-

Can I convert a 401(k) to a Roth IRA?

Can I convert a 401(k) to a Roth IRA? Before we look at whether you can convert a 401(k) to a Roth IRA, it is…

-

Moisand Fitzgerald Tamayo wins prestigious national award

Moisand Fitzgerald Tamayo Recognized by Schwab Advisor Services with 2019 Trailblazer IMPACT AwardTM November 4, 2019 – (Orlando) – Moisand Fitzgerald Tamayo, LLC was…

-

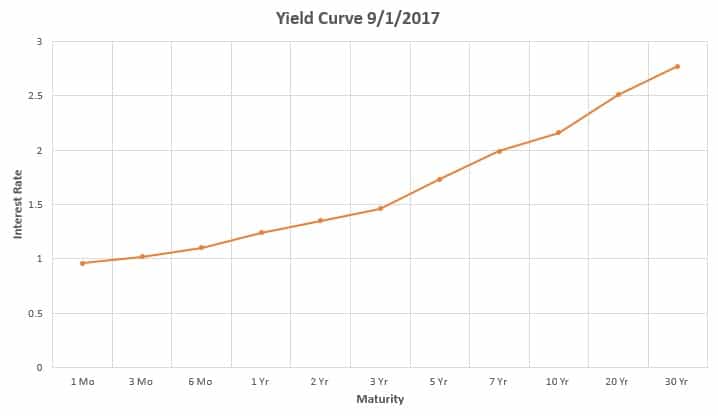

What does an inverted yield curve mean for your investments?

What does an inverted yield curve mean for your investments? The short answer to this question is “almost nothing.” The longer answer is because our clients’…

-

Should I buy or sell foreign stocks given today’s conditions?

Should I buy or sell foreign stocks given today’s conditions? Today’s Q&A combines two related questions into one, “Should I buy or sell foreign stocks…

-

Five financial articles you should always ignore

Five financial articles you should always ignore Quite simply, the best way to deal with the financial news media is to ignore them. This is…

-

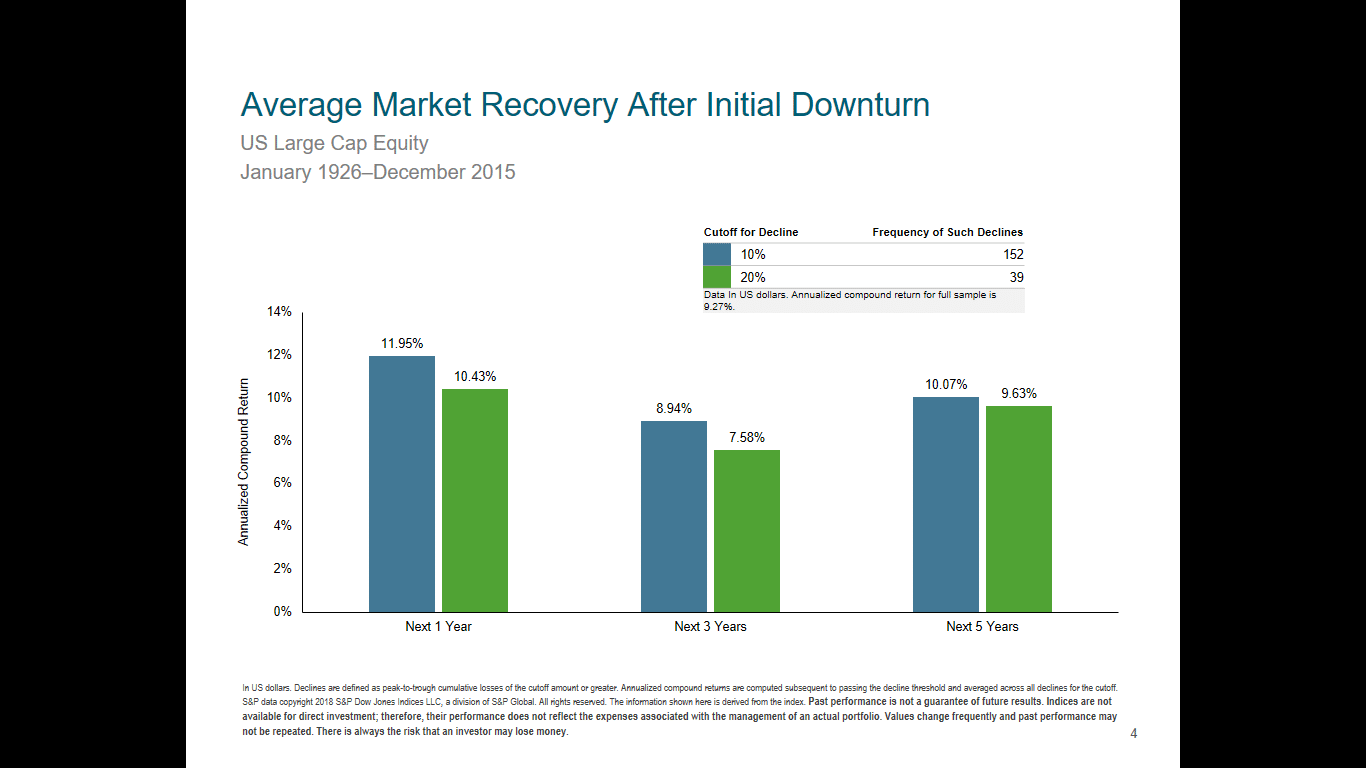

Lessons from the 2008 financial crisis

Lessons from the 2008 financial crisis In September 2008, the brokerage firm Lehman Brothers collapsed due to risky trading in poorly designed securities. This kicked…

-

Preparation is key to financial success

Preparation is key If you have ever attended a closely-matched sporting contest and witnessed a buzzer-beating shot in basketball, an extra inning baseball game, or…

-

What hasn’t changed in the new tax law?

With so many changes passed in the new tax code, it is easy to get confused. Many are asking, “What hasn’t changed in the new…

-

What will the market do now?

With two one-day declines of 1,000+ points in the Dow Jones Industrial Average recently, the media is full of people asking and answering the question,…

-

How can I do tax planning when the tax code is about to change?

With so much uncertainty surrounding tax proposals, many are asking, “How can I do tax planning when the tax code is about to change?” You…

-

Assessing the “Trump Bump” – What to Do Now

Assessing the “Trump Bump” – What to Do Now Recently, several clients have called to ask something like, “The markets have run up a lot.…

-

What if this is a “bad” time to invest?

What if this is a bad time to invest? There are many things happening in the world today which one can be concerned about.…