What will the market do now?

With two one-day declines of 1,000+ points in the Dow Jones Industrial Average recently, the media is full of people asking and answering the question, “What will the market do now?” It is an intriguing question, but for true investors, it is not a question that requires an accurate answer.

What will the market do now?

We’ll get to our usual array of news and notes soon but in our continuing effort to be “A Sanctuary From The Noise®”, we wanted to take a moment to provide some perspective and materials on the biggest financial news item of late — the return of market volatility.

Thus far, the declines in the market have been dramatic from a points perspective but on a percentage basis, the latest drop (to Feb 8th) is considered a mere “correction” and not unusual. Over any 30 year period we would expect to see at least 15 drops that size or greater. According to Yardeni Research, we’ve had 5 such corrections in the last 8 years and two more drops that were close at -9.9% and -9.8%. The truly unusual market behavior in recent years was the lack of volatility since the Brexit vote in mid 2016.

We speak often of keeping a long-term perspective. Dan’s February Q&A for Florida Today addresses the question “What will the market do now?” and describes one of our themes – the difference between speculating and investing. We invest our client’s money, we do not speculate.

Are you a speculator or an investor? Your choice should dictate how you feel about the market.

Are you a speculator or an investor? Your choice should dictate how you feel about the market. That sounds simple but it is often not easy because the messages we get from media can be so provocative or disturbing that we can easily be distracted into thinking or acting as a speculator. To help strengthen your investment resolve and keep your inner speculator at bay, we’d start with the seven guidelines in our post, “Easing stress during uncertain times” from September of 2011. Yes, 2011. The material is as applicable today as it was then – just as you would expect from sound long term principles!

“Everyone’s plan is unique but we have noticed that those who are most content about their finances work to maintain a prudent disposition by following these seven guidelines:

- I am an investor not a speculator. I will always remember that people who have accumulated extraordinary wealth also took extraordinary risk. For every person who made it big, there are multitudes that tried in a similar way and lost big. When someone brags about their return on an investment, I will assume there are many failures not being mentioned and I will remember that I have a real plan for my family’s needs based on realistic methods, not speculating.

- I do not confuse entertainment with advice. I acknowledge that the financial media is in the entertainment business and their need to be provocative can compromise my long-term focus, build an unneeded sense of urgency, and distract me from my goals. If I find myself getting anxious about my future, I will turn off the news and tune in to the positive things in life.

- There are no crystal balls. I will not change my investments based on a short term forecast about the economy or the markets. I will recognize that the urge to form an opinion will never go away, but I won’t act on it because no one can repeatedly predict the future. It is, by definition, uncertain. Being correct is not enough. To profit one must be right by enough to compensate for the costs of acting on the prediction. Over my time horizon, it is highly unlikely to be that accurate. When I hear “in this market….” or “because x is about to happen, you should …”, I will recognize the short term nature of the statement and remind myself that I am an investor with a good plan and I will ignore the suggestion.

- I am a capitalist. I will remember that despite its flaws, over time capitalism creates wealth better than any other system in the history of the world. For me to succeed, I will view volatility as a sign that markets are working. As new information arrives, markets will adjust prices quickly. This has always been the case so I expect, not dread, the many times dramatic volatility appears in the markets.

- I know risk is unavoidable but manageable. Because of the nature of risk and the financial industry, the most likely beneficiary of “safe” or “guaranteed” products is the salesperson and the company that created the product.

- I am broadly diversified. I will not be lured by the temptation to chase what has been “hot” in the markets, abandon solid holdings that look “cold” or vulnerable, or focus my portfolio in a few securities or even a few asset classes. I will remember that the likely outcome from doing such things is reducing one’s long term result. There is a mountain of research that supports this statement.

- I will contact my advisor. Whenever my family situation changes, I think my goals may be changing, or I have doubts about my plan, I will seek the advice of my advisor. These are the events that can warrant a change in plans.“

Is this time really different?

One common narrative these days is that the market has done nothing but go up since the 2008 financial crisis. The Yardeni numbers cited earlier say otherwise.

A second popular assertion is that the market’s valuation is so high, this must portend another Great Recession. Valuations are high but they’ve been high virtually every step of the way since the end of the recession.

If you are so inclined, you can read any of these past posts (dates in parentheses) and see that at the time, plenty of people were worried about the valuation of the market, recent volatility, or fears of upcoming volatility. It was easy to take any of the many opportunities to get distracted from one’s long term goals but.. if you acted like an investor and stuck with your plan anyway, there was plenty of reward available.

