-

Tax planning for a Joe Biden presidency

Tax planning for a Joe Biden presidency After every presidential election, attention turns to changes the new president wants to make to the tax code…

-

Tax-smart charitable giving

Tax-Smart Charitable Giving Our clients are generous, and their charitable giving reflects their generosity. We love the opportunity to help clients reach their philanthropic goals…

-

How the SECURE Act affects retirement accounts

How the SECURE Act affects retirement accounts Several tax code changes were enacted when the SECURE Act (Setting Every Community Up for Retirement Enhancement Act)…

-

How filing your 2019 tax return can affect your stimulus check

File now or in July? The recently passed CARES Act includes a provision to send stimulus checks to eligible Americans and their dependents. Eligibility for…

-

Can I buy real estate in my IRA?

Can I buy real estate in my IRA? You cannot buy a personal residence in your IRA but you can buy other properties. For most…

-

Looking back and looking forward

Looking back and looking forward The turn of the calendar is a natural time to reflect on the past year and look forward to the…

-

Should I pay off my mortgage?

Should I pay off my mortgage? One of the most common questions we get, especially as people near retirement is, “Should I pay off my…

-

Moisand Fitzgerald Tamayo wins prestigious national award

Moisand Fitzgerald Tamayo Recognized by Schwab Advisor Services with 2019 Trailblazer IMPACT AwardTM November 4, 2019 – (Orlando) – Moisand Fitzgerald Tamayo, LLC was…

-

What do I do if I miss my required minimum distribution?

What do I do if I miss my Required Minimum Distribution? Required Minimum Distributions (RMDs) are just that – required. The penalty for failing to…

-

Managing investment taxes

Managing investment taxes Managing investment taxes is an essential part of any good financial plan. For most clients, by far the largest expense incurred during…

-

Why is my charitable donation taxed?

Why is my charitable contribution taxed? Well planned and executed charitable donations should result in tax savings. To get the maximum benefit, you must know the…

-

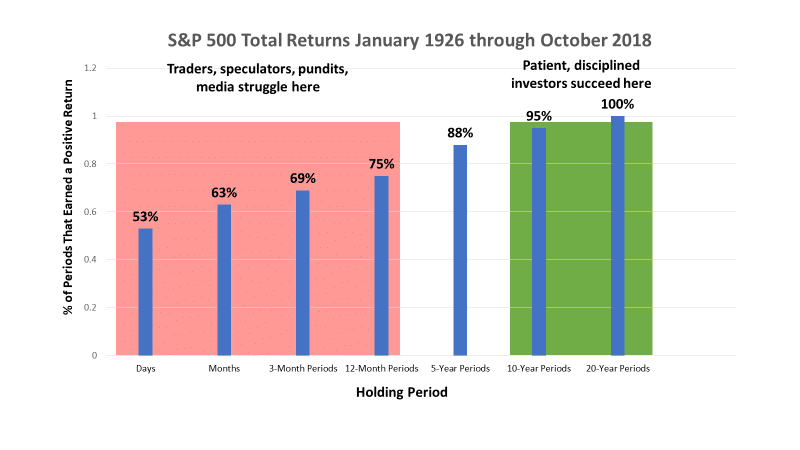

What to expect from financial markets

One of the keys to successful investing is understanding what to expect from financial markets. 2018 marked the first calendar year the Dow Jones Industrial…