasonable spending levels. It hasn’t mattered that the economic, political, and tax conditions existing in 1930 were dramatically different than those in 1946, 1957, 1966, 1974, 1981, or 2008, just to name a few of the many calendar years in which the S&P dropped 10% or more. Each time has been different, yet the same thing has always happened. Markets settled down and moved up again.

The unhappy truth is no one can predict the future and the investment markets tend to be far less predictable than other areas of life. However, we are not powerless. We have great control over quite a bit, such as the types and amount of risk we assume, the types of products we use, our tax efficiency, our spending/savings rates, the amount and type of information we choose to receive, and most importantly, how we choose to react to that information.

We have examined the household finances of many prospective clients over the years. Fact is we rarely see people fall short of their financial goals due to consequences of the economy or markets, but we often see people risk falling short because of what they do in reaction to economic and market events.

…we often see people risk falling short because of what they do in reaction to economic and market events.

Regardless of what happens, we will do our best to do what needs to be done to improve the odds clients reach their financial goals and objectives. We know what actions to take, such as rebalancing or making trades to help with a tax bill. Should things get worse, we’ll know what to do then too. We’ve been through a lot of market gyrations over the years. The historical record shows unequivocally the issue isn’t whether markets will recover from these crises but whether investors will move out of the market before the recovery comes without carefully considering the trade-offs required for that choice to succeed.

Investing has never been, is not, and never will be easy but the odds of success are very high if one behaves like a true prudent, long-term investor. Being resilient is preferable to being nimble. Consider the numbers above and hopefully the day-to-day drama won’t distract from the facts.

We at Moisand Fitzgerald Tamayo are here for you. If you want to chat, we are always happy to receive your call. We will do our best to help by being the Sanctuary From The Noise®. If you are diversified, patient and disciplined, you can stack the odds in your favor. Invest don’t speculate.

News & Notes

New higher contribution limits for retirement accounts in 2019: The IRS announced increases in the maximum contribution to an IRA from $5,500 to $6,000 ($7,000 if age 50 or older) and the maximum employee contribution to a 401(k) increased to $19,000 ($25,000 if over age 50). For a more extensive list of limits see: https://www.irs.gov/newsroom/401k-contribution-limit-increases-to-19000-for-2019-ira-limit-increases-to-6000

New tax tables for 2019: Below are the rates applied to taxable income – income after applicable deductions.

Single 2019 Tax Brackets

| Taxable Income | Tax Bracket: |

| $0-$9,700 | 10% |

| $9,700-$39,475 | 12% |

| $39,475-$84,200 | 22% |

| $84,200-$160,725 | 24% |

| $160,725-$204,100 | 32% |

| $204,100-$510,300 | 35% |

| $510,300+ | 37% |

Married Filing Jointly 2019 Tax Brackets

| Taxable Income | Tax Bracket: |

| $0-$19,400 | 10% |

| $19,400-$78,950 | 12% |

| $78,950-$168,400 | 22% |

| $168,400-$321,450 | 24% |

| $321,450-$408,200 | 32% |

| $408,200-$612,350 | 35% |

| $612,350+ | 37% |

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC

[i] Fisher [ii] Dimensional Fund Advisors [iii] above graph inspired by Bob Seawright, Above The Market [iv] Dimensional Fund Advisors