Beauty is in the eye of the beholder (3/12) Valuation measures are poor short term indicators

Should I prepare my portfolio for a post-election drop? (9/12)

Given current conditions should you buy or sell stocks? (4/13)

Are you ready for the next financial crisis? (9/13)

Stock market highs: six things to consider now (12/13) A reminder that market highs are a good thing, what we hope for, and not something to be feared.

Are investors fleeing stocks? (4/14) Don’t try market timing. Will you be right by enough again the next time the news offers a chance to speculate?

Will a stock market correction ruin my financial plan? (9/14) No, if the plan is sound and you don’t panic.

Should I be concerned about recent market behavior? (10/15) China was blamed for this forgotten correction.

Which Presidential candidates will be good, or bad, for the markets? (3/16) They all seem to experience good markets, bad markets, and recessions.

What if this is a “bad” time to invest? (4/16) “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Assessing the “Trump Bump” – What to do now (4/17) More on the perils of market timing.

What to do now

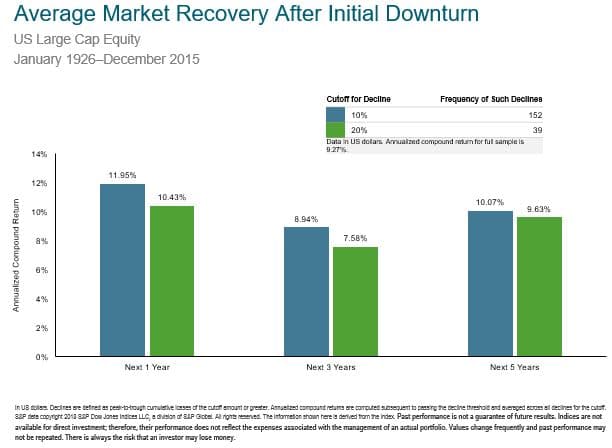

Being a long term investor doesn’t mean doing nothing as things change. It means doing sensible things when warranted and not getting seduced into acting like a speculator out of fear or greed. Our December 2015 post, “Why rebalancing can help when markets decline”, and this chart should be helpful in reinforcing the need to think beyond today’s media reports.

Making News…

We frequently produce Q&A columns for Florida Today, Investopedia and MarketWatch, a personal finance website of the Wall Street Journal, as well as pieces for Financial Advisor magazine and others. Here is a sampling from the last three months.

Mike Salmon, Derrick Chandler, and Charlie Fitzgerald all participated in the Orlando Sentinel‘s Financial Hotline answering questions from readers. Their answers appear in “Ask an Expert” columns in that publication from time to time as they did on November 28th, December 14th, December 21st, January 15th, and January 25th.

In the News…

It is unlikely people outside the financial planning profession would know who Dick Wagner was but he was a pioneer for the profession and a friend to many of the profession’s leaders including Dan Moisand . When Investment News included Dick in its “Icons and Innovators” special section, they tapped Charlie Fitzgerald, currently serving on the Board of Directors of CFP Board, for his thoughts about this inspiring man.

Charlie’s insights were used for for an “Adviser’s Consultant” column about why we spend so much time creating, maintaining, and refining a succession plan for our firm. It is to assure continuity of excellent advice and service for clients.

In our ongoing pursuit of lifelong learning, Ron Tamayo, Tommy Lucas, Charlie, Mike, and Derrick attended the annual Symposium of the FPA of Central Florida.

Mike, Derrick, and Dan attended the national conference of TD Ameritrade Institutional.

Things We Found of Note

We see Bitcoin as a highly speculative item but some are convinced it will be the next big thing, even a replacement for the dollar. We believe Bitcoin and other cyber-currencies are far from being mainstream. Here is yet another reason why: The North American Bitcoin Conference, designed to promote crypto-currencies, announces it will not accept Bitcoin for payment.

Over the long-term, betting against the market has been a bad idea. In “How to lose 93% of your money and be happy about it”, the Wall street Journal notes Morningstar data that shows that from March 9, 2009, through mid January 2018, the average bear fund (bets the market is going to go down) lost 92.9%.

According to the Social Security Administration, when the system was designed in 1930, men had an average life expectancy of 58 and women, 62. Today, on average, 65 year old men are expected to live to be 84.3 years old and today’s 65 year old women to 86.6.

What the world would look like if there were only 100 people

Can you believe 1968 was 50 years ago? This timeline from Smithsonian magazine will remind you of what an interesting year it was.