News & Posts...

Home »

Moisand Fitzgerald Tamayo, LLC

Moisand Fitzgerald Tamayo marks 25 years!

Moisand Fitzgerald Tamayo marks 25 years! 2023 marks the 25th anniversary of the founding of…

Read MoreWhat “The Sting” Can Teach Us About Scams

What “The Sting” Can Teach Us About Scams Key Points: Scams are being carried out…

Read MoreWhen are Roth IRA distributions taxable?

When are Roth IRA distributions taxable? From Ken in Satellite Beach: I thought once you…

Read MoreManaging risk

Managing risk Some of you may have been concerned about the recent failure of Silicon…

Read MoreWhat you need to know about tax extensions and new tax rules

What you need to know about tax extensions and new tax rules Many taxpayers will…

Read MoreWas “Always be diversified” the most important lesson from 2022?

Was “always be diversified” the most important lesson from 2022? 2022 presented several useful investing…

Read MoreEveryone is a temporary owner of their assets

Everyone is a temporary owner of their assets We have all heard the adage,…

Read MoreHow inflation may reduce your tax bill for 2023

How inflation may reduce your tax bill for 2023 Thanks to inflation, reducing your tax…

Read MoreHow do I make charitable donations from my 401(k)?

How do I make charitable donations from my 401(k)? Direct donations from a 401(k) to…

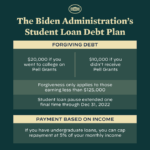

Read MoreThe latest from Washington, D.C.

Before we get to the personal finance related happenings from Washington D.C., we wanted…

Read MoreDoes it matter if we go into a recession?

Does it matter if we go into a recession? Key Points: Determining when an…

Read MoreWith the Fed raising rates, how high will rates go?

With the Fed raising rates, how high will rates go? The media keeps front…

Read MoreYou’ve got this

You’ve got this! Key Points: If watching the news gets you riled up, turn it…

Read MoreWill a stock market decline kill my retirement?

Will a stock market decline kill my retirement? Key Points: Those with a sound plan…

Read MoreIs now the time to move into dividend paying stocks?

Is now the time to move into dividend paying stocks? With costs rising and interest…

Read MoreMoisand Fitzgerald Tamayo named a “Best Place to Work”

Moisand Fitzgerald Tamayo named a “Best Place to Work” Being recognized as among the best…

Read MoreWill my tax return be processed quicker this year?

Will my tax return be processed quicker this year? The 2021 tax filing season was…

Read MoreEmotional investing can be costly

Emotional investing can be costly Emotional investing is inferior to evidence-based investing. It’s a belief…

Read MoreHow to achieve and maintain financial independence

How to achieve and maintain financial independence If you listen to a few famous success…

Read MoreWhat are the new RMD rules?

Have RMD rules changed? Required Minimum Distributions (RMD) are back in 2021 after a one…

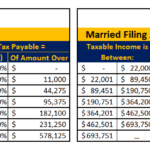

Read MoreHow your tax rates can change

How your tax rates can change As we enter the last part of 2021, Congress…

Read MoreShould I invest in rental real estate?

Should I invest in rental real estate? Owning rental real estate and collecting income has…

Read More

Is there a downside to diversification?

Is there a downside to diversification? Which would you have rather owned A or B? …

Read More