-

What you do makes the difference

What you do makes the difference One of the topics that comes up when we take on new clients is how they fared during prior…

-

Why 2020 was remarkable, yet normal

Why 2020 was remarkable, yet normal 2020 was a year we will long remember for its remarkable events. We were affected by a global pandemic,…

-

Tax planning for a Joe Biden presidency

Tax planning for a Joe Biden presidency After every presidential election, attention turns to changes the new president wants to make to the tax code…

-

How can I protect my portfolio from a post-election drop in stocks?

How can I protect my portfolio from a post-election drop in stocks? Concerned about how this election will come out? You are not alone. Unfortunately,…

-

What to expect in a stock market recovery

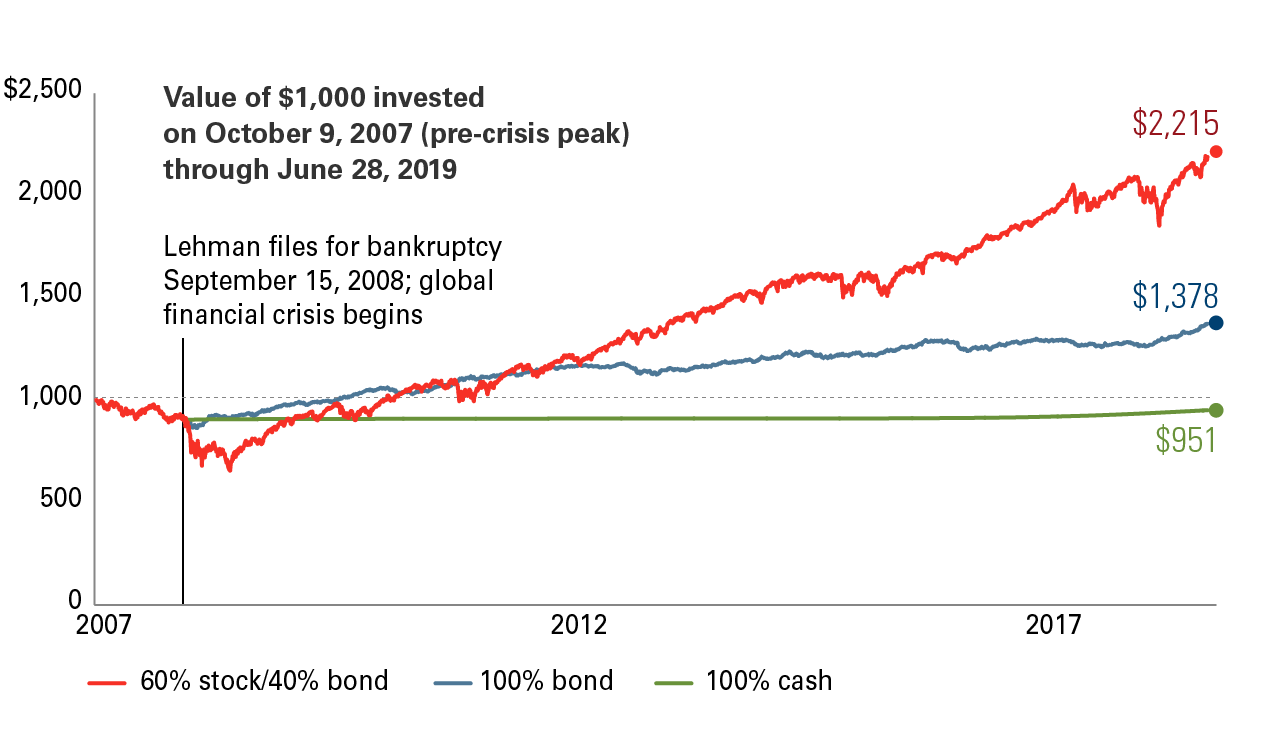

What to expect in a stock market recovery There is an adage in sports, “Pressure is something you feel when you are not prepared.” While…

-

Can I get money from my IRA tax free due to Covid-19?

Can I get money from my IRA tax free due to Covid-19? In response to the Covid-19 pandemic, the CARES Act changed several IRA and…

-

Decision making in the face of uncertainty

Decision making in the face of uncertainty When markets rise or fall ten percent in a day and your account values oscillate by thousands of…

-

Can I buy real estate in my IRA?

Can I buy real estate in my IRA? You cannot buy a personal residence in your IRA but you can buy other properties. For most…

-

Can I convert a 401(k) to a Roth IRA?

Can I convert a 401(k) to a Roth IRA? Before we look at whether you can convert a 401(k) to a Roth IRA, it is…

-

Moisand Fitzgerald Tamayo wins prestigious national award

Moisand Fitzgerald Tamayo Recognized by Schwab Advisor Services with 2019 Trailblazer IMPACT AwardTM November 4, 2019 – (Orlando) – Moisand Fitzgerald Tamayo, LLC was…

-

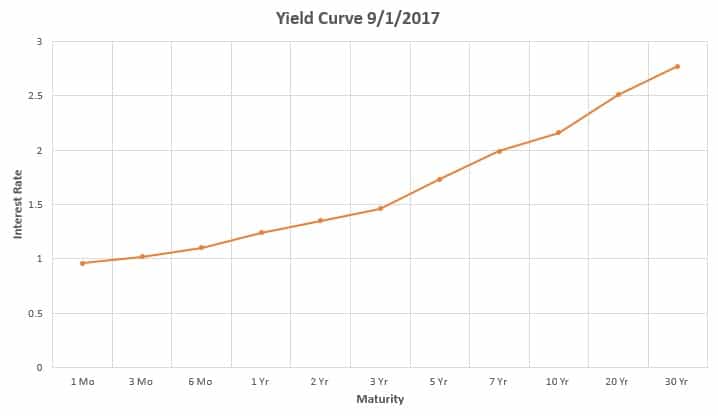

What does an inverted yield curve mean for your investments?

What does an inverted yield curve mean for your investments? The short answer to this question is “almost nothing.” The longer answer is because our clients’…

-

Should I buy or sell foreign stocks given today’s conditions?

Should I buy or sell foreign stocks given today’s conditions? Today’s Q&A combines two related questions into one, “Should I buy or sell foreign stocks…